After a week of steep volatility, altcoin prices appear to be stabilizing.

Indeed, the seven-day charts of the largest altcoins by market cap are still seeing red. Chainlink (LINK) is down roughly 12 percent, Uniswap (UNI) is down by 8 percent; Polygon (MATIC) is down 5 percent. Binance Coin (BNB) and DogeCoin (DOGE) are down just over 10 percent. Bitcoin Cash (BCH) is down 17 percent, while XRP and Polkadot (DOT) are respectively down by 25 and 33 percent over seven days.

However, the 24-hour charts of each of these coins tell very different tales. It appears that altcoin investors have been 'buying the dip': LINK has risen more than 23 percent in 24 hours, while MATIC is up more than 27 percent. UNI is up by more than 11 percent; BNB is up nearly 9 percent in 24 hours, while DOGE’s price is up 1 percent. BCH is up 6 percent; XRP is up 5 percent, while DOT was up by more than 10 percent.

Additionally, Ethereum (ETH), which fell below $1,800 on May 23rd for the first time since March 31st, is up nearly 10 percent in 24 hours and down just over 2 percent in 7 days. Cardano (ADA) was performing even better, with a 24-hour rise of 13 percent against a 7-day gain of 1.57.

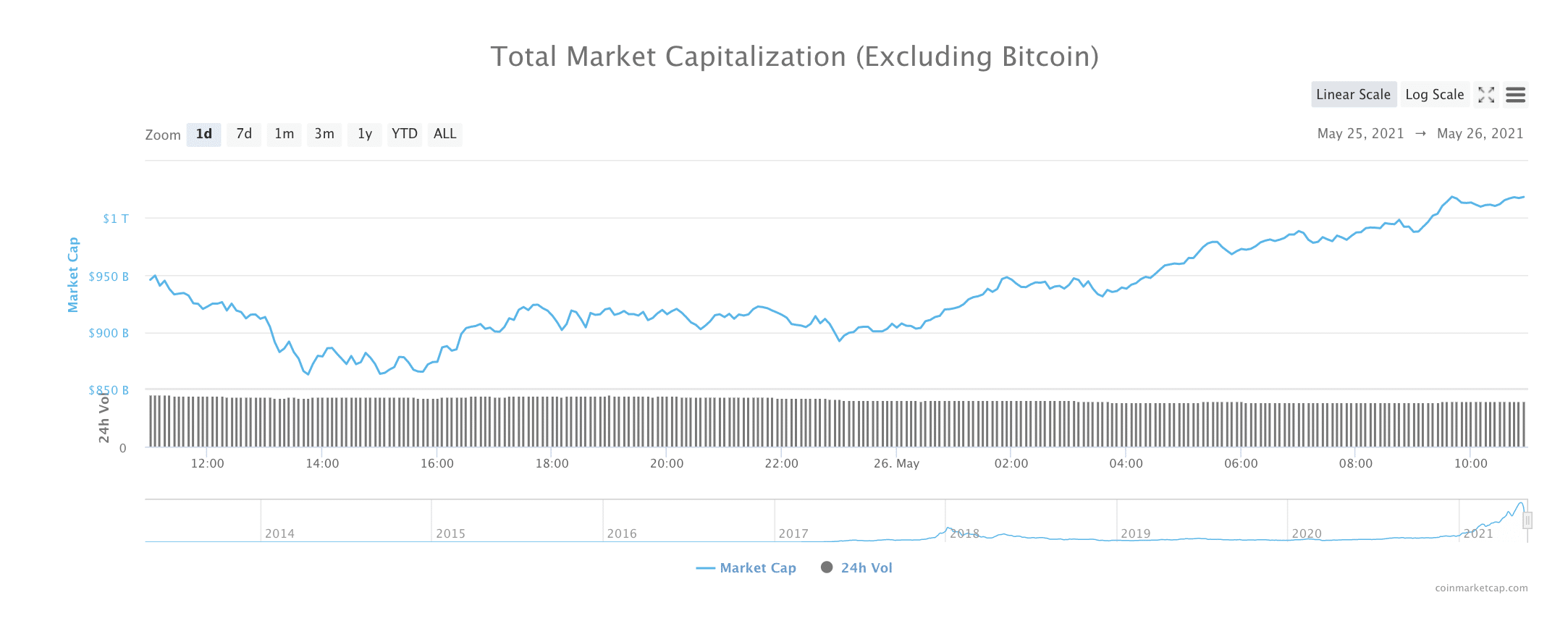

The total market capitalization of cryptocurrencies excluding Bitcoin was up in the past 24 hours, showing an increase from $945 billion to $1.01 trillion.

What caused the altcoin market rollercoaster last week? And what is causing markets to stabilize now?

Blows to Bitcoin (BTC)

Many analysts agree that an important contributing factor was the price of Bitcoin, which took a blow last week after China declared its intentions to crack down on crypto; around the same time, Tesla Founder Elon Musk announced that his company would no longer be accepting BTC payments, citing environmental concerns. The negative news was magnified by 775,000 leveraged BTC positions that were wiped out instantaneously as the price of Bitcoin fell.

As a result, Bitcoin fell nearly 30 percent over the course of several days. The drop was a harsh reminder that while BTC may be gaining traction as a 'store-of-value' asset, it is not nearly as stable as it may have seemed to be earlier in the year.

Monica Eaton-Cardone, the Co-Founder and COO of Chargebacks911, told Finance Magnates that: "A lion eats meat. Lots and lots of meat. That's what they do. So if you own a lion, you shouldn't be surprised that it's a ravenous meat-eater. Similarly, a speculative, cutting-edge investment like Bitcoin is going to fluctuate wildly. That's what they do.”

Monica Eaton-Cardone, Co-Founder & COO of Chargebacks 911.

Therefore, "If you're expecting the crypto market to stabilize, you're probably going to be disappointed. It's still a highly speculative, wildly unpredictable investment, and its near-term fate, I believe, is to bounce from soaring peaks to rock-bottom valleys.”

“Fluctuation ought to be our expectation because stability is going to be the exception. So, the good news is, yes, the crypto market will absolutely recover. The bad news is, it will also crash again. And you know what? Both might happen in the same week.”

Is Extreme Volatility in Altcoin Markets Over?

In fact, both could happen this week, while the death drops that plagued crypto price last week may have screeched to a halt (for now), the ride could start again at any moment.

Garrette Furo, Blockchain Consultant and Advisor for the Cosmos Network, told Finance Magnates that: “The assumption that cyclical or higher time frame downward movement has stopped is not a safe one.”

“Digital asset markets are famously volatile and whether this is a bounce or not remains to be seen,” he said. Still, Furo believes that: “fundamentals are growing every day in terms of network use, versatility and development power.”

And while crypto market volatility can seem whimsical at times, Furo explained that there is some method to the madness of price movements: “What is clear from price is that the market is strongly momentum-driven, with correlations going to 1 on the way up and the way down,” he said. “this usually is perpetuated by the news.”

In other words, just as soon as crypto market sentiment reached new highs, it was over: “Positive sentiment flowed from news cycles, pushing cryptos to all-time highs, [and was quickly] taken away by media pushing uncertainty with Chinese mining laws and Bitcoin energy consumption,” Furo said. “My guess is that the market is likely going to follow bitcoin and in that regard, yes, altcoins are in danger of further drops.”

Garrette Furo, a blockchain consultant and advisor working with Cosmos Network.

Investors May Be Buying Up Their Favourite Coins at a “Discount”

Peter Jensen, CEO at RocketFuel Blockchain, pointed out to Finance Magnates that many crypto investors see price drops as a positive thing, if nothing else, these dips are an opportunity to buy more of the coins that they love.

“Price volatility is a feature of crypto and is not a testament of its uncertainty – this is true for BTC as well as many altcoins,” he said. “Investors have embraced it as a quality of Cryptocurrencies and have rushed to buy in crypto during the dip, proving that even if the market falls in a day, there are investors who will look at it as an opportunity and rush to buy in crypto at cheap prices.”

Indeed, this appeared to be happening at the moment of press time, in the list of top ten cryptocurrencies by market cap, the seven-day prices of large-cap altcoins were down double-digits, while 24-hour prices were flashing green. This is an indication that investors have started to buy up their favorite coins at lower prices.

“The dip-buying has shown that large investors remain confident of the long-term bullish prospects of cryptocurrencies. Recent statistics from IntoTheBlock have shown that the number of addresses holding Bitcoin (holders) for over a year has increased by 120,000 from 21.81 million to 21.93 million. Appetite is growing.”

Therefore, Jensen said, “it’s not so much about ‘if altcoins are in danger of further dips’ so much as it’s about investors having the tolerance to handle continued fluctuation and unpredictability.”

Crypto Is at the Mercy of “A Rather Bizarre Combination of Market Forces”

Indeed, media narratives do play an incredibly important role in crypto markets, particularly at a moment when so many investors are entering crypto markets for the first time.

Earlier this week, Blockstream CSO Samson Mow pointed out to Finance Magnates that while the negative news coming from China and Tesla had a significant negative effect on crypto markets, both pieces of news were reiterations of two narratives that have been at play in crypto for years: that China is cracking down on crypto markets, and that Bitcoin has a serious environmental problem.

But, the media narratives around cryptocurrency markets are not the only factors that influence prices.

"By historic standards, the crypto marketplace is subject to a rather bizarre combination of market forces,” Eaton-Cardone told Finance Magnates.

For example, while the announcement that Tesla would no longer be accepting BTC was significant, Mr. Musk has moved crypto markets with much less: "If Elon Musk had Tweeted about the US bond market, there'd be virtually zero reaction from investors. No impact at all,” she said.

The “Elon Musk Effect” Still Has an Outsized Influence on Crypto Markets

“The fact that he was able to rock the crypto market so dramatically is indicative of crypto's weakness. Your Bitcoin portfolio might end-up being your winning lottery ticket, and it might ultimately skyrocket in value and make all your dreams come true, but it's still a very vulnerable investment.”

But, even with high volatility and flaky price movements, crypto–and Bitcoin, in particular, seems to have an unshakeable base of old-school supporters: “Clearly, some people are attracted to [crypto] for philosophical reasons,” Eaton-Cardone explained. “They're libertarian-minded and have a copy of Atlas Shrugged on their coffee table.”

“For them, it's as much a moral investment as a financial one. Not unlike the people who've turned to crypto because of dissatisfaction with government rules, regulations and fiscal policy, they're going to give crypto every benefit of the doubt,” she said. Therefore, “Elon Musk might have the power to rock the crypto market with a single Tweet, but ironically, it's his ultra-affluent, tech-loving acolytes, admirers and contemporaries who've given crypto a significant built-in basement.”

DeFi Use Cases Are Still Growing

Beyond media narratives and die-hard crypto devotees, the DeFi movement of the last year has increased the role of another important influencing factor on crypto prices: use cases. Last year, the so-called 'DeFi summer' saw the growth of decentralized lending platforms, liquidity protocols, data oracles, exchanges and more.

While these projects have been growing, Defi is still incredibly new. Dr. Klaus Kursawe, Blockchain Researcher at Vega Protocol, told Finance Magnates that: “The entire field of DeFi projects is so novel that it should not surprise anyone that teething problems hit individual projects, or the entire infrastructure, that requires constant improvements and added resilience.”

“Even though we can build on a vast body of research, the impact of DeFi applications, be it requirements for speed and throughput, scalability, cost-efficiency, or economic factors such as fair business models for miners and the management of MEV (Miner/maximum Extractable Value), have been evolving over a rather short time,” he said.

As such, “None of these issues are a fundamental roadblock though, and forward-looking projects are addressing them already.”

Will 2021 See Another “DeFi Summer”?

Moreover, Dr. Kursawe pointed out that: “Ethereum is moving to a new version that can increase speed and energy efficiency, and other projects are developing and implementing even more performance-optimized blockchains.”

“MEV (which caused damages amounting to $286.3M in just the last 30 days) is being addressed through fairness protocols and fair mining pools, and new solutions to other issues such as a lack of diversity are under active research. And, while no one can predict how the DeFi summer will pan out, what we can say is that the current moment in DeFi is more like ‘spring’ than summer's past.”

In other words, while the market may still be recovering from the negative action last week, things could improve, and the optimism is not limited to DeFi: Eaton-Cardone also said that: "As we recover from the pandemic, many are predicting a return to the roaring 20s, with pent-up people eager to throw their masks away, spend money, have fun and live life to its fullest again.”

“At the same time, fiscal incompetency and political irresponsibility are unlikely to suddenly stop. That certainly sounds like a crypto-friendly forecast. At least in the short-term."