The cryptocurrency trading landscape is very different now than it was even a year ago. Around this time last year, optimistic analysts were predicting that the bear market that had begun to drag on for an uncomfortably long amount of time would soon end and that the happy days of BTC “to the moon” would soon return.

Now, a year later, the bear market has continued to drag on and on...and on. Because it’s become so much more difficult for cryptocurrency traders to profit it off of trading assets directly, many have looked toward other methods of earning cash off of crypto.

One of the most popular methods of attempting to profit in the bear market is cryptocurrency futures trading. However, concerns of market manipulation still plague the crypto futures space. Is this a valid concern?

What is Cryptocurrency Futures Trading?

"Futures markets are a vehicle for hedging and speculating on the price of an underlying instrument without needing to own that underlying asset," explained Adam Todd, founder and CEO of Digitex Futures, in an email to Finance Magnates. "This means traders can bet on whether the price of something will rise or fall without needing to buy or sell the physical thing on which they are trading."

"Using Bitcoin futures as an example, instead of buying and selling physical Bitcoins, traders are buying and selling promises to buy or sell Bitcoins in the future."

Adam Todd.

Todd explained that futures trading could affect the price of Bitcoin "if the volume of futures contracts being traded is large enough. This is because traders who build up large exposure in the futures markets may have to hedge their risk by buying or selling physical Bitcoins."

"Due to high leverage trading, this can trigger very large buy or sell orders in the physical market which can have knock on effects to physical prices," he added.

Leverage trading allows investors to open positions that are higher than the balance of their accounts "Leverage is a very powerful tool because it can amplify your gains, but it's also dangerous because it can amplify your losses as well, and even wipe out your account if you aren't careful," explained a post from crypto exchange Kraken.

It sounds a lot like gambling--and, in a way, it is. However, the futures trading market has grown into an industry worth many trillions of dollars. The primary reason for this is institutional involvement in the futures markets--futures trading is exactly the kind of gambling that banks and other large financial institutions can legally be involved with.

Aditya Das.

Indeed, because “Bitcoin futures on CME or CBOE cash-settled markets allow traders to speculate on the future price of bitcoin without handling underlying assets, further allowing traders to buy and sell BTC without actually owning any...This distinction means crypto future markets are often characterised as 'casinos' because traders are capable of making larger gambles and bets, exaggerating potential gains or losses," explained Aditya Das, Analyst for Brave New Coin, to Finance Magnates.

However, cryptocurrency futures in particular also forged a pathway for banks and institutional investors to get involved in the cryptosphere. While these investors may have been too risk-averse to buy and trade Cryptocurrencies directly, crypto futures contracts presented an option that was a but more friendly and familiar to the traditional financial world.

Crypto Futures Alarmed Traditional Financiers

Still, for many institutional investors, futures contracts were not nearly enough. Fear of market manipulation has kept a great deal of financial institutions and investors away from the cryptocurrency futures markets. Before the first-ever crypto futures options were made available on CBOE and CME, panic spread throughout Wall Street and other parts of the financial sector.

In fact, Thomas Peterffy, CEO of major brokerage firm Interactive Brokers, published a full-page letter in the Wall Street Journal describing his concerns that opening up a cryptocurrency futures market could trigger a financial crisis similar to the recession that took place in 2008.

#Futures get a bad rep. Some blame futures for the #Bitcoin crash. Actually, $BTC was highly overvalued and seeing the professionals bet against it caused people to panick and sell.

What are Futures Functions?#Cryptocurrency #Crypto #fintech$FOTA https://t.co/i06GICjRVe pic.twitter.com/M2P0qD1rFN — Fortuna | FOTA (@Fortuna_FOTA) January 25, 2019

"If the Chicago Mercantile Exchange or any other clearing organization clears a cryptocurrency together with other products,” Peterffy wrote, “then a large cryptocurrency price move that destabilizes members that clear cryptocurrencies will destabilize the clearing organization itself and its ability to satisfy its fundamental obligation to pay the winners and collect from the losers on the other products in the same clearing pool."

Market Manipulation is a Real Concern--But Not Just for Crypto Futures

Of course, it is certainly possible that manipulation could take place in the crypto futures market--and it may have already happened on a large scale.

However, the threat of market manipulation in the cryptocurrency world may not be any more or less real than the threat of market manipulation in traditional financial spheres. JPMorgan Chase & Co was slapped with a $65 million fine in June of 2018 after the CFTC discovered that it had been tampering with its financial reports for years. The bank’s alleged motive was to influence the interest rates on USD International Swaps.

Similarly, CitiBank was fined roughly $100 million by the Attorney General’s Office for interest rate manipulation after investigative efforts were conducted in all 42 of the states that the bank has operations in. The fine also led to a widespread investigation of the bank by the CFTC.

A third case involved Goldman Sachs. The company was fined $120 million by the CFTC after attempting to manipulate a global dollar benchmark for interest rate products over a five-year period.

Here’s How Market Manipulation Could Work

If the contract is a cash futures contract (meaning that the entity that holds it is placing a bet on the price of an asset, and that the contract is settled in cash rather than the asset itself), an entity that holds a large amount of the asset could theoretically influence an asset’s price in a favorable direction.

Imagine that you have placed a bet that the price of Bitcoin will decrease 10 percent by the time your contract expires. If you have 200,000 BTC, you could sell all of them at once, which could trigger a noticeable drop in Bitcoin’s price. When smaller investors see that the value of their assets dropping, some of them will “panic-sell” their Bitcoins, which will trigger the price to fall further.

#Bitcoin longest bear market in history. When will they #STOP market manipulation? #BTC #WALES use these methods to make money off of use. It all started with #Bitcoin #Futures. We need to get rid of these Parasites. Just my opinion. #Long #Crypto #Short #Wales #Manipulation pic.twitter.com/qAFvwmNqnY

— Miami Crypto (@Gfernan33130787) February 25, 2019

If the price falls as far as your contract predicted that it would, you will win your “bet,” so to speak. Additionally, you may have the opportunity to buy back the Bitcoins that you sold to sink the price in the first place, which are now available to you at a discount.

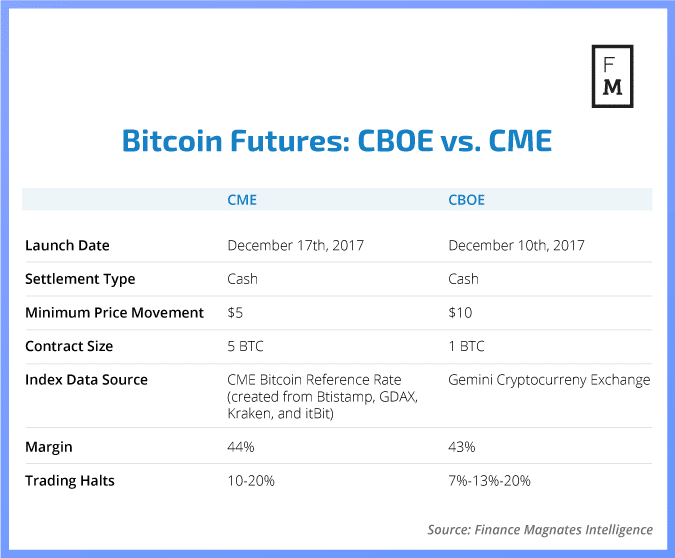

Some believe that the massive price bubble that formed in the cryptocurrency bubble at the end of 2017 was a direct result of price manipulation related to the launch of the Bitcoin futures contracts on CBOE and CME.

#US #CFTC Suspects Bitcoin #Futures #Price #Manipulation, Subpoenas Exchanges | Finance Magnates https://t.co/jM98yWjKeF #blockchain #Crypto #smallbusiness #decentralization #Bitcoin #Blockchain #ICO #cryptocurrency #Cryptocurrency #crypto #altcoin #Ethereum #Cryptocurrencies

— Adrian Brathwaite (@tarmedia) June 12, 2018

But Don’t Crypto Futures Contracts Benefit from the Transparent Nature of Public Blockchains?

It is true that cryptocurrency networks are inherently transparent--each network has a public Blockchain (a distributed ledger) that shows each one of the transactions that take place on it. Different blockchains have varying degrees of anonymity--for example, the Bitcoin network uses pseudonymous identities for wallet holders; other networks, like Dash, have additional layers of anonymity if they are desired.

Additionally, blockchains are stored across networks of computers and are therefore virtually impossible to alter or otherwise hack--more than half of the computers that uphold a crypto network would need to be compromised in order for tampering to happen. Because many blockchain networks exist across hundreds or even thousands of computers, this would be extremely difficult.

However, because Bitcoin futures and other kinds of cryptocurrency futures contracts are traded off-chain, they don’t necessarily benefit from the transparent nature of blockchain technology. Indeed, it is impossible to know how much cryptocurrency a futures contract holders owns, and therefore, we cannot know what kind of influence any single entity may have over the price of cryptocurrencies.

If futures contracts themselves were tied to a public blockchain, however, the futures market could become at least nominally more transparent. However, in order to really achieve a more transparent market, the identity of each trader would still need to be attached to the blockchain in some way.

Whether or not cryptocurrency futures contracts benefit from identity transparency via blockchain, there is something to be said about the efficiency of working with cryptocurrencies or other tokenized assets. There are no time-consuming, costly interbank transactions involved in sending, receiving, or storing cryptocurrencies (unless, for example, the Bitcoin network is under a period of particularly high traffic.)

Crypto Futures Trading Volume May Have Already Overtaken Crypto Itself

Whether manipulation is a real threat or not, the cryptocurrency futures market has continued to grow and grow. Exchanges such as BitMEX, Delta Exchange, and Bakkt have conquered various corners of the market.

In fact, Anton Kravchenko, CEO and Founder of Xena.Exchange, told Finance Magnates that “generally all futures dominate the direct trading, the trading volume of derivatives is 20 times more than spot instruments because trading of derivatives is usually easier, provides less cost and better liquidity,” he explained. “You can compare it to the trading of oil – there is a lot of volume in the futures, traders, asset managers and banks trade oil futures, but the spot market of oil is only for the real industry.”

CME’s Bitcoin Futures Overtake Coinbase Trading Volume For The First Time Ever https://t.co/SqAirZ8jnR via @bitcoinsguide #CME #CBOE #Coinbase #SEC #Wallstreet #bitcoin #EFT #manipulation #Futures # #BTCUSD #EUR #GBP #Investing #Financial #crypto

— Affiliyfuture 1 (@Affiliyfuture1) August 22, 2018

As an increasing number of platforms and trading options become available, Kravchenko said that the influx of retail investors, as well as regulated exchanges, could lead to “cross-breeding” and greater market participation across the board.

Indeed, at the moment, “CBOE futures market has high portion of institutional investors while cryptocurrency exchanges are overflowed with retails investors,” Kravchenko said. “This is going to change as cryptocurrency exchanges will mature and provide products that are unavailable on traditional exchanges, so institutional flow will move to professional and licensed cryptocurrency exchanges for juicy profits.”

Anton Kravchenko.