Earlier this week, CoinTelegraph reported on a 'silent crash' that was happening in non-fungible token (NFT) markets. The term 'silent crash' was credited to eGirl Capital member, Mewny (@mewn21).

Why were these crashes 'silent'? Because of the illiquid nature of NFTs, it is difficult to track trends in NFT markets. Anonymous developer @0xtuba explained that: “in liquid markets, you can see prices going down every day. In NFT-land, sellers have slower ‘market reaction’. Instead of sellers adjusting prices downwards every day for a month, it may just -80% ‘overnight’.”

In other words, “sellers may adjust prices -80% overnight once they realize that there are literally no more buyers for their 1-of-1 NFT. It may take them weeks/months to realize this, so the markets are much less reactive, hence, 'silent'. Most people do not know it is happening,” @0xtuba wrote.

And indeed, what goes up must come down. The massive amounts of capital that have been flowing into the non-fungible token space have been catching headlines for weeks. This has caused some analysts to call the NFT boom a ‘bubble’–which may or may not be true. Either way, though, the fact remains: some NFTs are losing value and fast.

For example, CoinTelegraph reported that CryptoPunks have seen a decrease in floor price over 40% to 14 ETH; additionally, data from evaluate.market shows that sales volume in multiple price categories for NBA Top Shot have signficantly declined since their peak on February 22nd.

“For everyone wishing they got into TopShot in Jan instead of Feb. Well ... welcome to January,” wrote @jfresshhh_, a non-fungible token enthusiast, wrote on Twitter.

https://twitter.com/jfresshhh_/status/1378210798435061766

Is the Hype around NFTs Creating a 'Bubble'?

Is the NFT craze indeed a 'bubble'? And, if so, is it starting to pop? Perhaps. However, it is unclear whether or not the hype has been enough to constitute a true 'bubble'.

Samson Mow, Chief Strategy Officer at Blockstream, explained to Finance Magnates that: “there’s been a lot of hype surrounding NFTs, and that hype is slowly dying down.”

This is what has happened: because of the hype around these markets, companies and individuals began minting NFTs as quickly as possible. “Many NFTs that were issued were highly experimental and did not actually fulfill any particular purpose as NFTs that they could not have fulfilled as a simple data entry in a spreadsheet,” Samson explained. “When you have high-profile brands enter into this experimentation phase, what you get is FOMO.”

Therefore, yes, in the short term, there are a lot of non-fungible tokens without much real value that have sold for crazy amounts of money. These 'silent crashes' may be a reflection of that.

Samson Mow, Chief Strategy Officer at Blockstream.

“Since the majority of today’s NFTs neither makes much sense nor provides much value, we’ll see that hype die down and the prices of many non-fungible tokens plummet,” Mow explained.

NFT Use Cases Are Continuing to Expand

So, is that it, then?

No. “That’s not to say all NFTs are useless,” Mow went on. For example, “NFTs have a real use case in gaming that hasn’t been properly explored yet — and that’s an industry worth hundreds of billions each year.”

And more use cases are developing: for example, in the art world, platforms like Async.Art have developed a 'programmable' art and music platform that can allow NFT holders to manipulate certain elements of an artistic work. Even without this programmable feature, non-fungible tokens minted in connection with certain works of art and music have maintained high levels of value.

Nithin Palavalli, Chief Executive Officer at RubiX, also told Finance Magnates that: “NFTs have an unlimited number of applications especially in industries like pharmaceutical, luxury, textiles, shipping, Supply Chain Management, ICT, IoT, et al.”

Palavalli also mentioned that his own company has built an alternative decentralized messenger app using NFT technology: “every message is an NFT and it is a completely peer-to-peer working protocol, with no server intervention in between and comes with immutability,” he said.

Nithin Palavalli, Chief Executive Officer at RubiX.

The Novelty of Non-fungible Token Markets Has Given Way to Interesting Experimentation

Still, the future of NFTs as investments is incredibly uncertain. “If you’re looking to buy an NFT in hope that it will be worth more in the future, don’t buy an NFT,” Mow told Finance Magnates. “For most NFTs, there’s no real benefit to long-term HODLing.”

Why is this? “A lot of NFTs are tied to the reputation of their issuers,” Mow explained, For example, “when NBA Top Shot was rolled out, people went crazy over the ‘moments’ they could buy because it was novel and interesting.”

However, the “‘moment’ owners don’t get any special privileges — no copyright, no commercial distribution rights. You really just get a copy of a video clip. I don’t see a scenario in which any of these moments will be worth more in the future than they are today.”

In other words, much of the manufactured scarcity that non-fungible token markets have created in the short-term may not be enough to sustain their value in the long term. “Manufactured scarcity” refers to the fact that NFTs can act as a scarce, collectable digital object that is tied to a ubiquitous piece of media, such as an NBA clip. Anyone can watch the clip at any time; the non-fungible token owner simply owns...well...

What Do You Actually Own When You Own a Non-fungible Token?

What is it that they actually own, come to think of it?

The truth is that it depends. “The T in NFT stands for Token so you own a token… it is like owning a crypto asset that has specific legal, contractual or even sentimental properties. So, when you look at it in that way, you can [own] anything,” he said.

For example, “I could get married and put the contract in an NFT. Government ID's could be NFT's. Articles of Incorporations could be NFT's...it's digital ownership of an arbitrary asset.”

Samson Mow explained that in other words, “what you own can vary drastically from issuer to issuer,” Mow explained to Finance Magnates. “Some entitle you to commercial distribution rights of digital property. Others transfer the copyright of a collectable to you. Yet others don’t really entitle you to anything — all you can do is look at them inside an app and brag about owning them.”

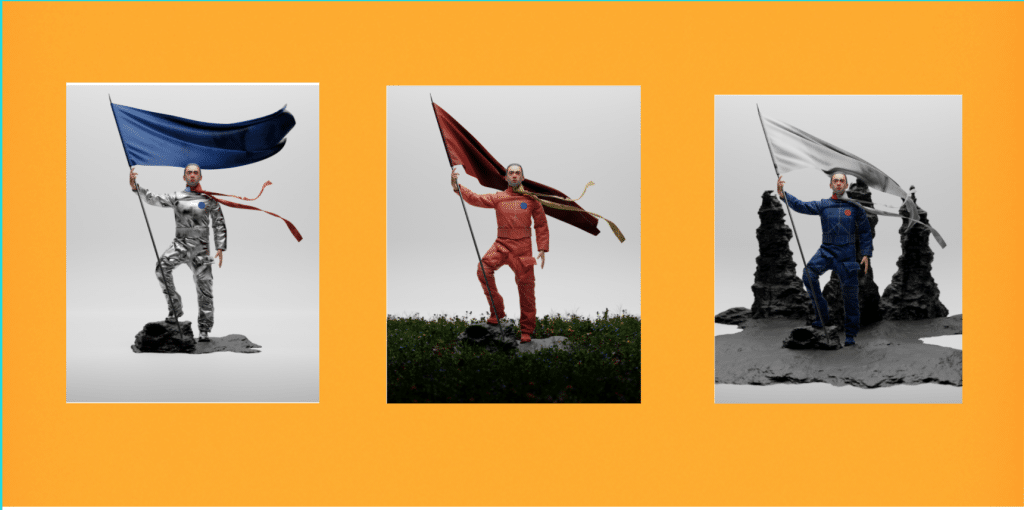

There are also firms and individuals within the NFT space that are creating new ways to define 'ownership' in the non-fungible token space. For example, NFT artist Mike Raymond’s work 'The Pioneer' is viewable by anyone at any time. However, NFT token holders have the option to change certain elements of the piece: owner of the piece’s 'clothes' layer can change the color of the man’s spacesuit; owners of the 'accessories' and 'background' token layers can control other elements of how the piece looks at any given time.

Mike Raymond’s “The Pioneer” in various states of presentation. The clothes, flag, and background can be altered by token holders.

The Case of the "Vanishing" NFTs

However, the question of what it really means to 'own' an NFT and 'digital object permanence' remains problematic.

A recent article by Vice chronicled a tale of 'vanishing' NFTs: individuals who would purchase non-fungible tokens only to find that the material that they were tied to had completely disappeared. Vice explained that “When you buy an NFT, in most cases you're not purchasing artwork or even an image file. Instead, you are buying a little bit of code that references a piece of media located somewhere else on the internet.”

In other words, when you purchase an NFT, there is not necessarily any guarantee that whatever it is tied to will not disappear. These disappearances are particularly common in cases where copyright laws have been violated.

Therefore, as Samson Mow explained, “what’s important to note is that there’s no such thing as ‘decentralized’ ownership independent of third parties.”

“You can’t enforce ownership rights on a Blockchain . And in the case of NFTs that represent Tweets: if an ‘NFT-ed’ Tweet is deleted, your NFT won’t bring that Tweet back. If Twitter was shut down, your NFT wouldn’t bring it back.”

Are NFTs Good Long-Term Investments?

It is possible that this could one day be remedied with blockchain-based digital storage. For example, Arweave is a blockchain project that is seeking to act as a “Library of Alexandria” for permanent, digital storage.

However, until then it is buyer beware. Purchasing a non-fungible token does carry some risks, even if you are buying from the most reputable artist on the most reputable marketplace.

Therefore, Samson Mow says that: “Don’t buy an NFT as an investment.”

“Doing so would be like buying Pokemon cards for your retirement fund. Maybe one of them might be worth something in the future, but most probably won’t,” he said.

Instead, “buying NFTs only makes sense if you have a use for them, such as an NFT representing an asset within a game you play. Packing the asset into this non-fungible token format allows you to carry it outside the game and trade it peer-to-peer with other players. That’s a real NFT use case.”

On purchasing NFT artwork, NFT specialist Eloisa Marchesoni said that: “predicting whether the value will increase in the future is nearly impossible, just as it is also very difficult to predict which particular NFT from a famous artist or creator will end up being the most valued.”

Eloisa Marchesoni, NFT specialist and blockchain enthusiast.

“Although Picasso's life is relatively documented, there is little evidence to suggest that he has preserved his most valuable paintings. So, even the artists themselves are not always able to determine which pieces will accrue the most value,” he said.

“However, NFT artworks should only be purchased because the work in question has artistic value to the buyer and not because of potential future profits. As with any purchase, consumers should consider whether they get good value for money, in terms of how much an NFT is worth to them, but I wouldn't bet on selling it at a profit. That doesn't mean you won't be able to have a profit, but that shouldn't be your main motivation.”

Non-fungible Tokens beyond This Moment

While certain parts of NFT art markets may ultimately turn out to be a short-lived phenomenon, Garrette Furo, a blockchain consultant and advisor working with Cosmos Network, told Finance Magnates that non-fungible token tech may have a promising future.

“I'd like to separate the artistic movement in NFT's from NFT's as a broad technology because they're being misdefined,” he said. “NFTs are not new technologies and primarily exist to make cryptographic representations of assets that truly need to be unique.”

"Neither art on NFTs, NFTs, Blockchains or Bitcoin are really in a bubble in my view,” he said. “The utility here goes far beyond remittance and value stores.”

Garrette Furo, a blockchain consultant and advisor working with Cosmos Network.