The global spotlight that shone onto the cryptosphere in 2017 shed light on some serious issues. A great deal of the exchanges and other crypto-related services on the market were incredibly difficult to use, had extraordinarily bad customer support, and high fees.

In response to this, a number of new trading platforms were launched with the promises to provide better services at lower costs. Now, this wave of new exchanges is vying to become the go-to for new investors.

One of these exchanges in Cobinhood. Launched on December 18th of 2017, at the height of the cryptocurrency boom. Previous to its launch as an exchange, Cobinhood began offering ICO underwriting services in November of 2017.

Recently, Finance Magnates spoke with Wei-Ning Huang, Co-Founder & CTO at COBINHOOD, about the exchange’s current status and its plans for the future.

The Cobinhood logo.

Cobinhood Was Created to “Meet the Demands of Modern-Day Investors”: How Successful Has it Been So Far?

“The company was founded by myself, former Senior Software Engineer at Google, and Popo Chen, the original co-founder of '17 Media’,” Huang said.

He explained that like many cryptocurrency exchanges, the inspiration for Cobinhood was originally conceived because of a sense of frustration with available trading platforms. We started like any other cryptocurrency traders and felt the full effects of high transaction fees, slow customer support, unpredictable downtimes first-hand. COBINHOOD was created to solve these problematic issues and meet the demands of modern-day investors.”

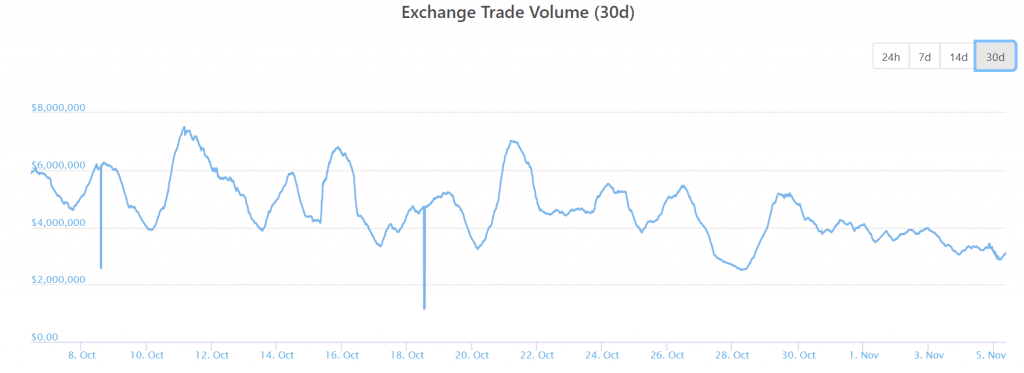

Cobinhood's 30-day trading volume (CoinGecko.)

Each platform has its own, unique methods of solving these problems. Cobinhood’s angle is to “[provide] users with a high-frequency trading experience in a no-fee environment. The COBINHOOD name was inspired by the legendary heroic outlaw Robin Hood. COBINHOOD removes any associated trading fees for its users, maximizing returns on cryptocurrency investments and giving back to those who cannot fight for themselves – much like the notorious English folklore, literature and film figure.”

However, not everything has been sunshine and roses. The exchange sparked outcry during its ICO last year when it "[enabled] its partner, cryptocurrency investor Ian Balina, to offer a 150% bonus to his followers. This was while only a 20% bonus was offered to everybody else (it has since already dropped to 10%)," as Finance Magnates reported.

While the exchange does not charge any trading fees, it does charge withdrawal fees: “0.001 for BTC, 0.007 for ETH, 20 USD for USDT, and equivalent amount of 8.4 USD for the rest of the tokens,” CoinGecko reports. However, Cobinhood "does not profit from withdrawal transactions, these fees will go to the miners who are responsible for maintaining the network," a blog post from the company explains.

Huang added that the company “is the only end-to-end ICO services provider [to guarantee] listing on our exchange after a partnered project finishes its token sale. Our ecosystem not only includes ICO services, but also a developer platform, margin trading and instant listings.”

Creating Resources for Beginners

Cobinhood has made an effort to reach out to both institutional and retail investors, “including beginners,” Huang said. For these “beginners,” the exchange offers a set of “detailed tutorials and active communities that guide through the difficulties of entering and mastering the Blockchain world.”

‘We also want our users to feel valued,” he added. “We offer ICO services and exclusive benefits along with countless easy ways to win free cryptocurrency through our Candy Machine & Airdrop Center campaigns.”

So far, it seems that the efforts have paid off. “Currently we have are around 500,000 registered users...70% of [which] are located in the U.S. and Europe and the other 30% are from Asia. ” Huang explained. He’s also very optimistic for the future: “as we continue on our current innovation, growth and development trajectory, we can expect to double this figure by the end of next year.”

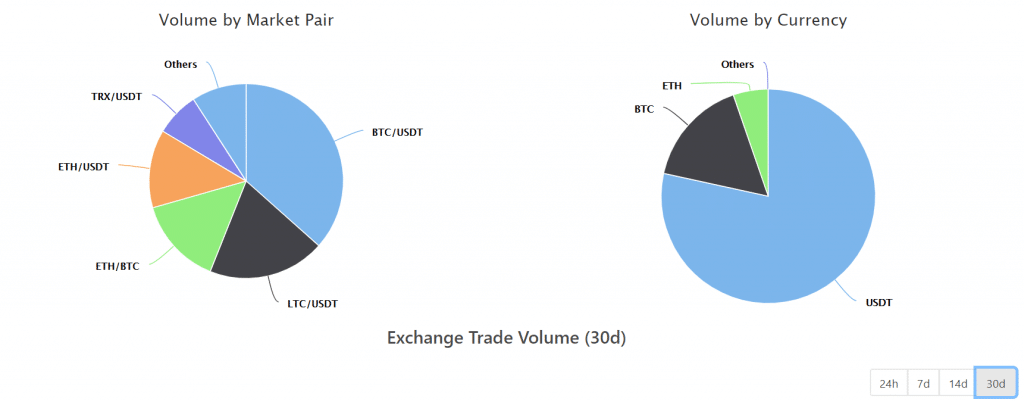

Cobinhood's 30-day trading volume by market pair and currency (CoinGecko.)

For institutional and high-volume investors, Huang said that the exchange has built a team to “[focus] on VIP and enterprises customer services.”

“We just launched margin trading and funding and will continue to add new features and financial products on our exchange,” he explained.

“Additionally, we are developing the DEXON Foundation, running on blocklattice technology that will work together with COBINHOOD to form an infinitely scalable, low-latency decentralized transaction processing engine. DEXON is the fastest blockchain guiding mass adoption within the banking industry and real-world application requirements.”

Cobinhood’s Security Practices: No Hacks So Far, Positive Feedback from the Community

As for security, “COBINHOOD believes in 100% transparency,” Huang said. “We disclose all online and offline wallet addresses for public scrutiny, ensuring that no embezzlement can take place that a forensic audit won’t catch.” So far, there have been no hacks reported on the exchange; as such, “the COBINHOOD exchange was given a 5-star security rating by Dashlane and ranked 8th out of 200 cryptocurrency exchanges in a security report by ICORating.”

“For all online transactions, COBINHOOD requires two-factor authentication (2FA) to log in, and withdrawals require an extra email confirmation. For all offline transactions, each COBINHOOD has a multisignature wallet with 8 hardware security modules (HSMs). In order to access the offline wallet, five out of the eight HSMs have to be confirmed. That way, if just one or two HSMs are compromised, your crypto assets remain secure. HSMs are also geo-distributed across different countries, further maximizing security,” Huang explained.

Looking Ahead

“COBINHOOD has big plans for the rest of 2018 and the start of 2019,” Huang said.

“We are continuing to develop the DEXON Foundation, Testnet, Explorer, Mainnet and implementing open source consensus, SDK and fullnode technology. We’ll be Hosting developer meetups as well.”