Bitfinex'ed, a mysterious self-acclaimed justice warrior, is probably one of the most vocal critics in the cryptocurrency industry. For around a year’s time, Bitfinex'ed has been on a crusade, fighting what he calls corruption and fraud.

He’s not the only one. Despite its status as one of the largest exchanges on the market, Bitfinex has been shrouded in obscurity. The exchange's audit remains quite controversial.

Another questionable issue is the alleged close ties that the exchange has with Tether (USDT), a cryptocurrency that claims to be backed on a one-to-one basis with USD. Bitfinex and Tether share two board members, Phil Potter and Giancarlo Devasini.

Essentially, the theory goes that Bitfinex has been allegedly ‘minting’ fake USDT to pump up the volume of BTC and other Cryptocurrencies on their exchange. It is important to note that Tether tried several times to rebuke those claims by issuing audits proving that the coin is backed by real US dollars.

One of the most outspoken voices against Bitfinex in the crypto community has been the individual behind Bitfinex’ed, a Twitter account that spread the theory and warned people against using the exchange or its allegedly related coin, Tether.

Bitfinex’ed’s Twitter account (which has almost 40K followers) went into ‘Protected’ mode earlier this year, but the account’s influence rang on. And in April, the blogger 'disappeared' and stopped posting on all his platforms. A few days ago, they reappeared again and continued Tweeting.

Prior to that, Finance Magnates interviewed the individual behind Bitfinex’ed about their views on the mysterious exchange’s past deeds and future motives.

Before we dive into the blogger's claims, it is important to note that the crypto community splits between those who believe Bitfinex'ed (for the most of it) and between those who don't. Some voices claim that behind the anonymous profile there is a person, or a group of people, with an interest to harm Tether and Bitfinex.

Rocks on the horizon

While the United States government has not yet come close to drafting any sweeping legislation that would directly affect cryptocurrencies, several government bodies have been taking steps toward enforcing pre-existing laws on crypto firms.

Further, the North American Securities Administrators Association has launched ‘Operation Cryptosweep,’ an investigative operation against cryptocurrency scams involving law enforcement offices spread across the United States and Canada. Earlier this month, the CFTC has issued subpoenas to several cryptocurrency exchanges for suspected Bitcoin futures price manipulation.

The tightening law enforcement around the crypto sphere, along with a growing public awareness, is putting much pressure on the crypto exchanges. Bitfinex’ed believes that Bitfinex and other actors don't stand much of a chance moving forward.

Tether: counterfeit at worst, money laundering at best

“Tether is already under CFTC investigation and probably other agencies,” Bitfinex’ed wrote. “I believe them to be at worst counterfeiting US Dollars, at best facilitating billions of dollars of money laundering.”

Further, “they fired the auditor recently after promising audits for years,” referencing Tether’s severed relationship with Friedman LLP. “This is the second time they failed to complete an audit. No legitimate institution would send hundreds of millions of dollars, per day... to Tether especially with all of the history with Bitfinex. It is either fake, or money laundering.”

On Wednesday, Tether released a report, conducted by a law firm called Freeh, Sporkin & Sullivan LLP (FSS), per its request, with a review of the company's bank account and documentation. According to the report, which is claimed to be based on an unbiased and random sample, the cryptocurrency is fully backed by US dollars. As you can imagine, Bitfinex'ed wasn't impressed.

Like Tethers, the so-called report is not worth the paper it's not printed on. We were not born yesterday. pic.twitter.com/guPrrt8Znw

— Bitfinex'ed ?? (@Bitfinexed) June 20, 2018

According to Bitfinex’ed, the problem is with the very concept of a pegged currency: “Crypto-currencies that are pegged by USD reserves only have one purpose: Enable exchanges that have poor KYC/AML standards to obtain a form of US dollar banking. A legitimate exchange with real USD would have to comply with AML/KYC.”

Therefore, “Projects like TrueUSD’s [another pegged cryptocurrency] only potential clients are those exchanges, and as a result, will be targeted for facilitating money laundering. Bitfinex also doesn't want to require AML/KYC in order for people to trade on their platform, they only 'require' verification to withdraw USD... and then they drag their feet on 'verifying' people to ensure people can't withdraw fiat.”

Self-Regulation only works when you don’t benefit from the bad guys

Bitfinex’ed also noted that the cryptocurrency industry’s efforts to be self-regulating might have hit a weak spot when it comes to Tether and Bitfinex. “If the community was self-policing, exchanges would have immediately disabled Tether pairs once Tether failed to produce an audit/fired their auditor...Bittrex could demand the US dollars on behalf of their customers, the same with Poloniex and other exchanges.”

“The concept of self-regulation has been proven, in my eyes, to be debunked,” Bitfinex’ed continued. “The problem is people do not care about fraud when they think they benefit from it, and have a stake in it (such as holding cryptos).”

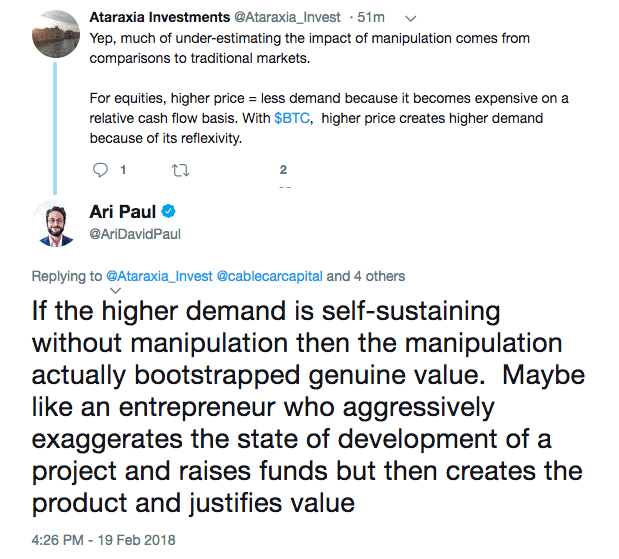

”I'll quote Ari David Paul (who has invested in TrueUSD, a Tether competitor and appears to be followed by Bitfinex on Twitter),” said Bitfinex’ed.

”A small group of people” controls the price of bitcoin

In fact, Bitfinex’ed seems to believe that some of the same people who are benefiting from the alleged fraud are the same people who are in control of a few other important things: “the price of bitcoin is controlled by a small group of people,” said Bitfinex’ed.

In addition to the supposed pegged currency schemes, “they'll take advantage of news events to move prices if they can, and if there aren't any news events, they'll just move the price anyway to liquidate people on margin. If there's too many longs, they'll go short and dump, too many shorts, they'll go long and pump. The price of Bitcoin is currently manipulated solely to liquidate people on margin. It's only a matter of time before we see a "$1000-1500" move, up or down, in an hour or less in order to liquidate people... based on absolutely no news.”

A public service

Despite what Bitfinex’ed sees as flagrant manipulation and disregard for the law, Bitfinex’ed believes that the highest price to be paid will be paid by the victims of the pegged currency schemes. “There were innocent people who were not engaging in criminal activity that used Liberty Reserve. They lost their money. The same will be true for people 'hodling' Tethers, and because Bitcoin has been inflated by counterfeit money, once that buy side is removed, the whole thing falls apart.”

At this point in time, perhaps the individual who has paid the highest price for calling out Tether and Bitfinex’s suspicious behavior is Bitfinex’ed himself, who has been threatened with legal action. Still, “whether I lost money or not is completely irrelevant,” Bitfinex’ed said. “Someone must warn people about the fraud,” said Bitfinexed.

Finance Magnates reached out to Bitfinex to get the exchange's response to Bitfinex'ed claims. However, the exchange did not provide any response in time of press.