Earlier this week, cybersecurity firm Cipher Trace published a report with findings that so far this year, nearly $1.4 billion dollars in cryptocurrency have been stolen by malicious actors.

On the surface of things, it looks as though the crypto space might be cleaning up its act: while the number is sizeable, the figure is considerably less than the amount of cryptocurrency that had been stolen around the same time last year; both 2019 and 2020 are showing exponential increase in thefts over 2018, when $1.7 billion was stolen through the year.

Specifically, CipherTrace’s Q2 report from 2019 revealed that $4.26 billion had been taken in the first six months of the year. The majority of the stolen funds in 2019 were taken in connection with PlusToken, a massive Ponzi scheme based out of China that made off with some $3 billion in crypto coins.

However, while scammers have taken quite a bit less this year than they had in 2019, there are some eerie similarities between this year’s crypto scam landscape and last year’s: specifically, most of this years’ stolen funds can be attributed to Wotoken, which--like PlusToken--is shaping up to be another large-scale Ponzi scheme with more than $1 billion in spoils.

Indeed, “the largest contributor to 2020's crypto crime total was Wotoken's billion-dollar Ponzi scheme out of China,” said John Jeffries, Chief Financial Analyst at CipherTrace, to Finance Magnates.

John Jefferies, Chief Financial Analyst at CipherTrace.

As such, “2020 is on track to be, at minimum, the second-highest year on record for the total amount netted by criminals from cryptocurrency crime,” he said. “However, it's possible that 2020's cryptocurrency crime numbers could exceed 2019's $4.5 billion.”

This may be particularly true if scams like PlusToken and Wotoken continue to permeate the cryptocurrency world. While Plustoken and Wotoken are certainly some of the most prominent examples, there are many others, including the infamous OneCoin scam, which made off with $4 billion over the course of several years.

Why do these scams continue to be so effective? And has the crypto scam landscape changed--or do crypto criminals keep singing the same old song?

Greed and altruism: Ponzi schemes are so successful because the play on peoples’ emotions

Nir Kshetri, Professor in the Bryan School of Business and Economics at UNCG and research fellow at Kobe University, told Finance Magnates that Ponzi schemes continue to proliferate the cryptocurrency space because they are so effective.

Indeed, “the criminals behind crypto frauds are likely to utilize proven techniques that they have been using for quite some time,” Kshetri said. Specifically, “many cryptocurrency fraudsters appeal to people’s greed.”

In other words, these kinds of schemes are so successful because “they promise big returns.”

Indeed, high returns are essential in the crypto Ponzi playbook: they were a feature of Plustoken, Onecoin, and Bitconnect--another scam that was shut down in 2018.

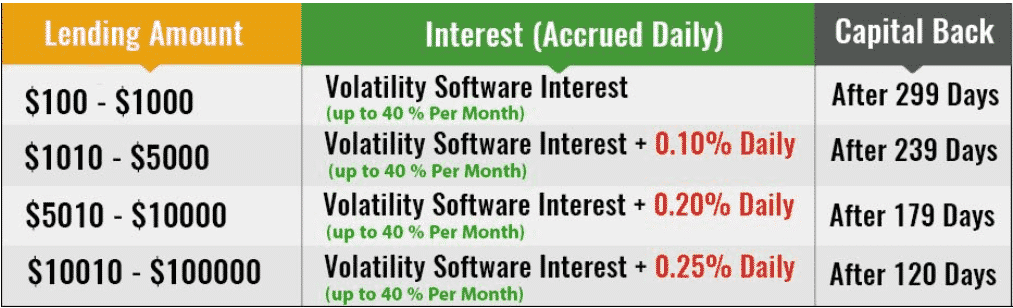

Bitconnect guaranteed daily returns for users, with higher rates for investors who were willing to ‘lock’ more of their capital into the Bitconnect ‘network’ for longer periods of time.

Kshetri pointed to another alleged Ponzi scheme that appears to still be operational as an example: “an unknown group of ‘entrepreneurs’ runs the scam bot iCenter, which is a Ponzi scheme for Cryptocurrencies such as Bitcoin and Litecoin,” he said.

“It doesn’t provide information on investment strategies, but somehow promises investors 1.2% daily returns.” Some of iCenter’s Facebook posts promised returns over 2.5% “according to your investment amount."

At press time, the iCenter website was down, and appeared to have been defunct for quite some; a message on the iCenter Telegram group (which had 4,432 subscribers) dating back to October 2018 said that “Our server provider is currently experiencing a technical issue. They are already aware of it and it should be sorted very soon. We appreciate your understanding, the Bot's should be working very soon. (sic)”

(Exit scam, anyone?)

Unwitting victims of crypto Ponzi schemes can recruit other victims

Another problem with these Ponzi schemes is that they don’t just play on peoples’ greed: they also insidiously play on peoples’ altruism.

After all, if you had just found an amazing, life-changing platform that would quickly multiply your savings, wouldn’t you also send it to your friends? Your neighbors? Your parents? Your grandma?

“Victims may [incidentally] exploit friends and family through social media,” Kshetri explained. “When one person is [taken in] by the promise of big returns on cryptocurrency investments, they may spread the word to friends and family members.”

These schemes also invoke the visages of trusted celebrities in order to reel in unwitting victims: “sometimes big names such as celebrities get involved, [although] not all the celebrities know they’re involved,” Kshetri continued.

For example, “the fraudsters behind iCenter featured a video that purported to be an endorsement by Dwayne’ ‘The Rock’ Johnson, holding a sign featuring iCenter’s logo. Videos of Justin Timberlake and Christopher Walken were deceptively edited so they appeared to praise iCenter, too.”

Coronavirus may have heightened susceptibility to crypto crimes online

While Ponzi schemes may play on peoples’ tendencies for greed and altruism, there’s another kind of cryptocurrency scam that is playing on another human emotion: fear.

After all, 2020 has been one of the most anxiety-filled periods of time in recent history; with coronavirus quarantines going into their third and fourth months, and protests raging in Hong Kong and North America, existential fear across the globe seems to be reaching a fever pitch.

CipherTrace’s John Jeffries told Finance Magnates that the Coronavirus pandemic in particular has “certainly made its mark in cybercrimes, especially as government resources and attention are funneled to mitigating impacts [of the virus] and oversight [on cybercrime] is reduced.”

Steven Merrill, head of the FBI’s Financial Crimes Section, said in an interview posted on the FBI’s website that potential victims are especially vulnerable right now because “for example, people are looking for medical attention and medical equipment. They also may be unemployed and looking for work.”

“There may be an extra level of desperation right now that may cause someone to make an emotional decision that could make them a victim,” Merill said.

Corona-infected bats for sale on the darknet

Other COVID-19 crimes involving cryptocurrency are downright creepy: in April, Chainalysis published research on a dark-market vendor selling what he claimed was coronavirus-infected blood, conveniently injected into the bodies of bats.

Taking a slightly less unorthodox (though still unethical) route, other darknet vendors sold personal protective equipment (PPE) on the darknet in exchange for cryptocurrencies.

However, John Jeffries explained that dark market crimes took the lions’ share of crypto transactions related to COVID-19: in other words, darknet criminals seem to be more interested in stealing money online than in buying corona-infected bats.

“Though nearly all dark market COVID-19 crimes involve cryptocurrency Payments , COVID-19 fake PPE did not see many successful sales on darknet markets,” Jeffries said. Instead, “Coronavirus-related phishing kits,” which buyers can conveniently purchase in order to steal money and personal information from unwitting victims, “were found to be the most popular item.”

"I expect that the crypto fraud industry in 2020 will be bigger than in 2019"

With the coronavirus still playing a significant role of human societies across the globe, and heightened levels of fear and anxiety persisting, Nir Kshetri says that he believes that crypto scams could continue to proliferate throughout the globe.

“With the emergence of new COVID-19 themed frauds as well as the existing ones, I expect that the crypto fraud industry in 2020 will be bigger than in 2019,” he said.

Nir Kshetri, Professor in the Bryan School of Business and Economics at UNCG and research fellow at Kobe University.

Similarly, CipherTrace’s John Jeffries said that although “it's nearly impossible to predict,” given the fact that “$1.4 billion was lost to crypto crimes during the first five months of 2020, it's very possible that by year's end the total netted by criminals could exceed 2019's $4.5 billion.”

“I am [also] concerned about exit scams later in 2020 by smaller VASPs that are struggling financially,” Jeffries added.

However, in the meantime, there is some positive news: Jeffries told Finance Magnates that “to the positive, the findings in our report illustrate that the amount of criminal funds directly received by exchanges dropped by 47% in 2019.”

“This trend in an ongoing annual reduction in criminal funds funneled through exchanges can be attributed in large part to the implementation of effective AML controls,” he explained.

2020 could bring more regulatory attention to various aspects of the crypto industry

Jeffries also predicts that this year could bring more regulatory attention to Bitcoin ATMS.

“Despite the overall reduction in criminal funds sent to exchanges, the percentage of funds sent to high-risk exchanges from US Bitcoin ATMs (BATMs) has seen exponential growth, doubling every year since 2017,” Jeffries said.

“We expect BATMs to become a greater point of regulatory focus and enforcement because of this, as demonstrated by the case made against Kunal Kalra for using his BATM operation to launder more than $25 million in cash and cryptocurrencies.”

More regulation in the crypto space could potentially reduce the impact of fraud in crypto over the long term. However, as long as cryptocurrency scams continue to appear anew within the space, investors and traders need to stay vigilant.

“Investors looking for returns in blockchains and cryptocurrencies should note that they are complex systems that are new even to those who are selling them,” Nir Kshetri said.

“Newcomers and relative experts have also fallen prey to scams. In an environment like the current cryptocurrency market combined with COVID-19, potential investors should be very careful to research before making investment decisions. Make sure to find out who is involved as well as what the actual plan is for making real money.”