Cryptocurrency has been lauded as a technology that will ‘bank the unbanked’ and bring zero-cost financial services to anyone who wishes to use them.

And indeed, cryptocurrency offers its user the opportunity to hold limitless amounts of funds inside of a free digital wallet that, with the proper care and precautions, can only be accessed by them.

Of course, this has many upsides – in addition to providing financial services to people who may have never had previously had access to them, cryptocurrency and the technology that powers it allow for easy and quick investing, costless remittances, and fast, secure transaction settlement in financial institutions.

The hype that surrounded the cryptocurrency world started in 2017 caused crypto enthusiasts to broadcast these benefits in every corner of the media. Words like “decentralized,” “immutable,” and “trustless” decorated news sites and start-up funding proposals alike.

However, these words of praise were often accompanied by warnings of risk – instances of hacking, fraud, and money laundering haunted – and continue to haunt – the cryptocurrency industry.

Unfortunately, many cryptocurrency industry insiders all but ignored these risk factors. As a result, more and more incidences of lost funds and devastated users and exchanges have continued to occur.

Painful Reminders

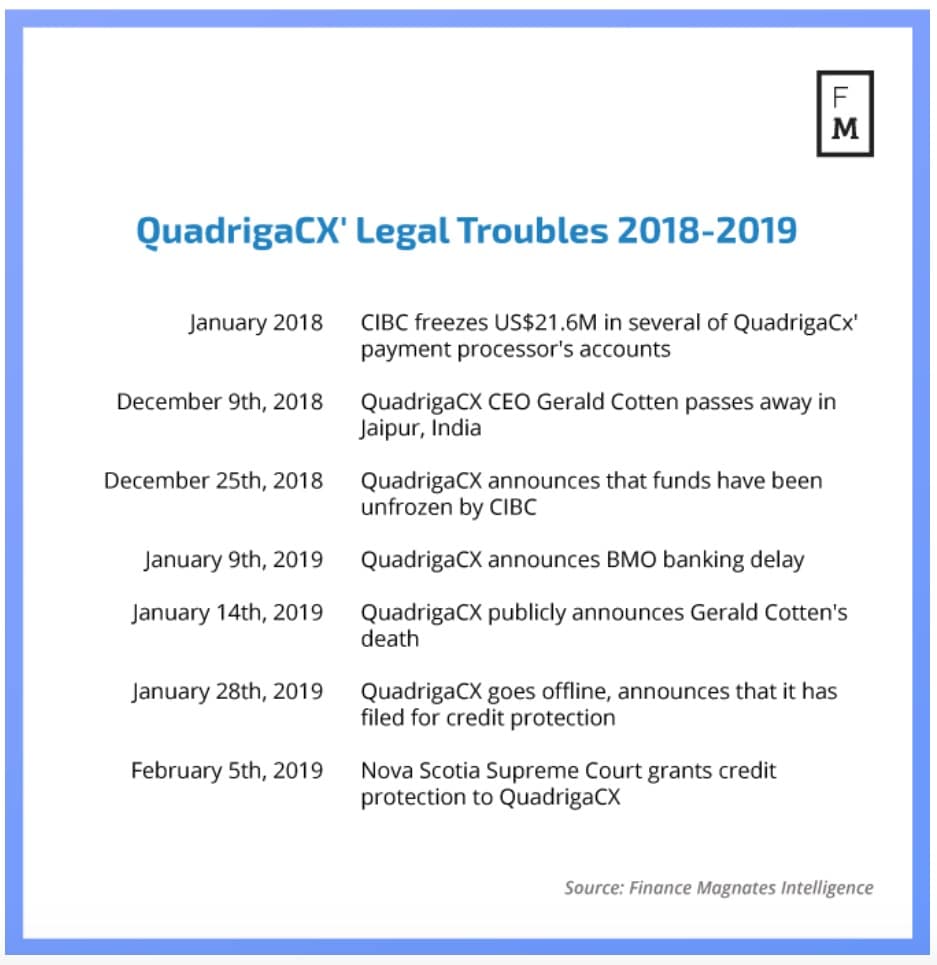

The most recent major example of this were the events that occurred at Canadian cryptocurrency exchange QuadrigaCX. 115,000 of the exchange’s users were left without access to their funds after the exchange’s CEO, Gerald Cotten, unexpectedly passed away in December.

Due to an apparent lack of foresight on the exchange’s part and a lack of oversight from Canadian regulators, Cotten was the sole possessor of the knowledge of where the exchange’s private keys are stored.

In other words, when Cotten died, the private keys to the exchange’s cryptocurrency wallets were lost with him, perhaps forever.

We’ve posted an update regarding the latest on our company operations: https://t.co/qT7reUA17N

— QuadrigaCX (@QuadrigaCoinEx) February 5, 2019

(‘Private keys’ are the strings of characters that can be used to send cryptocurrency. In other words, the owner of the keys maintains control of the cryptocurrency they are associated with. Thus, QuadrigaCX was left without access to most of its funds when Cotten passed away.)

Sample private key. Source: Wikipedia

At present, the encrypted laptop where the private keys are suspected to be stored has been handed over to a security expert by Cotten’s widowed wife, Jennifer Robertson. It is unclear whether the expert will be able to recover the keys.

Affected users are not expected to receive any recourse for their losses. Naturally, this has caused quite a stir within and without the cryptocurrency world--those who saw cryptocurrency as a risky, foolish venture have been validated; those who saw cryptocurrency as the answer to the world’s financial problems are disillusioned.

However, there is a third group that sees the QuadrigaCX incident as an unfortunate example of a very preventable disaster.

While the exchange should have (and could have) had protections against the loss of its private keys, affected users could have also taken a simple step to avoid having their funds lost: not storing their cryptocurrency on the exchange in the first place.

Indeed, QuadrigaCX serves as an important reminder to cryptocurrency hodlers that the financial freedom that comes with cryptocurrency ownership comes at the cost of sole responsibility.

If your coins are lost, there is not necessarily any government or other protections that will get them back to you.

Therefore, knowing how to sufficiently protect one’s assets in the cryptosphere is of the utmost importance. Here are a few practices that can keep you and your cryptocurrency safe.

Keep Your Coins in the Freezing Cold

The most basic--and perhaps most important--factor in keeping your cryptocurrency safe is the method in which your coins are stored.

Generally speaking, the most secure method of keeping your cryptocurrency safe is to store your private keys offline. This is called keeping your coins in “cold storage” – “hot storage” being the practice of keeping your private keys in such a way that they can be accessed by the internet.

There are several ways to keep your coins in cold storage, each with its own advantages and disadvantages.

The easiest and cheapest method is to make a paper wallet. There are several websites that can be used to securely generate random strings of characters that can be used to store Cryptocurrencies .

Once you’ve made your paper wallet, the best practice is to keep several copies of it in secure locations. That way, if one copy is lost or otherwise destroyed, your coins will still be accessible.

How do hardware wallets compare to paper wallet cold storage?https://t.co/UZsANW1Keo

One more faulty comparison of paper wallet and hardware wallet security. Paper wallets are not more secure than hardware wallets. You need to generate them securely and that's almost impossible — Andreas M. Antonopoulos (@aantonop) March 26, 2018

However, several precautions must be taken when creating a paper wallet. Ensure that the wallet generator you’re using isn’t a phishing site that will steal your keys. Additionally, use antivirus software to ensure that there aren’t viruses that might steal your private keys from your clipboard when you copy them.

If it’s possible, print your paper wallets with a printer that isn’t connected to the internet to ensure that any viruses that might be living in your printer can’t steal your keys.

Many experts recommend against the creation of paper wallets since it is so difficult to generate them without the risk of phishing or other theft.

The second (and slightly pricier option) is to store your private keys on a piece of hardware. You can either purchase an encrypted hard drive or a hardware wallet that has been built with the specific purpose of storing cryptocurrency keys.

Some of these hardware wallets have the added benefit of regeneration keys--collections of words or phrases that can be used to regenerate your wallet if you should lose access to it.

Hardware Wallet Comparison – #KeepKey vs #Trezor vs #Ledger Nano - https://t.co/M2kVgDrfOj–-keepkey-vs-trezor-vs-ledger-nano/

— CryptocoinTALK (@cryptocointalk) March 26, 2016

Protecting the wallet itself and the regeneration key are extremely important. Losing access to the wallet puts you at risk for losing your funds.

If you have a large amount of cryptocurrency, you might consider employing a cryptocurrency custody service to take care of your funds for you.

These services utilize advanced encryption, physical vaults, and distributed storage to ensure that your crypto will be kept safe. Some of them also offer insurance should anything happen to your cryptocurrency.

However, be absolutely certain of the legitimacy of a cryptocurrency custody service and the protections it offers before utilizing its services.

Do Your Due Diligence

Another important step that you can take to protect your cryptocurrency is to carefully research the exchanges and other cryptocurrency platforms you use before you send your coins into them.

One method of ensuring that the service you’re using is legitimate is to see what the cryptocurrency community has to say about it.

A simple google search will give you access to the best and worst experiences that people have had with a particular cryptocurrency company.

Some important things to keep in mind when researching an exchange include:

- Has this platform been hacked before? What kind of steps did the platform take to prevent a similar hack in the future?

- Is this service insured? If so, is it insured by a government body or a private company?

- What kind of customer service is available to me if I have a problem?

- Where is this platform based? What kind of government regulations protect me in the event of a hack or other emergency?

- What kind of reputation does this platform have in the cryptocurrency community?

- How does this platform store its cryptocurrency? Does it utilize cold storage?

- What kind of protections are available for my login ID? Does the platform use two-factor authentication?

- Has this platform ever had any “copycat” phishing sites? What were the addresses of these sites?

Consider a Cryptocurrency-Based CFD

According to Investopedia, a CFD (or “contract for difference”) is “an arrangement made in a futures contract whereby differences in settlement are made through cash Payments , rather than by the delivery of physical goods or securities.

This is generally an easier method of settlement, because both losses and gains are paid in cash. CFDs provide investors with the all the benefits and risks of owning a security without actually owning it.”

In other words, you don’t have to buy cryptocurrency directly in order to make (or lose) money trading cryptocurrency. Instead, you are essentially placing an order on what you believe the price of an asset (like Bitcoin) will be in the future.

You can speculate that the price will either be lower or higher than it is at the current moment; you agree to exchange whatever the difference in the price of an asset will be from the moment that the contract is opened to the moment when it closes.

When you place this order, you agree to exchange the difference between your prediction and the actual value of the asset. CFDs are a ‘leveraged investment’, which means that if the asset’s price moves toward your prediction, you make exponential gains; if they move against you, you will suffer exponential losses.

Therefore, while trading CFDs is a method in which you can invest in cryptocurrency without having to hold any crypto assets yourself, it can be risky.

When trading CFDs, ensure that you do not bet more than you can afford to lose, and be aware of the fact that you may go into debt if you don’t take the proper precautions.

This article was written by the ADSS Research Team.