In 2019, Bitwise Asset Management published a report that shocked much of the crypto industry.

In a presentation to the SEC, Bitwise alleged that “95% of Bitcoin trading volume is fake and/or non-economic in nature,” and that cryptocurrency exchanges were purposely manipulating data in order to attract traders to their platforms.

Two years later, and both exchanges and market data reporting entities have cracked down on this particular type of market manipulation. It is still present but to a much lesser degree.

Indeed, Bitcoin markets are still subject to this and other kinds of manipulation – some that may be even more insidious.

Ilan Sterk, the VP of Trading & Capital Markets at Orbs Group and VP Trading & Business Development at Alef Bit Technologies, recently undertook extensive research on Bitcoin market manipulation. His findings? “I have learned that there are players in the crypto markets who purposely impact the price in order to make money from this action,” he told Finance Magnates.

”There Are Many Cases That May Be Suspected as Manipulation."

In other words, while Bitcoin markets may be somewhat free of manipulation on the exchange side, traders who hold large amounts of BTC may be playing the markets to their advantage, and no one seems to be taking meaningful action to get in their way.

Ilan Sterk, VP of Trading & Capital Markets at Orbs Group and VP Trading & Business Development at Alef Bit Technologies.

“As evidenced in my analysis, there are many cases that may be suspected as manipulation,” Ilan told Finance Magnates, referencing an analytical report he published in September.

What does this manipulation look like? Essentially, these manipulative traders leverage their positions across a number of exchanges and a number of trading products: “it seems that the Bitcoin price is manipulated by sophisticated traders who use several exchanges (regulated and unregulated) in parallel to impact the Bitcoin price by buying or selling huge amounts of Bitcoin in the spot market,” he said.

“They use this manipulative activity to make huge profits in the derivatives markets of the Futures or Options.”

Evidence of Manipulation Was Present on Both Regulated and Non-regulated Crypto Exchanges

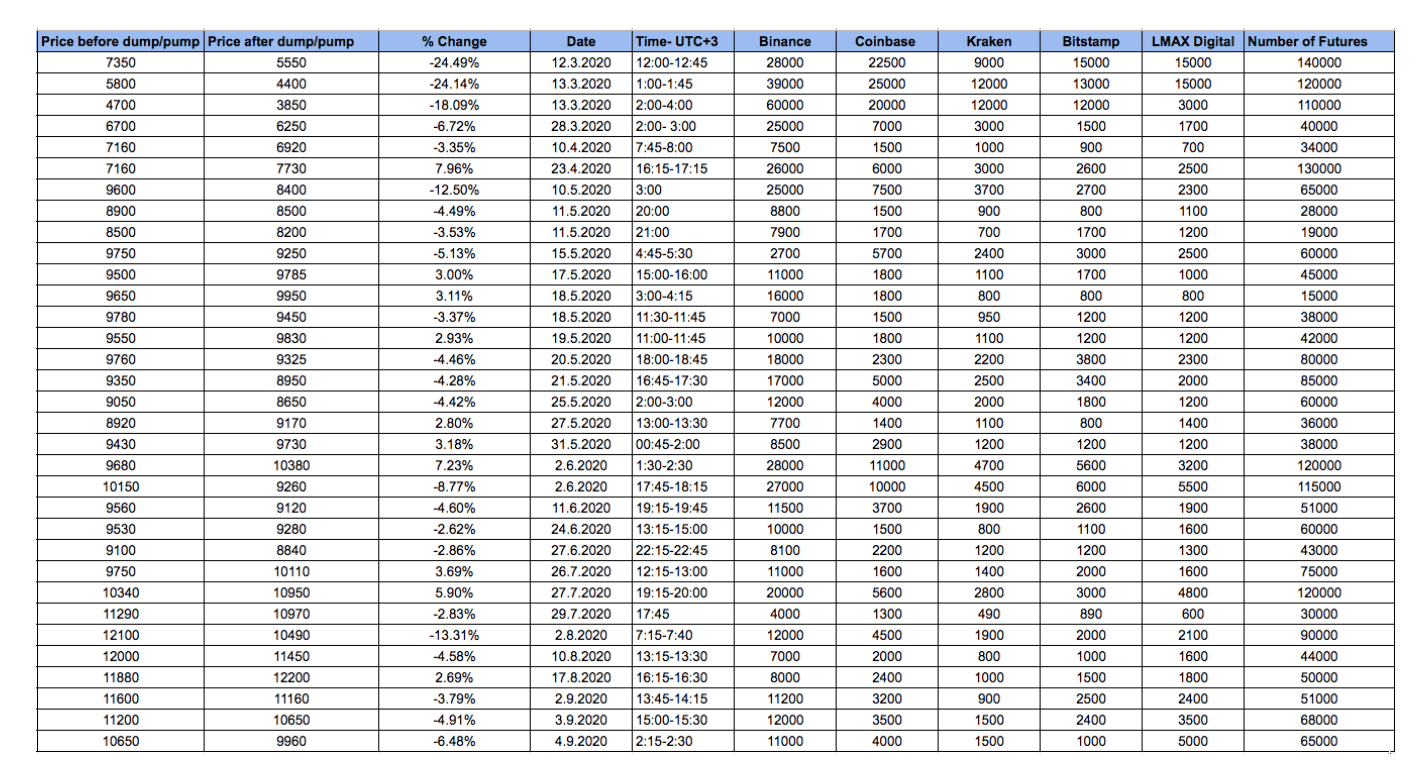

For a six-month period earlier this year, Ilan says that he “collected volume data on BTC prices from Tier 1 exchanges (regulated and unregulated) and also Futures data from different exchanges.”

What Ilan found is that that regulation does not seem to deter Bitcoin manipulation. There was evidence of manipulation on both kinds of exchange. Importantly, Ilan wrote in his analysis that "I must emphasize that I don’t suspect that any of the exchanges that I collected the data from participated directly in the price manipulative patterns."

Still, "in all of the cases that I have reviewed, thousands of Bitcoin were bought or sold within minutes, [even when there was] not enough Liquidity in the exchanges to contain such volumes,” Ilan said.

In each of these BTC 'pump and dump' events, Ilan says that spot volume was higher by “up to 10 times or more than the average volume in the exchange.” As a result, “the outcome was a sharp increase or decline in the price of BTC.”

Ilan explained that the first red flag is the fact that such large trades are taking place on exchanges with such thin books: “the fact that huge amounts of BTC are executed in exchanges that have a scarcity of liquidity already implies that a manipulation of the market is happening, leading to a quick profit,” Ilan said.

This is key in the manipulators’ playbook: “the manipulators exploit the fact that the order book is thin,” he said. “They sell massive amounts [of an asset] in the spot market, which has a huge impact on the underlying asset. The asset then fluctuates to the upside (if the manipulator buys huge amounts) or to the downside (if the manipulator sells huge amounts).”

This is where the multi-exchange manipulation effect comes into play: “due to the fact that many times there is an increase in futures positions before the dump or the pump. My guess is that traders sell the BTC spot at a loss but on the other hand, make huge profits in options (long put) and futures (short position).”

In other words, traders with large amounts of BTC may be throwing spot market prices in order to fulfill their bets on futures markets.

And when Ilan says “huge profits”, he really means it: “some exchanges allow leverage of up to 125 times.”

For Some Unlucky Traders, Manipulation Means Huge Liquidations

Unfortunately, in leveraged markets, huge profits for some mean huge losses for others: “the continued influence of Bitcoin manipulation means that many traders get liquidated and have a huge loss due to margin calls every time the manipulation has an impact on the Bitcoin price,” Ilan said, adding that “many traders use leverage when trading spot or Futures.”

For example, “on 2.8.2020 Bitcoin declined 12% within 30 minutes and led to the liquidation of $1.1B worth of futures positions,” Ilan said. “More than 70,000 traders were liquidated across all exchanges. Nearly $400 million was liquidated on each OKEx and Huobi; followed by BitMEX ($164M) and Binance ($86M).

“Another example occurred on 11.5.2020 when Bitcoin dropped by 8%. This led to the liquidation of $250 million in Bitmex futures (and we can assume that the numbers in the total market are much higher.)”

Additionally, Ilan suggested that this kind of manipulative phenomenon could have taken place on March 12th, also known as “Crypto’s Black Thursday.

“On 12.3.2020 Bitcoin was down 17% within minutes and a few hours later was down by another 40% on very high volumes,” he said. “The sharp decline led to the liquidation of $1.5 million in Bitmex futures alone.”

"Suspicious cases found from the beginning of March until September" via Ilan's analysis post on Medium. Futures data collected from "one of the leading future exchanges."

Anticipating a Drop around March 12th, Manipulators May Have Played up the Drama to Earn Higher Gains from Futures Contracts

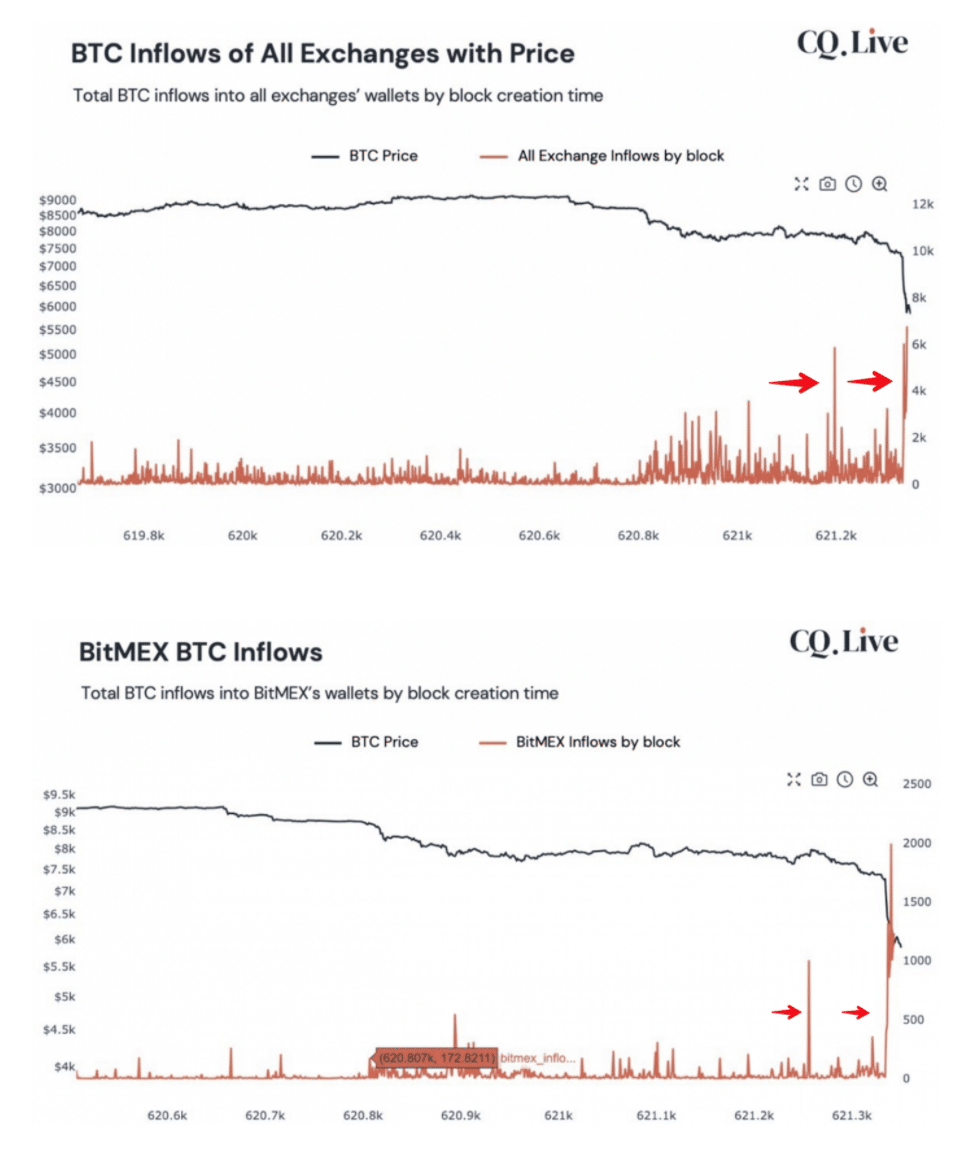

Moreover, Ilan noted that several days before Black Thursday, “inflows (deposits) into major exchanges began rising at a higher-than-usual rate beginning on March 8th.” Specifically, “the average inflow per transaction was about 1,000 BTC, and after that, inflows ranged from 1,500 to 6,000 BTC in the run-up to Thursday’s price drop.”

"On 12.3.2020 Bitcoin was down 17% within minutes and a few hours later was down by another 40% on very high volumes. A few days before the flash crash coins movement from private wallets to exchanges was exponentially higher than usual." (Ilan Sterk, via Medium)

Therefore, manipulators anticipating a big price move may have focused many of their efforts around March 12th in particular: “the Bitcoin slide began with a near 10 percent drop on March 8th. In the following three days, BTC posted marginal losses – before plunging by a staggering 40 percent on Thursday.”

In any case, Ilan explained that these three examples show “the magnitude of the impact of the suspected manipulation on traders' positions.”

Additionally, Ilan found that within several hours of many similar instances, “the open interest and the long/short ratio increased or decreased (before the pump or the dump) toward the side that the Bitcoin later moved toward.”

Challenging Bitwise’s 2019 Findings on Market Manipulation

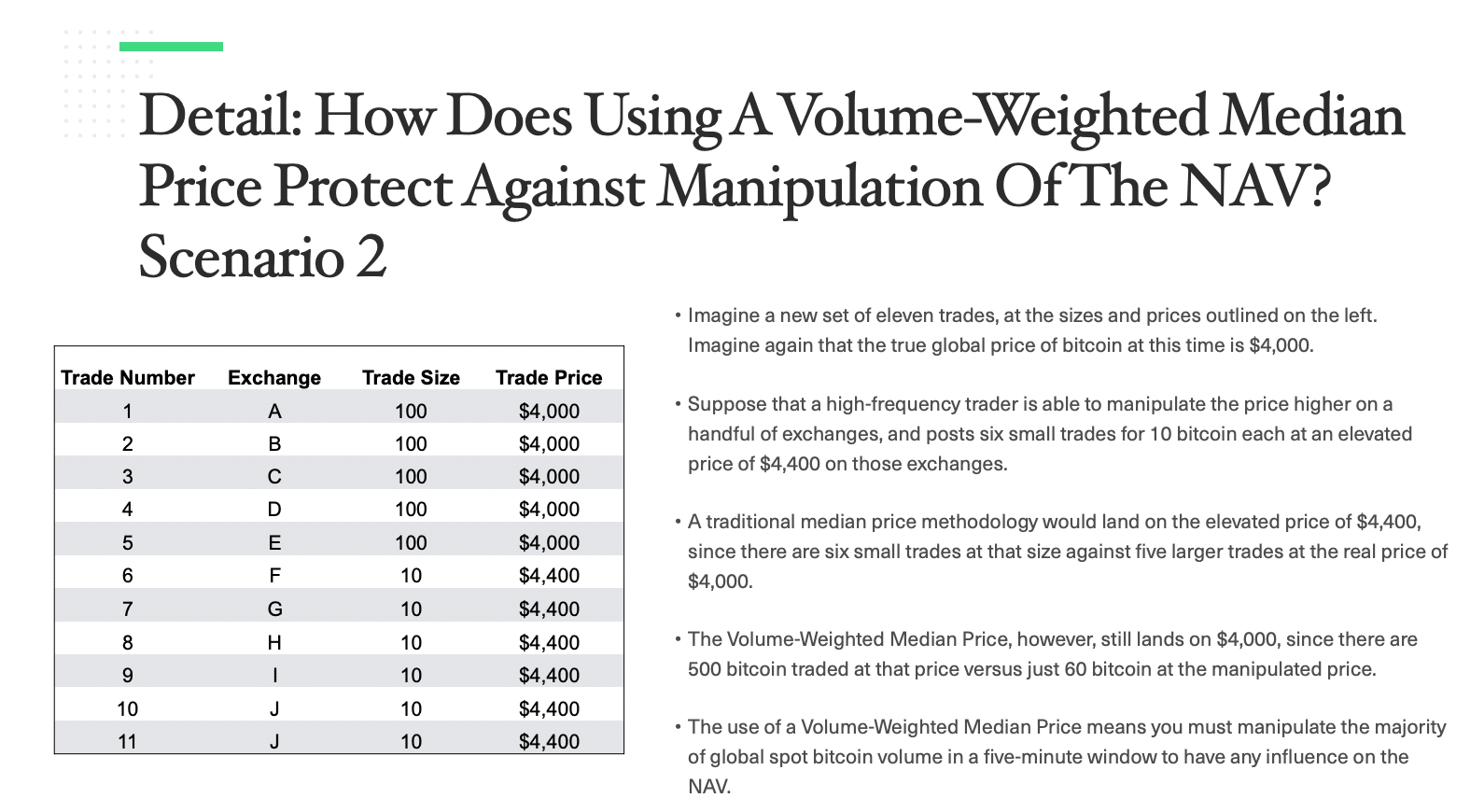

These findings challenge some of the points set forth by Bitwise in its 2019 report regarding how markets can be navigated to avoid the effects of manipulation.

In the presentation, Bitwise claimed that “the use of a large number of exchanges makes market manipulation more difficult in a well-arbitraged and fractured market, as a malicious actor would need to manipulate multiple exchanges to impact the NAV. They also claimed that any manipulation attempt would have to involve a majority of global spot bitcoin volume in a five-minute window to have an effect.”

via Bitwise's report to the SEC (2019).

Specifically, “the Bitwise presentation to the SEC mentioned that the Bitwise Bitcoin ETF Trust provides direct exposure to bitcoin priced off the equivalent of a crypto consolidated tape,” Ilan said.

As such, Bitwise proposed that its ETF would “draw prices from 10 crypto exchanges, representing [essentially] all of the trading volume in the spot bitcoin market.” Bitwise alleged that “drawing on multiple exchanges…[allowed the firm] to calculate its net asset value (NAV) in a manner that significantly deters manipulation.”

BTC Market Manipulators May Be Hiding in Plain Sight

This multi-exchange method could be what makes the manipulation so difficult to detect.

While well-respected, regulated cryptocurrency exchanges tend to have aniti-manipulation protocols in place, this kind of multi-exchange, multi-product manipulation means that market manipulators may be able to use top exchanges for illicit purposes without setting off any big alarms.

In other words, BTC market manipulators may be hiding in plain sight. Ilan says that his findings are based on “volume data on BTC prices for six months from the major Tier-1 exchanges (regulated and unregulated) and also Futures from different exchanges.”

Ilan added that the findings came from the analysis of 22 cases since March this year “in which Bitcoin moved up or down at least 2.5% within minutes on high volumes,” he said. These high-volume movements often resulted in quick price swings ranging from 2.5% to 24%.

“In each case, I dug into the volumes, the trading pattern that led to the manipulation, open interest ratio, and long/short ratio in the futures market. In addition, I tracked BTC inflows into the exchanges from private wallets,” he said.

While some of the movements seemed to be the result of organic trading, others showed evidence of foul play: “in some of the cases I reviewed, manipulators delivered huge amounts of BTC to exchanges several days before the dump,” he said.

“My Findings May Challenge the Bitwise Theory.”

However, because Ilan’s findings show that using multiple exchanges in tandem with one another to manipulate markets may indicate that drawing data from more than one exchange is not an effective way of deterring the effects of manipulation.

“My findings may challenge the Bitwise theory, since although using a large number of exchanges makes market manipulation more difficult, it is still feasible, as manipulators [can] use several exchanges” for their illicit purposes, Ilan said.

Moreover, Ilan’s findings challenge another part of the Bitwise presentation that described another method of deterring manipulation that Ilan refers to as the 'five-minute effect'.

Specifically, Bitwise’s presentation claimed that “the use of a Volume-Weighted Median Price means you must manipulate the majority of global spot bitcoin volume in a five-minute window to have any influence on the NAV.”

However, Ilan’s research found “that the suspected manipulation activity can take between one minute to two hours, but most of the time it lasts 30-45 minutes.

“This includes trading activity of 5000-20,000 BTC [across] several exchanges, regulated and unregulated, for purposes of manipulation,” Ilan said.

New Trading Products May Have Provided New Avenues for Manipulation

Unfortunately for most BTC holders and traders, Ilan believes that markets may be feeling the effects of manipulation for the time to come: “I don’t think that in the near term the manipulation will be eliminated,” he said.

And in fact, some of the more advanced trading products that have recently entered into the crypto space may be exacerbating the problem.

“Crypto markets are more mature than they were several years ago and there are more sophisticated products today such as leveraged spot and derivatives, including Futures and Options,” Ilan said. “The manipulators use them.”

Indeed, “leveraged products can exaggerate price increase or decrease and traders use them for manipulation impacting the price even more significantly,” which may only encourage manipulators to crack on with their dirty deeds.

However, crypto platforms that may be unwittingly part of these manipulative schemes are not powerless: “in order to prevent this there should be more surveillance tools in the exchanges that can help to detect market manipulation (i.e. spoofing),” Ilan said. “This can be done through tools such as real-time and historical analysis of trades and order books.”

To Truly Stop Market Manipulation, Crypto Exchanges Would Need to Band Together like Never Before

Essentially, “exchanges need to implement strict internal processes to prevent such manipulative activities.”

“When they detect suspicious activity (such as sales of large amounts of Bitcoin), exchanges must conduct a deep review of the specific activity, and ask participants questions similar to the questions asked by regulators in traditional markets,” Ilan said, acknowledging that there are structural differences between traditional and crypto markets.

“If a Crypto exchange finds evidence that a specific trade or trades were manipulative they should close the trader account and ban him from any future trade within the exchange.”

Furthermore, Ilan suggested that exchanges work together to create a 'blacklist' to stop market manipulation across the board: “as the outcome of my research, I suggested building a blacklist on Blockchain and initiating a unified authority that will consist of representatives from all exchanges,” he said, adding that “I’m sure that this will not be easy.

“Any trader participating in manipulative activity would then be added to the blacklist and could not open a new account with other Crypto exchanges,” he said.

However, this is only possible if exchanges are capable of effectively collaborating which, due to the fragmented nature of the exchange space, may not be a realistic goal for some time.

If and when this would be possible, exchanges could have more power than ever before: for example, “in traditional markets, one of the checks and balances is a circuit breaker that is used for halting trading in a stock exchange in order to curb panic selling,” Ilan said.

“Since Crypto trades in many exchanges in order to apply a circuit breaker you would need all exchanges to cooperate to suspend trading together,” he said. “Otherwise even if some exchanges suspend trading it would continue in others.”