In the midst of what may be the worst financial crash since the start of the great depression, the Bank of China has come forth to speak out once again against the practice of trading cryptocurrency. The bank’s latest anti-crypto statements came in a post on the Bank’s official WeChat account entitled “3.15 Protection of Financial Consumption Rights and Interests” on Sunday, March 22nd; the post was originally reported by CoinTelegraph.

“First of all, the amount of fraudulent transactions with bots is serious,” the post read. “The average turnover rate of the top three overseas cryptocurrency exchanges is much higher than that of foreign licensed exchanges.” (Translated quote.)

Source: PBOC WeChat account

The post mentioned market manipulation, which it said “exists in these exchanges where forced leveraged trading eventually causes the exchanges to explode”, and money laundering, which is “a big issue.” The post also pointed to the Bitcoin-as-a-safe-haven narrative as a falsehood.

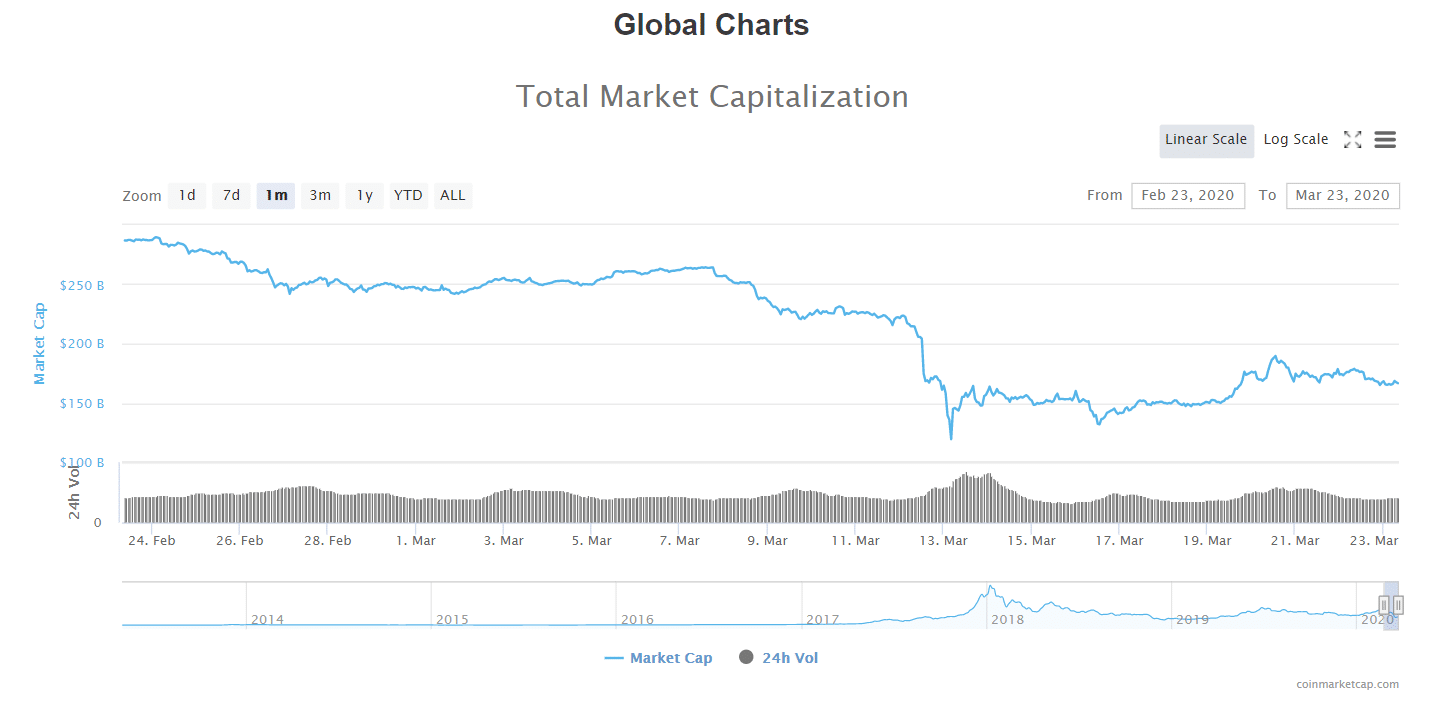

The post appears to be addressing the fact that cryptocurrency markets have shed a collective $120 billion in the last month, equivalent to roughly 41.9% of their total market cap over the past 30 days. Much of this can be attributed to Bitcoin, which lost roughly $71 billion, or just under 40%, of its market cap over the same period.

Additionally, concerns about market manipulation on leveraged exchanges were brought to the surface last week when crypto derivatives exchange BitMEX had a temporary meltdown amidst steep price correction.

However, there are other questions about the safety of this kind of crypto exchange more generally--previously, two Princeton researchers found that when shorting opportunities on crypto derivatives exchanges are constrained and valuation disagreements arise, optimism and overconfidence can combine to create price bubbles.

China’s messaging about crypto trading has long been bearish, but it is favorable toward Blockchain

While this isn’t the first time that the Chinese government has publicly spoken out against cryptocurrency trading, Chinese president Xi Jinping said in October last year that his country must “seize the opportunities” presented by blockchain technology.

Then, in November, the Chinese government’s state-run news source Xinhua News Agency posted a front-page article entitled “BitcoinL The First Successful Application of Blockchain Technology.”

The Chinese government has also been developing its own national cryptocurrency for several years, a project that regained traction after Facebook announced the launch of its Libra project in June of 2019.

Still, the Chinese government instituted bans on domestic cryptocurrency exchanges and initial coin offerings (ICOs) in late 2017 and seems to be continuously bearish toward cryptocurrency trading.

In an interview last September, Finance Magnates asked Marie Tatibouet, chief marketing officer of cryptocurrency exchange Gate.io (which was previously headquartered in China), about how the exchange managed to navigate the sweeping set of bans restricting the cryptocurrency industry that came from the Chinese government in 2017.

While the exchange is no longer headquartered in China, it still serves Chinese users and has offices in the country, as well as Canada and South Korea.

She told Finance Magnates that things may look a bit different from the inside than the outside: “the ban is open to interpretation,” she said. “If you know anything about China, you’ll know that a lot of the Regulation that comes through is always very much open to interpretation, especially when it comes to enforcement.”

Nevertheless, “we’ve been very careful,” Tatibouet continued. “We don’t do any outward promotion on the Chinese market.”