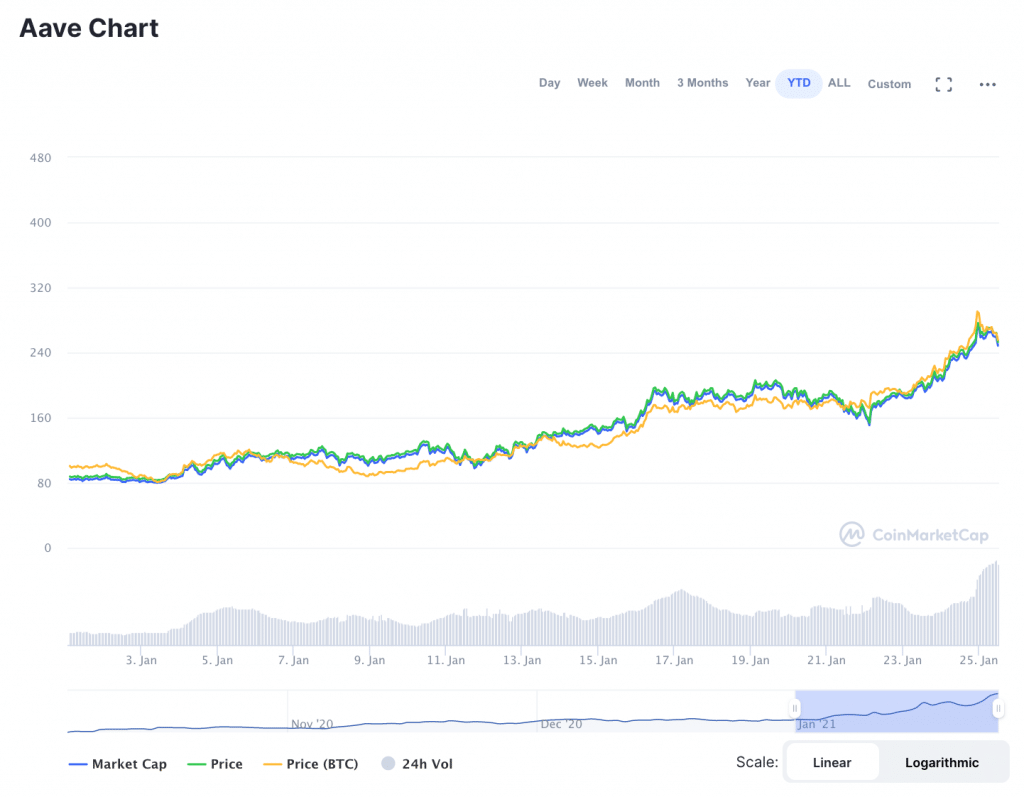

DeFi token asset, Aave (AAVE) has been on a bull run for weeks. Yesterday, the asset managed to reach a new all-time high of nearly $290. While the price has since cooled off at $255 at press time, the price is still up over 194% since the beginning of the year.

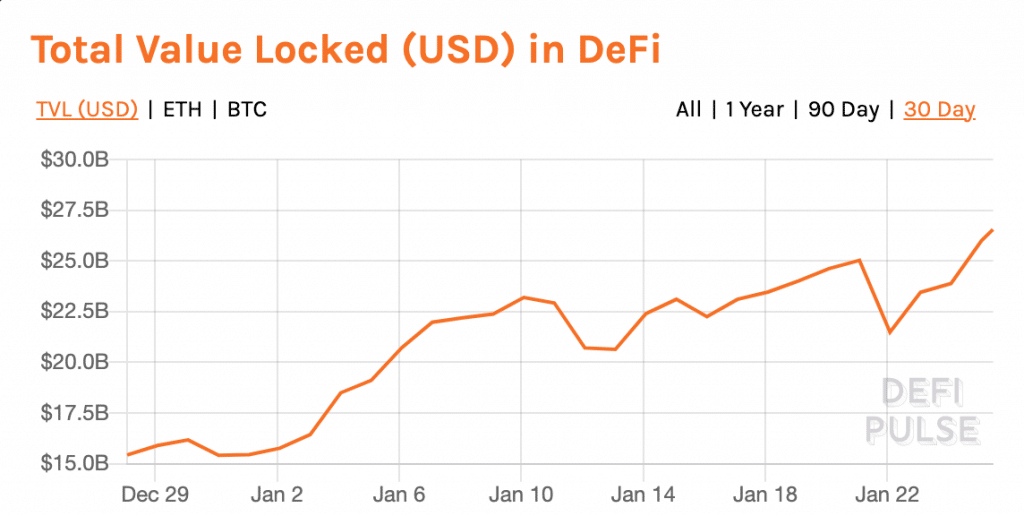

What’s driving the price of Aave up? Analysts believe that the rally can be partially attributed to a more generalized influx of capital into the DeFi space in recent weeks. The total value locked (TVL) in the DeFi ecosystem as a whole is currently $26.55 billion; on January 1st, 2020, it was $15.45 billion. Aave’s TVL sits at roughly $3.83 billion; on January 1st, 2020, it was $1.99 billion.

Because Aave is a lending platform whose token listings include a number of tokens within the DeFi space, Aave’s usage and popularity grow organically along with the popularity of other assets in the DeFi ecosystem. CoinTelegraph reported that “the steady addition of new tokens to the lending and borrowing protocol increases the likelihood that its TVL will continue to rise.”

Aave’s most popular products are the 'flash loans' that it launched 12 months ago. So far, more than $1.7 billion has been lent through these loans.

The loans allow crypto holders to quickly collateralize their portfolios to fund purchases of crypto assets and other products. As such, these loans enable borrowers to cash in on the value of their holdings without actually selling their tokens, and thereby creating a taxable event.

Aave Founder Stani Kulechov: DeFi’s Future “Depends on How People Will Adopt the Technology or Even Use It.”

Stani Kulechov, the Founder and Chief Executive of Aave, said in a debate during the Finance Magnates Virtual Summit last year that currently, it is difficult to determine whether or not DeFi will present viable alternatives to centralized financial systems. “In the long term, it might,” he said. “It really depends on how people will adopt the technology, or even use it.”

However, Kulechov believes that many of DeFi have promise for a more transparent and fair financial system: “traditional finance is like a black box or a combination of black boxes,” he said.

He explained that “as a consumer, investor, or stakeholder, you cannot see what’s going on” in these traditional financial systems. This creates “a bit of a challenge in the sense that you probably don’t see what kind of markets there are, and what kind of competition there is.”

Stani Kulechov, Founder and CEO of Aave.

On the other hand, “decentralized finance, by default, is made in such a way that you can see all of the actions there because of its immutable nature, those actions are actually real in the sense that they’re not just figures in a database that can be changed, but they’re actually values that exist in a Blockchain in an immutable way.”

Therefore, as opposed to the opaque nature of centralized finance, “from an end-user or developer perspective,” decentralized finance allows one to “participate in the system,” Kulechov said. “You can build a financial application that could be used in the future by millions of people.”

“Anyone can create the next application in DeFi,” he continued. “And because it’s an ‘internet’, you can create applications that can act as one piece that interacts with anything on-chain.”