On June 18, cryptocurrency network Bancor has announced the launch of what is described as “Blockchain -based community currencies” in Kenya. According to an official statement from the company, the currencies have been developed to “[combat] poverty through the stimulation of local and regional commerce and peer-to-peer economic collaboration.”

The currencies will be seeded with money raised during Bancor $153 million ICO in June of last year. The initiative will be supervised by Will Ruddick, Bancor’s Nairobi-based Director of Community Currencies. Prior to this position, Ruddick built Grassroots Economics, a nonprofit that builds community currencies. The nonprofit is currently serving more than 20 schools and 1,000 local businesses and works in partnership with the Kenyan government.

Announcing the launch of Bancor's new #blockchain based community currencies in #Kenya. It's time we put the power of money creation in the hands of the people who need it most. More in @VentureBeat https://t.co/zvLoHutb5j @grassEcon pic.twitter.com/uPG9dzsRXt

— Bancor (@Bancor) June 18, 2018

Ruddick and the team at Grassroots will reportedly make use of Bancor’s protocol to expand Grassroot’s existing paper currency system into a blockchain-based network. Entities from around the world who support the initiative will be able to buy and sell local currencies using major Cryptocurrencies or credit, making it possible to boost the value of the community currencies from afar.

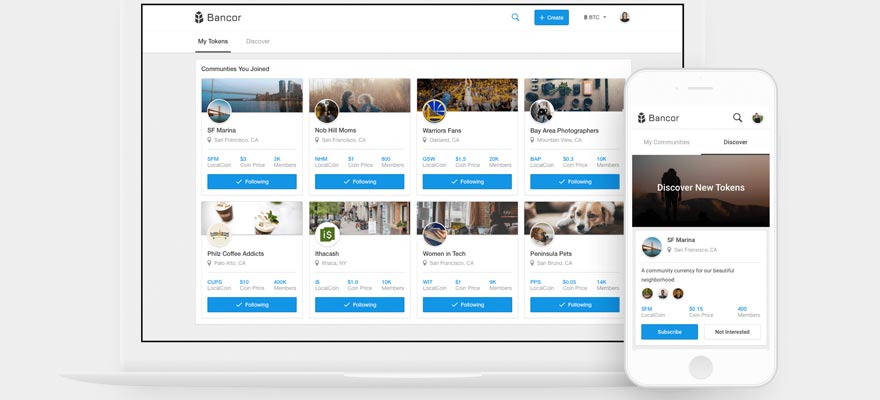

Currencies that exist within the Bancor network, called Smart Tokens, can be swapped with one another nearly instantly; exchange rates are calculated dynamically with fluctuations in the prices of tokens.

"Bancor and Grassroots Economics are partnering to develop tokens that end the cycle of poverty." https://t.co/ZXrWsCkQS8 #GrassrootsEconomics #EconomicsForChange #Bancor #EOS pic.twitter.com/nnamlmOEO9

— Grassroots Economics (@grassEcon) June 7, 2018

Galia Benartzi, Co-Founder of Bancor, said that she believes that Bancor’s unique technology “can be applied to help communities create wealth on a local level through the use of blockchain-based community currencies that fill regional trade gaps, enable basic income and food security, and promote thriving local and interconnected global markets.”

Initially, the project will be piloted in Kibera and Kawangware, described by Bancor as “the two largest underserved neighborhoods in Kenya.” Grassroots will tap into local businesses in the areas, offering discounts to customers who use the community currencies for their transactions; eventually, a pegged, “parent” currency backed by the Kenyan Shilling will allow various community currencies to be traded with one another.

“Communities should be afforded the same privileges as nations to develop their own prospering economies with the stability of their own currencies,” said Ruddick in a company statement.