The Floor is a fintech hub dedicated to connecting Israeli startups with global financial institutions, located inside the Tel Aviv Stock Exchange building. Finance Magnates recently sat down with Moises Cohen, co-founder and Board Director of The Floor, to hear from him about the challenges and opportunities facing the Israeli fintech scene.

To unlock the Asian market, register now to the iFX EXPO in Hong Kong.

The Floor hosts a lot of international delegations of both business and political leaders - about 100 over the last six months. These include top executives from European, Asian and especially Chinese banks, leading international stock exchange groups and the likes of the mayors of Toronto and Milan, finance ministers from around the world and the Prime Minister of Luxembourg. They all come to see how the Israeli model works and try to learn how they can improve their own ecosystems.

Their goal is to cultivate the top 5% of Israeli fintech startups and already reports good traction. Success stories are expected to be announced soon as well as a possible expansion of the venue. The Floor has created such an effective way to access international banks that even startups from established fintech hubs such as London have approached it for help.

Moises Cohen, Co-Founder and Board Director, The Floor

Traditionally Israeli fintech startups have done exceptionally well in the field of trading, as trading operates in the same way both in Israel and around the world. However, they have not cooperated well with international banks, which largely have no presence in Israel and are therefore unknown to them. To address this problem, the Floor is working on a 'fintech academy', teaching technology-focused Israeli entrepreneurs about how global banks work, their needs and how to engage with them.

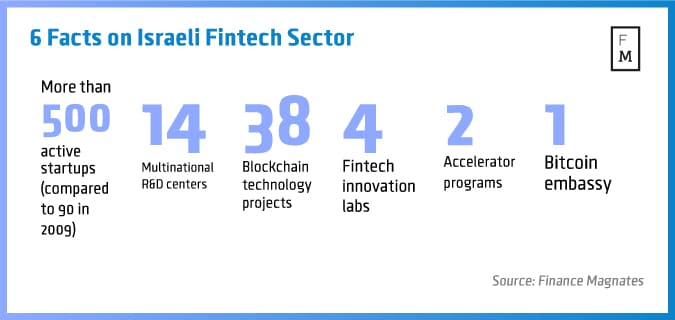

One area that Cohen considers to be surprisingly underperforming in Israel is Blockchain technology. He sees that cyber-security startups are scooping up all the top cryptography talent and thus blockchain startups can’t properly develop. This is why there are only around 35 blockchain startups in Israel, mostly irrelevant to fintech. However, Cohen thinks that blockchain technology will revolutionize the way the world works, similar to how the internet did in the '90s. Therefore one of the objectives of the fintech academy will be to evangelize the technology amongst Israeli entrepreneurs. He expects that once this potential is known, a rapid shift from cyber to blockchain will occur. “There are now around 500 cyber startups in Israel, ten years from now there will be 500 blockchain startups in Israel,” says Cohen.

Cohen explains: “This is the only field in fintech that can really bring disruption to banking.” Blockchain can disrupt many areas like trade finance, Payments , capital markets, etc. Banks understand this and invest in blockchain to stay ahead of the curve. The Floor’s task is to deliver the talent.

What is the solution you provide?

"Israel has one of the largest ecosystems of fintech startups worldwide comprising more than 470 companies as of today (excluding cybersecurity) and roughly speaking 60-70 new fintech startups appearing on the scene every year.

The Floor

The paradox facing Israel is that while, on the one hand, we have one of the biggest fintech ecosystems of startups worldwide, on the other hand, we are lacking the physical presence of International banks operating here. For a young Israeli fintech entrepreneur it is very difficult, if not almost impossible, to gain access to senior stakeholders in International banks that do not operate locally…at the same time however, there is an increasing number of International banks looking for ways to engage with the local fintech ecosystem in a systematic way…This is actually what The Floor does…closing the gap by connecting both worlds.

Although Israeli entrepreneurs are extremely strong in the field of technology, enlisting very talented entrepreneurs coming from elite army units, they demonstrate weakness in business/banking know-how. At The Floor, together with our partners, we are investing great efforts to solve this problem by providing business and industry mentorship to help strengthen our member entrepreneurs."

How do banks view fintech startups?

The Floor

"More recently we are seeing an interesting shift in the startups business model; a few years ago the vast majority of Israeli startups were B2C, thinking that they would beat the banks at their own game, compete with them, or even replace them. Today they realize that it is not that easy hence the major shift from B2C to B2B. One of our goals at The Floor is to help startups pivot from B2C to B2B in order to partner with banks rather than compete with them.

We also believe that the bank’s perspective on startups has changed from one of being reluctant to work with them and seeing them as a potential threat, to one of realizing the huge potential that lies in joining forces. Over recent years the majority of banks have been creating innovation teams and some have even created corporate VCs in order to address this growing market.

This is why from our perspective today it’s all about collaboration rather than competition."

What are the challenges in the field?

"The main challenge facing fintech entrepreneurs in Israel today is the ability to raise capital; the majority of startups are struggling to raise money. It is true to say that if you just put the word ‘Fintech’ in your logo you would need to be a very lazy entrepreneur not to raise the first million seed investment…however, it is a different story when it comes to A and B rounds which are extremely difficult and, unfortunately, we see many talented companies closing because of cash-flow issues. This is why at The Floor we are dedicated to helping startups raise that much needed capital."

What key strengths do Israeli startups offer?

"At The Floor we focus on 9 fintech related themes that have been selected jointly with our strategic partners (Blockchain, IoT, AI, Big Data/Analytics, Capital Markets, Compliance/KYC, Digital Banking, Digital Payments, Anti-fraud). Capital Markets, Analytics and Anti-fraud are the areas where we see the most mature companies providing differentiated solutions to work with banks.

Surprisingly Blockchain so far has been a bit disappointing: Given the number of people coming from an army background plus the encryption component of this technology you would expect to find a big talent pool in Israel just waiting to create blockchain startups …but this is not the case…as we see that people from elite army units still prefer to create cybersecurity ventures. That does not mean however that we are not trying, with the support of our partners, to cause a shift in focus by explaining to the local entrepreneurs about blockchain and the huge potential that lies behind it and the impact that it could have on the way we bank…and with that in mind we are very proud to announce the first blockchain startup joining us! (still in stealth mode)."