The big news in the cryptocurrency community now is that 0x could possibly be included on the biggest cryptocurrency exchange in the US. But is there any basis to this?

What is 0x?

0x is an “open, permissionless protocol allowing for ERC20 tokens to be traded on the Ethereum Blockchain .”

Explanation: a decentralised exchange is a cryptocurrency exchange which is run entirely through smart contracts, making it completely peer-to-peer. The advantage of this is that no third party is involved, which is both cheaper because there are no exchange fees, and safer because the user is always in control of his money.

However, costs are still incurred because transactions are processed on the blockchain. 0x aims to improve on this by focusing on off-chain ordering, greatly limiting the number of commands that are processed on the blockchain. To do this, it utilises 'relayers', which are nodes that broadcast orders. Only final, value transactions affect the main blockchain, a system which "reduces blockchain bloat."

0x was founded in October 2016, and two weeks ago underwent an upgrade. It was recently listed on a small-scale London-based cryptocurrency exchange too. As of now, each ZRX token is worth $1.38, and the network has a market capitalisation of $728.3 million, according to coinmarketcap.com.

There is some speculation that the coin could be listed on a major America cryptocurrency exchange, which is significant because if true it will likely cause this price to rise.

The exchange in question is GDAX, a major cryptocurrency exchange operated by Coinbase of San Francisco. It is the 12th biggest cryptocurrency exchange in the world, processing $140 million in orders daily according to coinmarketcap.com.

In March it received a licence to operate in the UK and opened a bank account at Barclays, which marked the first time that a major British bank has entertained the business of such an entity.

The speculation is based on a number of factors.

Coinbase added ERC20 support in March. In plain English, this means that it can now offer Ethereum-based coins for trading.

We’re excited to announce our intention to support the Ethereum ERC20 technical standard for Coinbase in the coming months.

We are not announcing support for any specific assets today.https://t.co/glAjG42tZD pic.twitter.com/S1tPXJcTGH — Coinbase (@coinbase) March 26, 2018

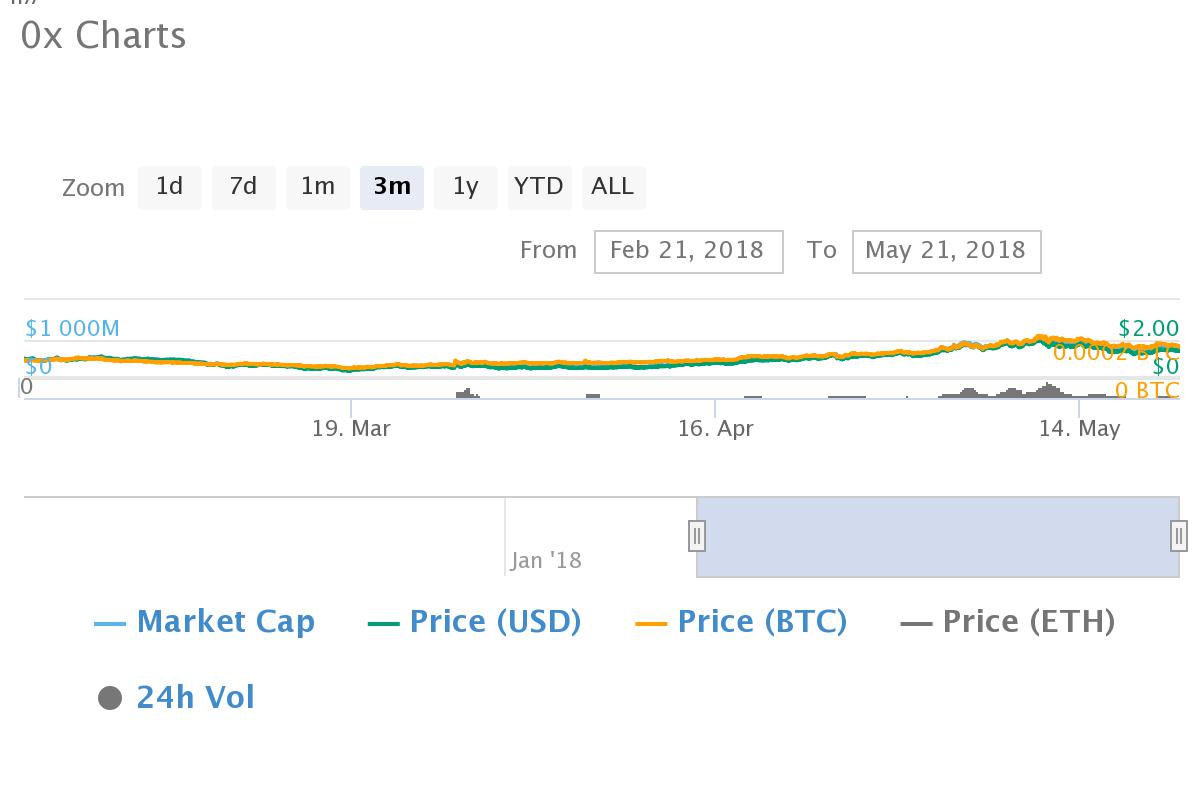

0x is an ERC20 token. According to Medium, the price of the token shot up by 40 percent within an hour of the Coinbase announcement, even though Coinbase deliberately refrained from naming any specific tokens. The spike can be seen in the graph below:

Source: coinmarketcap.com

0x is suspected to be a candidate for listing because three former Coinbase employees are involved with the 0x project. Coinbase has been supportive of ex-employees and their projects in the past. The best example is Charlie Lee and Litecoin, which was listed on the exchange in May 2017.

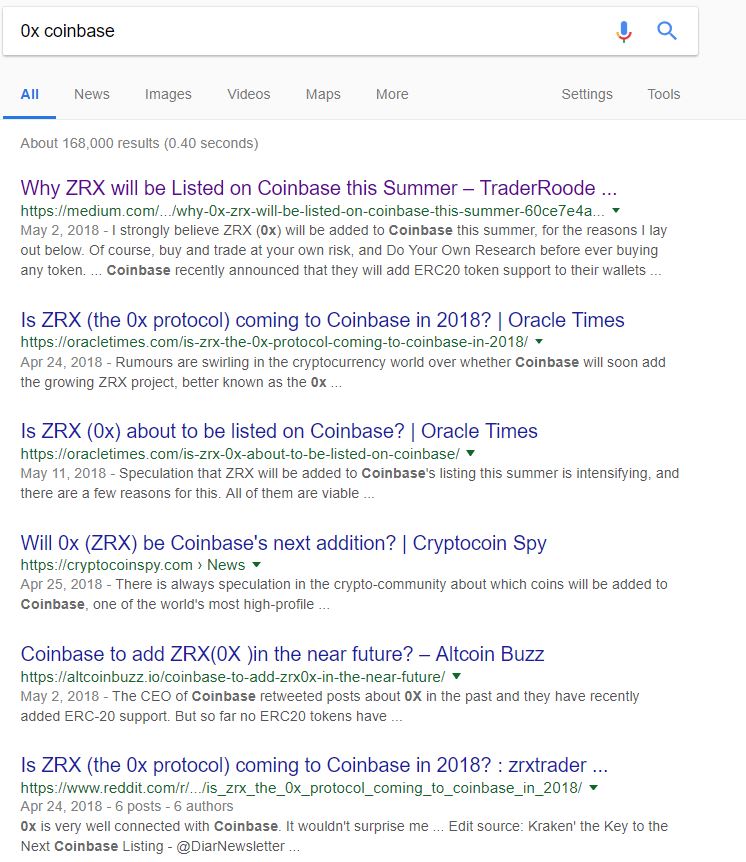

A Google search reveals that this subject is of some interest to the community:

Cryptocurrency exchanges are very sensitive to pump and dump schemes because cryptocurrency movement is driven by social media to a much larger extent than any other commodity.

For example, in December 2017 GDAX had to suspend Bitcoin Cash trading because the price of the coin jumped suspiciously around the time of its listing, leading to allegations of insider trading. It is currently facing a class-action lawsuit over losses related to this.