SBI VC Trade, a Japanese cryptocurrency exchange owned by SBI Holdings, has confirmed it has finalised an agreement to accept customer accounts and assets from DMM Bitcoin, which faced issues following a cyberattack.

The confirmation came after DMM Bitcoin, part of the DMM.com Group, announced earlier this month that it would cease operations and enter liquidation. It also disclosed the potential deal with SBI’s crypto exchange.

A New Platform for DMM Bitcoin’s Customers

According to the latest update from SBI VC Trade on Wednesday, DMM Bitcoin customer accounts and assets held in custody are scheduled to be transferred to its platform on 8 March 2025. The update further noted that DMM Bitcoin customers will not need to create accounts with SBI VC Trade, as accounts will be opened for them automatically.

However, there are differences in the services offered by DMM Bitcoin and SBI VC Trade, some of which the latter intends to address.

SBI VC Trade plans to provide support for 14 cryptocurrency products that it does not currently support but that DMM does. However, these services may not be available by the asset transfer date, and SBI will not offer any crypto-to-crypto exchange services.

Furthermore, SBI’s crypto exchange will not provide leveraged trading services, which DMM offered, and it will also not accept any unsettled leveraged trading positions from DMM customers.

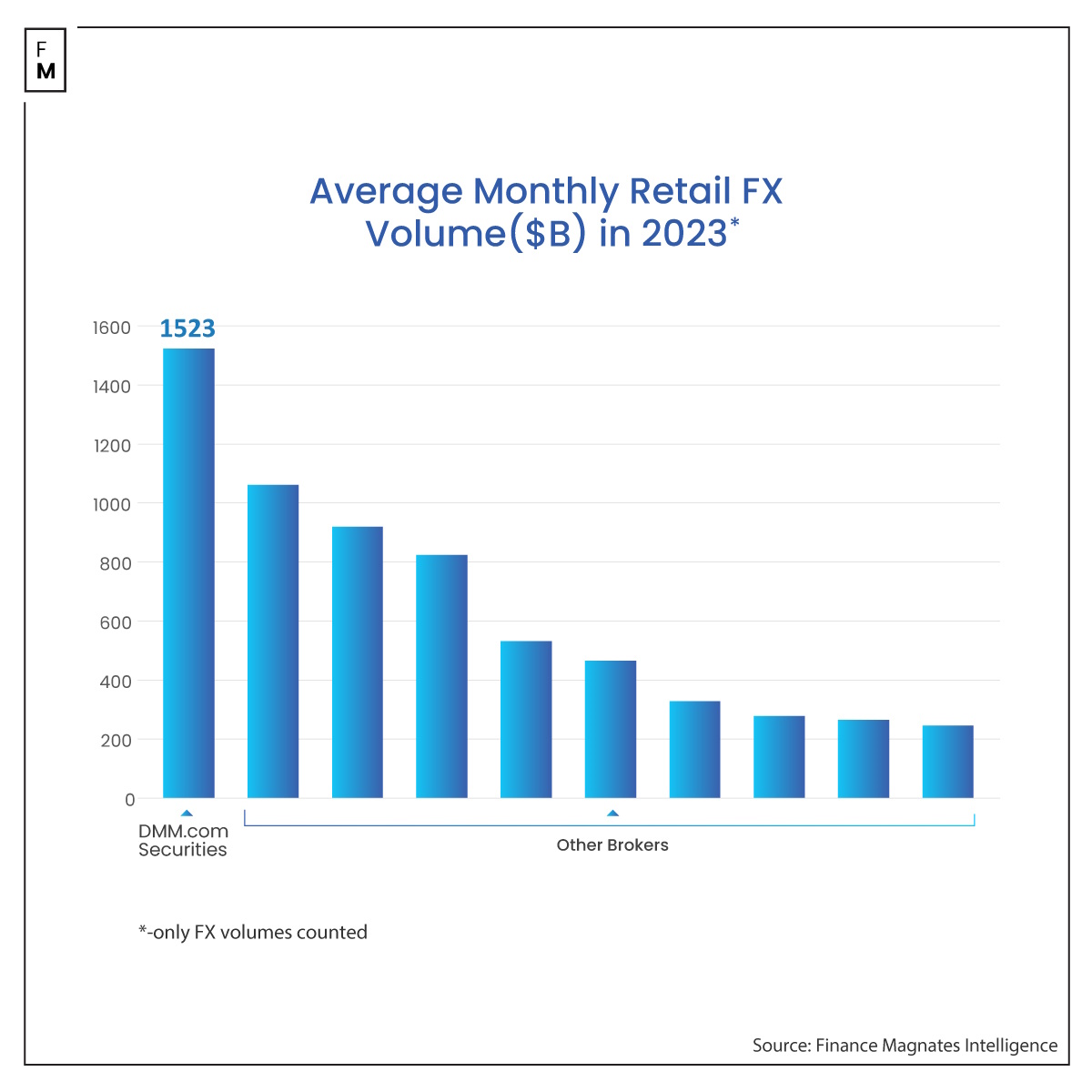

DMM.com is one of Japan’s largest internet brands, offering financial services that include forex and contracts for differences (CFDs) trading. It is also the leading local platform by trading volume.

Another Attack by North Korean Hackers

DMM Bitcoin faced significant challenges after a security breach in May resulted in a $320 million loss in Bitcoin. The attackers breached the exchange’s servers and accessed the private keys of its wallets, stealing more than 4,500 Bitcoins from a single wallet. Some analysts believe the North Korea-linked Lazarus Group was responsible for the attack.

This breach was Japan’s second-largest crypto exchange hack, surpassed only by the $532 million Coincheck hack. Globally, it ranks among the largest thefts from cryptocurrency exchanges.

Recently, the FBI, the Department of Defense Cyber Crime Center (DC3), and Japan’s National Police Agency concluded that the North Korea-linked crime group TraderTraitor was behind the attack on the exchange.