Crypto markets have lost roughly 30 percent off of their total market capitalization over the past seven days. As crypto prices continue to tumble, and traders scramble to close their volatile holdings, the stablecoin market is surging: according to CoinTelegraph, the total stablecoin supply has grown by roughly 190% over the past 90 days. However, not all stablecoins are created equal.

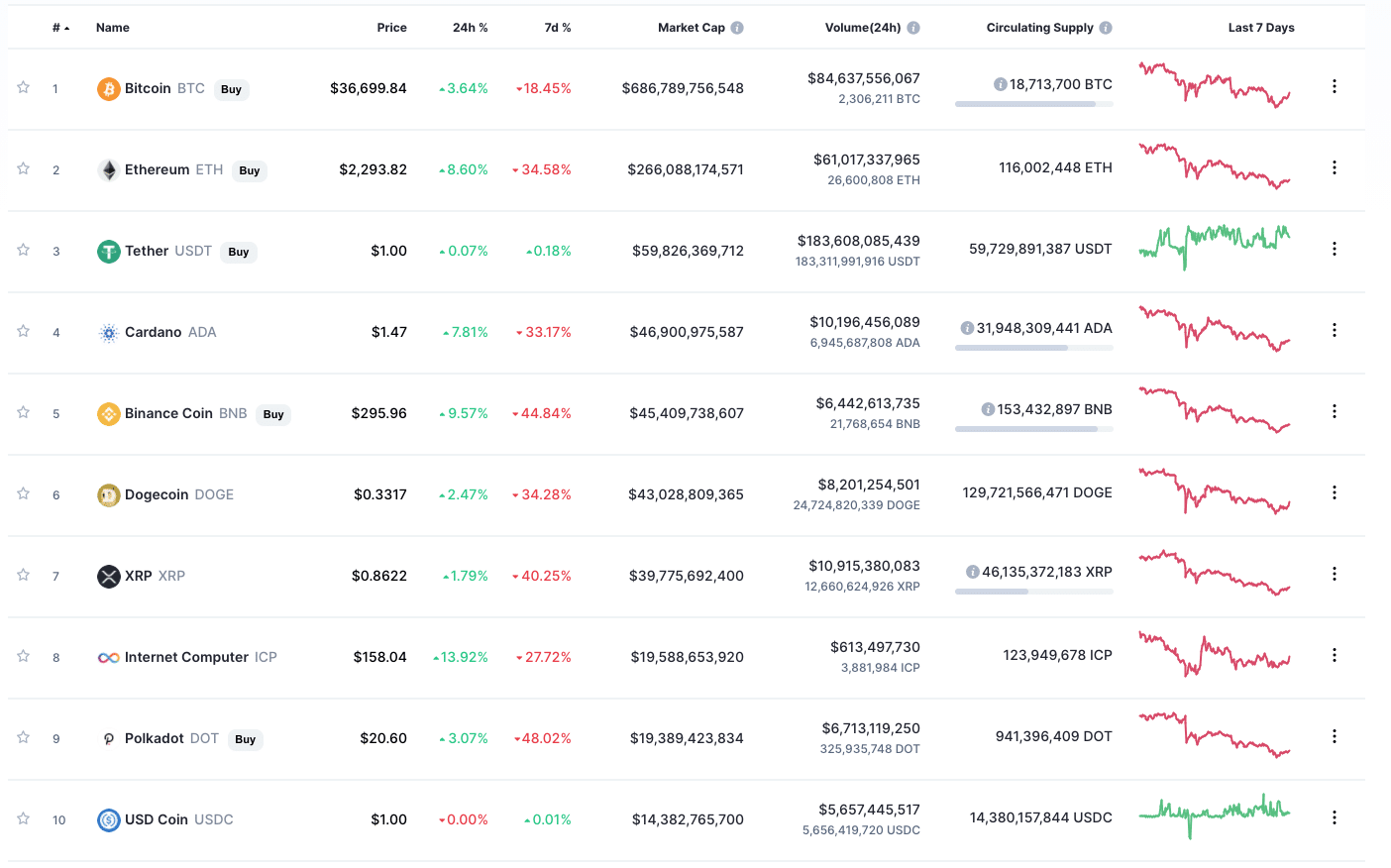

Amidst the valuation bloodbath, centralized stablecoins are performing better than ever–Tether (USDt) and Centre’s USD Coin (USDC) are respectively #3 and #10 in CoinMarketCap’s list of largest coins by market cap. Data from CoinGecko shows that together, the two coins hold roughly 80% of all stablecoin market capitalization.

Top ten Cryptocurrencies by market cap via CoinMarketCap.com (2021-05-24 at 11.32.33).

While these centralized stablecoins are performing well amidst the crypto market crash, algorithmic stablecoins are another story. Algorithmic stablecoins hold their value by automatically increasing or decreasing their own supply or the supply of the asset to which they are pegged. However, according to CoinTelegraph, some of these coins have lost their pegs.

“This Too Shall Pass”?

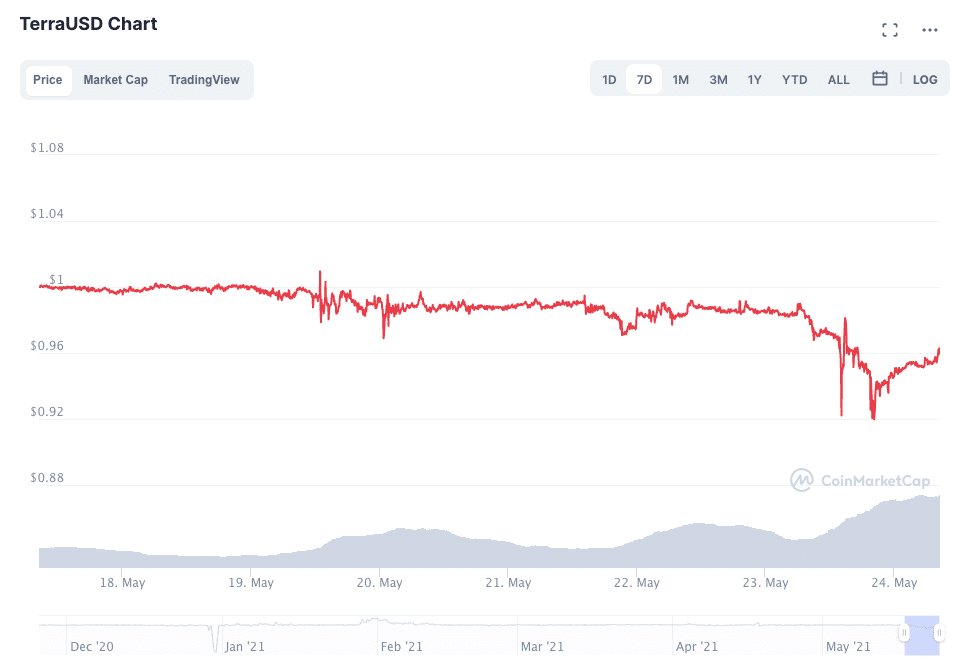

For example, TerraUSD (UST), which is tied to the LUNA coin, was sitting around $0.95 at press time, having fallen as low as $0.92 on Sunday, May 23rd. The Twitter account associated with decentralized Liquidity protocol, THORChain said that the asset was being 'stress-tested', and urged followers to 'Back the builders'.

Terra founder Do Kwon and “team/backers have their fingers on the pulse and are moving fast,” THORChain wrote.

Do Kwon said in a tweet on May 23rd that while the Terra economy was experiencing stress “none of the fundamentals in [the Terra ecosystem] have changed. asserting the project has been. “The ecosystem is significantly de-risked for having survived one of the worst market crashes in crypto,” he wrote.

“Building pure, unbiased and decentralized money is the long game,” Kwon said.

The Terra Twitter account wrote that: ”Our community will emerge stronger from this ephemeral market turmoil. This too shall pass.”

However, not everyone is convinced. One Terra follower wrote that: “What is scaring me is that $UST has not retained its peg to the dollar. It keeps peaking below a dollar and falling back down. Any explanations?? (sic)”

Still, another user explained that: “it’s because it’s an algorithmic stablecoin, it has to constantly burn/mint UST/LUNA to keep its peg. I’ve always seen it come back to a dollar tho, so not worried. (sic)”

Other algorithmic stablecoins are even further away from their $1 target pegs. CoinTelegraph reported that Ampleforth (AMPL) fell to $0.48 on May 23rd, its lowest level in an entire year. On the other hand, the Ether-backed RAI algorithmic stablecoin has managed to stay relatively close to its target peg of $3 throughout the market crash.