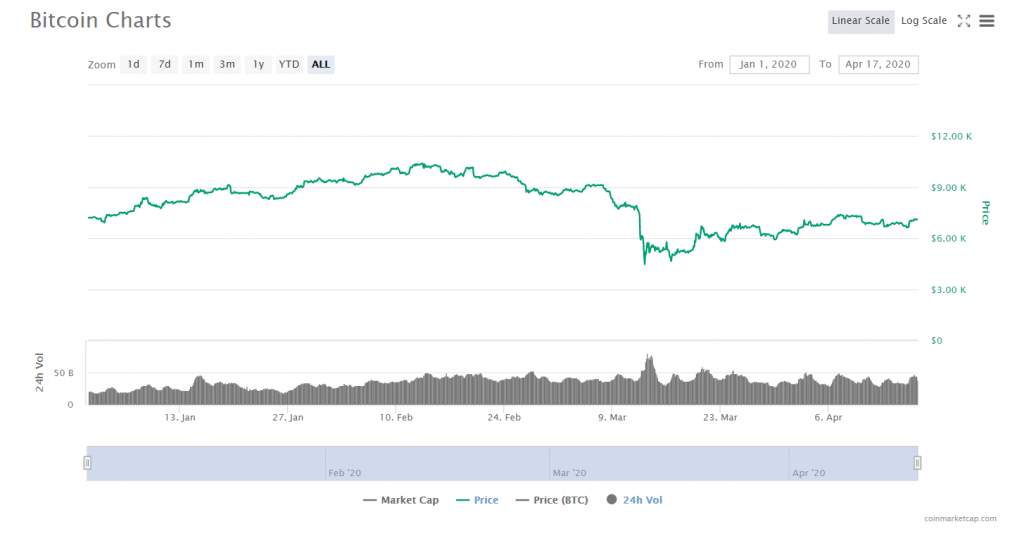

The effect of the coronavirus on the price of Bitcoin has been drastic. After several weeks bouncing between the $8,000-$10,5000 range Bitcoin took a veritable cliff dive from roughly $8,000 to nearly $4,000 over the course of several days; by the end of March, it had stabilized around $6,100.

So far this month, the price of Bitcoin has continued to slowly recover, staying largely between the $6,900 to $7,300 range--and of course, outside of crypto markets, many argue that the global economy is still months away from finding its footing again.

However, while the coronavirus-related economic fallout has negatively affected most of the world’s industries and businesses, there have been a few corners of the world that have actually managed to increase the amount of business that they are doing.

Beyond the crypto world, medical supply manufacturers and home-delivery retail companies are booming; inside the crypto world, cryptocurrency exchanges are having some of their best weeks and months in quite some time in terms of crypto trading volume.

Indeed, a quarterly report on crypto exchanges by crypto research firm CryptoCompare said that while trading volumes on cryptocurrency exchanges have gradually been increasing each month this year, March saw a 35 percent increase in trading volume “from many of the largest Top Tier exchanges” over February. Crypto derivatives volumes also saw a 5 percent increase from February to March.

What happened? And will it continue?

OTC trading volumes began to pick up before spot trading volumes

To a large extent, fluctuations in Bitcoin’s reported trading volume since the beginning of the year have closely followed the news cycles surrounding the coronavirus and its effects on the global economy.

While the impact of the coronavirus on cryptocurrency prices and spot exchange volumes wasn’t necessarily ‘clearly visible’ until March, reports that the virus could be impacting trading volumes on OTC platforms emerged as early as February.

Indeed, CoinDesk reported in late February that OTC crypto trading volume “has been on the rise since the virus became a constant part of the news cycle.”

Michael Leon, a trader at Chicago-based Althena Investor Services (which serves OTC crypto clients), told the publication that, at the time, “we have been seeing a significant uptick in volume over the last 60 days.”

However, “when Wuhan was placed under quarantine on January 23rd, bitcoin’s real volume (spot and derivatives exchanges that have reliable volume) was recovering from lows at the end of December,” explained Jose Llisterri, co-founder of cryptocurrency derivatives exchange Interdax, in an email to Finance Magnates.

Interdax co-founder and Chief Product Officer Jose Llisterri.

Then, as the outbreak continued to rage in Wuhan--but hadn’t yet reached the rest of the world--“Bitcoin’s trading volume steadily increased from January 23rd into March.”

However, as the month of March progressed, trading volume exploded: “as the World Health Organisation declared Covid-19 a pandemic on March 11th, the following two days saw a bloodbath in both traditional and cryptocurrency markets as panic selling ran rampant,” Llisterri explained. “Professional traders and investors cashed out of equities as financial markets slumped.”

Trading volumes spike as the Coronavirus’s economic fallout ravaged financial markets, including Bitcoin

Indeed, according to data from CoinMarketCap.com, BTC’s trading volume on March 1st was roughly $35.3 billion. It climbed steadily over the next several days, reaching as high as $43 billion on Tuesday, March 3rd; the next several days sat approximately between the $35 billion to $41 billion.

The first signs of big movement took place during the second weekend of March, when roughly $38 billion was shaved off of the market cap of all Cryptocurrencies over the course of a single 48-hour period.

Indeed, crypto markets fell from $263 billion at 05.00 GMT on Saturday, March 7th, to $225 billion at the same time on Monday, March 9th, representing a decline of roughly 14.4%. The most significant decline took place over the latter half of the two-day period, when the market cap fell from $251 billion from $225 billion (roughly 10.3%).

At the same time, Bitcoin’s trading volume saw its first bump that seemed to be directly related to the coronavirus, peaking around $48.6 billion around 17.00 UTC.

However, the action didn’t really get going until later in the week, when (from March 12 to March 14th), Bitcoin’s trading volume spiked, hanging largely between $70 billion and $80 billion for several days.

The spike in trading volume coincided with a cliff-dive in the price of Bitcoin, which sank below $5000 for the first time in over a year.

CryptoCompare said that “the massive market crash on March 12th-13th saw daily volumes hit $75.9bn in a single day (13th March)--the single greatest daily volume recorded in cryptoasset history).”

“Long-term holders sat it out, but traders went short.”

What happened, exactly? Jose Llisterri explained that “long-term holders sat it out, but traders went short.”

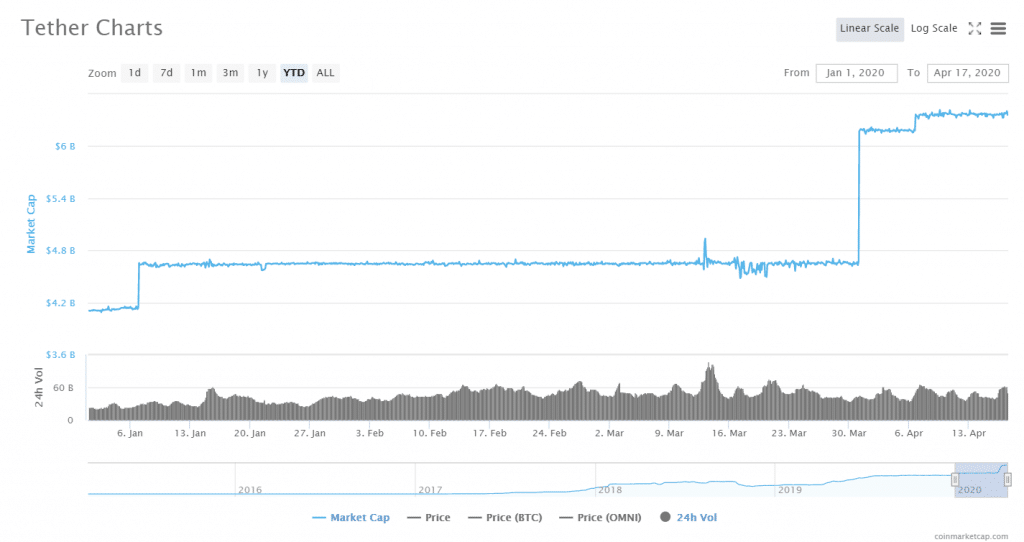

In other words, there was a mad dash for cash: CoinTelegraph reported that as crypto markets were crashing, “fiat volumes also increased substantially as traders sought Liquidity amidst the Coronavirus panic,” which “also triggered similar selloffs in global equities and commodities markets.”

Stablecoin issuer Tether also saw the monthly volume of its USD-backed stablecoin, Tether Dollars (USDT), triple during the month of March as crypto traders desperately sought to get out of more volatile markets.

The dash for cash brought a massive amount of BTC back onto cryptocurrency exchanges; however, after this massive influx of BTC onto cryptocurrency exchanges, Llisterri said that the trend began to reverse: “the large inflows of BTC to exchanges during March 9th-13th have now mostly flowed out of exchanges,” he explained.

“Most transfers were above $10,000 on the Bitcoin network, lots of BTC were moved in very large chunks. High-value withdrawals also accounted for most of the outflows, suggesting professional traders and large investors were moving markets.”

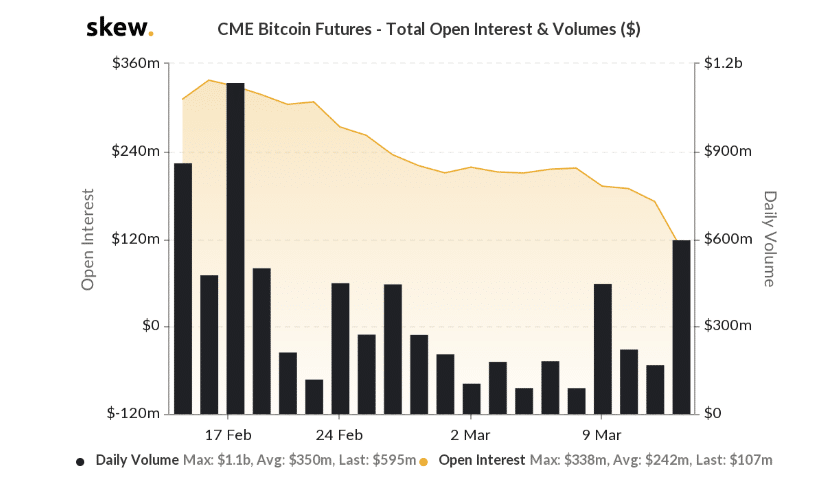

A massive drop in CME trading volume could indicate that institutional traders were some of the first to exit the crypto derivatives market

The exodus of professional traders and large investors from crypto markets during this time period was also demonstrated by significant movements within the crypto derivatives exchange space.

Indeed, while it’s true that crypto derivatives volumes also saw a 5 percent increase from February to March (bringing in a new all-time high, at that), CryptoCompare reported that CME, which operates a regulated Bitcoin derivatives exchange based in the United States, saw its trading volume for Bitcoin futures dive to the tune of 44 percent from February to March.

Some analysts have claimed that the decrease can be attributed in particular to the possibility that quantitative easing and economic efforts by the United States government and other governments around the world have largely been targeted toward more traditional asset markets.

Indeed, in a report for CoinTelegraph, analyst Antonio Madeira wrote that “the quantitative easing program launched by the U.S. Federal Reserve brought a small degree of trust back to the stock markets for institutional investors. The same cannot be said for Bitcoin.”

DEX volumes also saw a spike: "solving a real problem" for the first time, "not just a toy anymore.”

And, apparently, the same cannot be said for Ethereum-based assets, either. In addition to boosts in Bitcoin trading volumes on centralized BTC exchanges, so too was there an increase in activity on decentralized exchanges that are primarily used to trade Ethereum-based assets.

Indeed, citing a report by research firm Dune Analytics, The Block Crypto reported that the total volume for non-custodial exchanges, also known as decentralized exchanges (DEXs), reached a new all-time high of $668 million in the month of March. The figure represented a 53 percent increase over trading volume in February.

This is particularly signficant due to the fact that DEX volume hit a nine-month low in December of 2019, though The Block said that the share of volume traded on these exchanges was relatively high compared to their centralized counterparts.

Dune Analytics also noted in its report that this was the first time that volumes on these DEXs were rising in accordance with falling ether (ETH) prices, saying that it seemed that DEXs might actually be "solving a real problem" for the first time, and are "not just a toy anymore.”

What are your thoughts on the ways that the coronavirus has affected crypto exchanges and trading volumes? Let us know in the comments below.