Joining several others of its ilk, Admiral Markets has announced the addition of Bitcoin, Ethereum, Litecoin and Ripple for trading on its platform. All of these Cryptocurrencies will be available as pairs against the US dollar and this is in response to the growing international popularity of cryptocurrencies. They have spawned a new industry by themselves and have been gaining recognition across the financial industry.

The London Summit 2017 is coming, get involved!

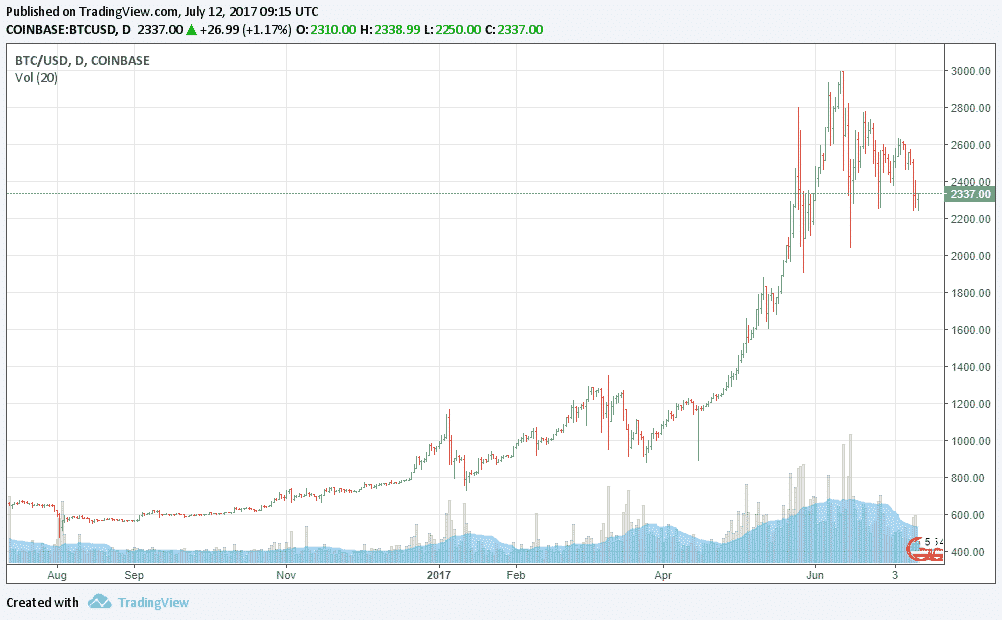

In its announcement, Admiral Markets acknowledged the growing clout of cryptocurrencies as trading instruments but also warned traders about the risks that are involved due to the high Volatility of these instruments - rises and falls of around 10% of their values in a single day are common occurrences. This is the reason why Admiral Markets is offering leverage of only 1:5 for BTC/USD and ETH/USD and only 1:2 for LTC/USD and XRP/USD.

Admiral Markets has also restricted the exposure on these instruments to 10,000 EUR at any point of time, and for now only long positions are available on these instruments. This means that traders can only buy and then sell and cannot go short as the broker needs to build some reserves at the exchange.

Cryptocurrencies Gaining Traction

Admiral Markets joins brokers like Alpari, Libertex and XTB who have also added cryptocurrencies to their range of instruments over the last few weeks. They are hoping to capitalise on the growing volumes in this sector, and this is also a recognition that the market is maturing.

With more brokers offering these instruments, it is likely that volumes will increase even more, which should help the market to mature more quickly. This will help to bring volatility under control in the long term, which will help to attract even more traders.

The fact that these markets are available 24 hours a day, 7 days a week is likely to be another attractive factor for traders who complain about the lack of markets to trade over the weekend.