A cryptocurrency industry consortium known as the Universal Protocol Alliance has launched a new gold-backed Stablecoin that is pegged to gold guaranteed by the Western Australian Perth Mint, which is owned by the Australian government.

The consortium, which counts Bittrex Global, Ledger, CertiK, and Uphold among its members, has dubbed the token as ‘Universal Gold,’ or UPXAU. The token can be purchased for an investment as low as $1; there are no limits on how many tokens can be bought. The tokens also have no holding fees, as many more traditional gold investment products do.

JP Thierot, chief executive of Uphold, told CoinTelegraph that “the Universal Gold project has been in the making for quite some time,” and that one of the Alliance’s largest investors is “a prominent goldbug” who helped to develop the Alliance’s relationship to the Perth Mint.

“The Perth Mint is the largest refiner of new gold in the world, and is owned by the Government of Western Australia, which guarantees all the gold it holds in the same way the FDIC guarantees US dollars held in American banks,” Thierot explained.

The Association has also described the coin as being imminently spendable: Forbes reported that as soon as an investor buys some UPXAU, “she can spend parts of it using her Uphold credit card, or take physical delivery.”

UPXAU isn’t the Perth Mint’s first gold-backed crypto token

The token is somewhat similar in nature to the Perth Mint Gold Token (PMGT), which was launched by Australian fintech firm Infinigold last year. The gold backing PMGT is also guaranteed by the government of Western Australia, which owns the Perth Mint. Therefore, when PMGT launched, the company claimed that its coin was “the world’s first sovereign gold digital token.”

At the time of PMGT’s launch, Richard Hayes, chief executive of the Perth Mint, said that “the digitization of gold via a public ledger is a natural progression for the global commodity markets.”

“It will promote gold as a mainstream asset, enhance its accessibility, and offer greater Liquidity , transparency, and auditability of the real assets backing this type of digital token.”

JP Thierot, chief executive of Uphold.

Global turmoil has brought increased attention to gold

There seems to be an increased level of attention on gold-backed stablecoins as a result of the economic instability that the COVID-19 pandemic has caused around the world.

In January of this year, a report by Bitcoin.com found that there are at least 77 of these gold-backed projects currently on the books in spite of the fact that at least 30 similar projects have failed over the course of the last ten years.

Since January, a number of new gold-backed stablecoins have continued to launch, including Tether’s XAUT, another gold-backed stablecoin that was launched in February.

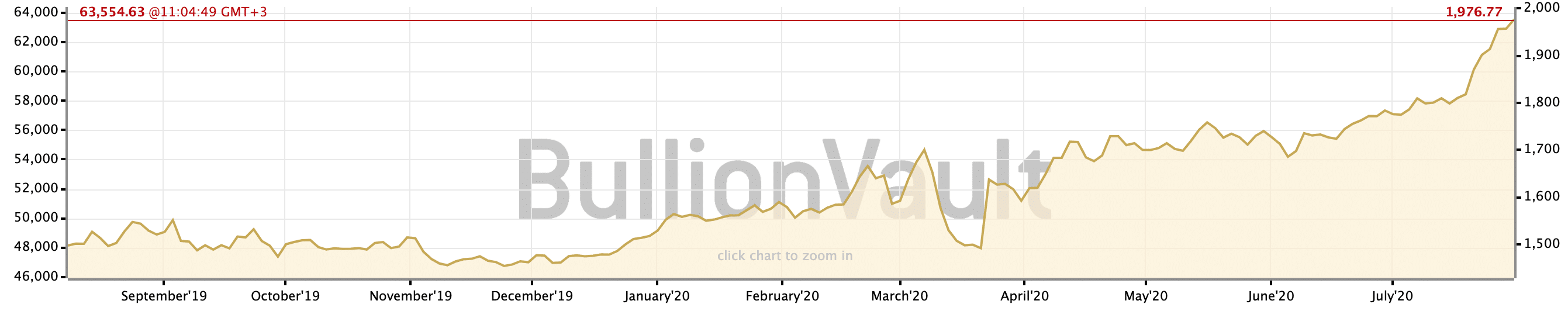

As global tensions have continued to develop throughout the year, the price of gold has increased from roughly $1,530 on January 1st to around $1,980 at press time.