For Robinhood, the stock brokerage platform on which many WallStreetBets users recently began buying GameStop (NYSE:GME) stock, the events of the past week have been nothing but trouble.

If you have not been following along, here is what went down: a group of millions of retail traders based on the WallStreetBets (WSB) subreddit organized a massive short squeeze effort against Wall Street hedge funds: they began buying huge amounts of stock from companies that hedge funds had bet against, including GameStop and a number of other 'meme stocks'.

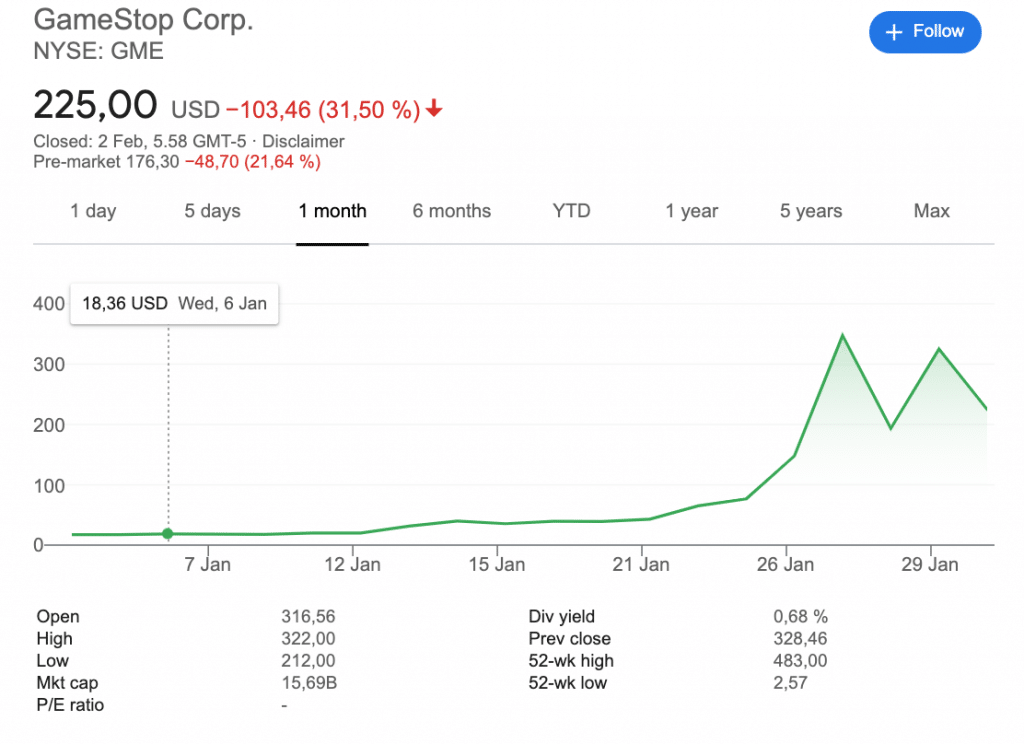

As a result, the price of GME and several other stocks (ie Blackberry, NYSE:BB; and AMC Entertainment Holdings, NYSE:AMC) shot up by margins of triple- or even quadruple-digit percentage points. Thus, the hedge funds who had bet against the stocks were forced to either take losses, find replacement holders, or white-knuckle their holdings as GME and other stock prices continued to rise.

At the height of the drama last week, Robinhood made a controversial decision: the platform pulled the plug on most retail trading activities related to 50 of the stocks listed on its platform, including GME. Retail traders were suddenly barred from buying and trading certain assets, leaving selling the assets as their only option. The decision has drawn the ire from users and lawmakers alike; even Elon Musk threw shade at Robinhood Chief Executive, Vlad Tenev.

Robinhood still has not restored all trading activities on all of the stocks that it limited retail activities last week: retail users are once again allowed to buy shares of GME, but only until they own a total of 20 shares.

The events of the week have had huge implications for the future of financial markets: the roles of retail traders and hedge funds; the jurisdiction of trading platforms, and the flow of capital through it all. In fact, some of these implications already seem to be coming to fruition: specifically, for cryptocurrency.

The Rise of Cryptocurrencies (Again)

There has been a lot of talk about cryptocurrencies this year. After all, a combination of talks over new COVID stimulus programs in the US increased institutional interest, and retail fever drove crypto prices to new highs in the first weeks of the year.

However, in the days before the WSB saga began, questions were beginning to arise over the viability of crypto’s rally over the long-term: sure, a new crop of institutional and retail investors have taken an interest in crypto in the short-term. But, what happens when the hype dies down in a few months? In a year? BTC was losing steam; other crypto tokens were also seeing price dips.

That was all before last week. The events that surrounded the WSB saga seemed to have had a positive effect on markets. At press time, data from Messari showed that BTC was up 9% over the course of the last seven days. ETH followed closely behind with a 6% rise over the same period. On the whole, the total cryptocurrency market cap had increased from $935 billion to $1.05 trillion.

Simultaneously, trading volumes on a number of cryptocurrency exchanges have seen spikes in trading activity coinciding with some of the WSB movement. CoinDesk reported that this has resulted in rises in the token prices of a number of exchange cryptocurrencies, including Binance Coin (BNB).

Why is the WSB phenomenon connected to the rise of cryptocurrency markets? Of course, some of the excitement around the WSB movement into GME and other stocks sparked 'spin-off' pumps into several crypto assets, including XRP, Stellar Lumens (XLM) and DogeCoin (DOGE.)

However, beyond the pumps into targeted cryptocurrency markets the WSB movement may have brought a crop of new traders (and new cash) into crypto for the long-term. Why is this? Frustration might just be the answer.

Indeed, CNBC reported that “[the] same underlying anger and frustration over how institutional investors make profits” that drove the WSB movement “has also played a role in bitcoin’s rise.”

u can’t sell houses u don’t own

— Elon Musk (@elonmusk) January 28, 2021

u can’t sell cars u don’t own

but

u *can* sell stock u don’t own!?

this is bs – shorting is a scam

legal only for vestigial reasons

Therefore, “investing in an independent cryptocurrency such as bitcoin...means you are putting your money toward a technology and a currency that could one day replace the modern financial system,” CNBC explained. “This is certainly not lost on retail traders looking for the ultimate way to cut institutional investors out of the equation.”

The Case for DeFi

Indeed, while cryptocurrencies may be some of the main benefactors of the WSB saga so far, WSB traders seem to be after something even bigger, a total change in the status quo; an ideological shift in the way that capital markets operate.

Indeed, some of the rhetoric surrounding the WSB discussion seems to focus around the need for a paradigm shift in the way that capital markets function: more power to retail investors, and less to Wall Street giants. WSB traders argue that this is the reality of the true democratization of finance, the same democratization of Finance that Robinhood has been preaching to its users for years.

However, when you are playing by the financial industry’s rulebook, there is a limit to how much 'democratization' that can really happen. Indeed, as Larry Tabb, Head of Market Structure at Bloomberg Intelligence, told the Financial Times: firms like Robinhood "can only be disruptive to a certain point, because, at the end of the day, you’re one side of a trade.”

As such, some analysts have argued that the WSB saga has made the case for decentralized finance (DeFi) even stronger. 'DeFi' describes a set of Blockchain and crypto-based financial services that have been designed to provide the same kinds of financial services that traditional institutions do, but without any centralized single authority holding the power to control the services.

Why did last week’s events bolster the case for DeFi? It all comes down to Robinhood’s controversial decision to bar retail traders from buying and trading GameStop (GME) and other stocks. The move outraged many of the platform's retail users, who pointed to Robinhood’s close relationship with Citadel Securities as well as other institutional clients as the real reason behind the decision to pull the plug on certain trading activities.

Robinhood explained in a blog post that the decision was based on its “many financial requirements, including SEC net capital obligations and clearinghouse deposits.”

“Some of these requirements fluctuate based on volatility in the markets and can be substantial in the current environment. These requirements exist to protect investors and the markets,” the blog post said.

Fed up with the Status Quo

Still, users are not convinced, and they are not happy. Even after Google Play removed 100,000 1-star reviews from Robinhood’s listing in its app store (raising its rating from 1-star to over 4 stars, where it was before the WSB saga), disgruntled users returned by the thousands to send Robinhood’s rating back down to 1.2 stars. At the same time, the hashtag #deleterobinhood has become more popular on Twitter as users have grown increasingly frustrated.

Cryptocurrency writer and analyst, William M. Peaster explained the anger this way in a post on blockchain-based blogging platform Voice: “they see the episode as just the latest high-profile reminder that mainstream finance is heavily rigged in favor of the wealthy and powerful.”

However, DeFi supporters argue that decentralized finance is the way forward: traders who would have been able to buy their GME stocks on a DeFi exchange would never have faced the risk of being barred from trading activities at the mercy of a centralized brokerage authority.

Indeed, Peaster explained that: “DeFi is open, permissionless, 24/7, and non-custodial, so you stay in control of your funds the whole time without having to worry about if a centralized company like Robinhood will freeze your funds or block you from selling.”

The Beginning of Something Bigger?

In the meantime, WSB traders are moving on, with or without Robinhood. And, while a number of these traders have made piles of cash from the WSB movement, it is not all about the money: some traders are out for blood, and hedge funds are squarely in their crosshairs.

In fact, WSB has already done significant damage to one such victim: on Monday, Finance Magnates reported that Melvin Capital lost more than 50 percent in January because of the WSB short squeeze.

The loss was so significant that Citadel Securities and Point72 had to rescue it: together, the two firms injected $3 billion into Melvin as an emergency effort. This brought the fund’s total AUM back up to roughly $8 billion; however, this is still significantly lower than the $12.5 billion it held before the squeeze began. Both Citadel and Point72 also sustained losses in January, though they were not nearly as serious as Melvin.

Despite WSB’s continued pump (GME is still up more than 1100% compared to 30 days ago), some hedge funds are holding onto their GME shares for dear life, hoping that their hodling can outlive the ire of WSB traders. And indeed, it is possible that the WSB movement could peter out before hedge funds are forced to take their losses.

Then again, WSB may only be the beginning of a much bigger movement toward the true democratization of finance: after all, if a group of traders on Reddit can orchestrate the "biggest short squeeze in 25 years", there is no telling what else they can do.