With the massive surge in the popularity of Cryptocurrencies , it appears that the United Kingdom might soon have its very own Bitcoin-like digital coin, according to a report in The Telegraph.

The Bank of England has established a research unit to probe the possibility of issuing a prototype cryptocurrency, which could serve as a rival to the likes of Bitcoin and Ethereum.

Discover credible partners and premium clients at China’s leading finance event!

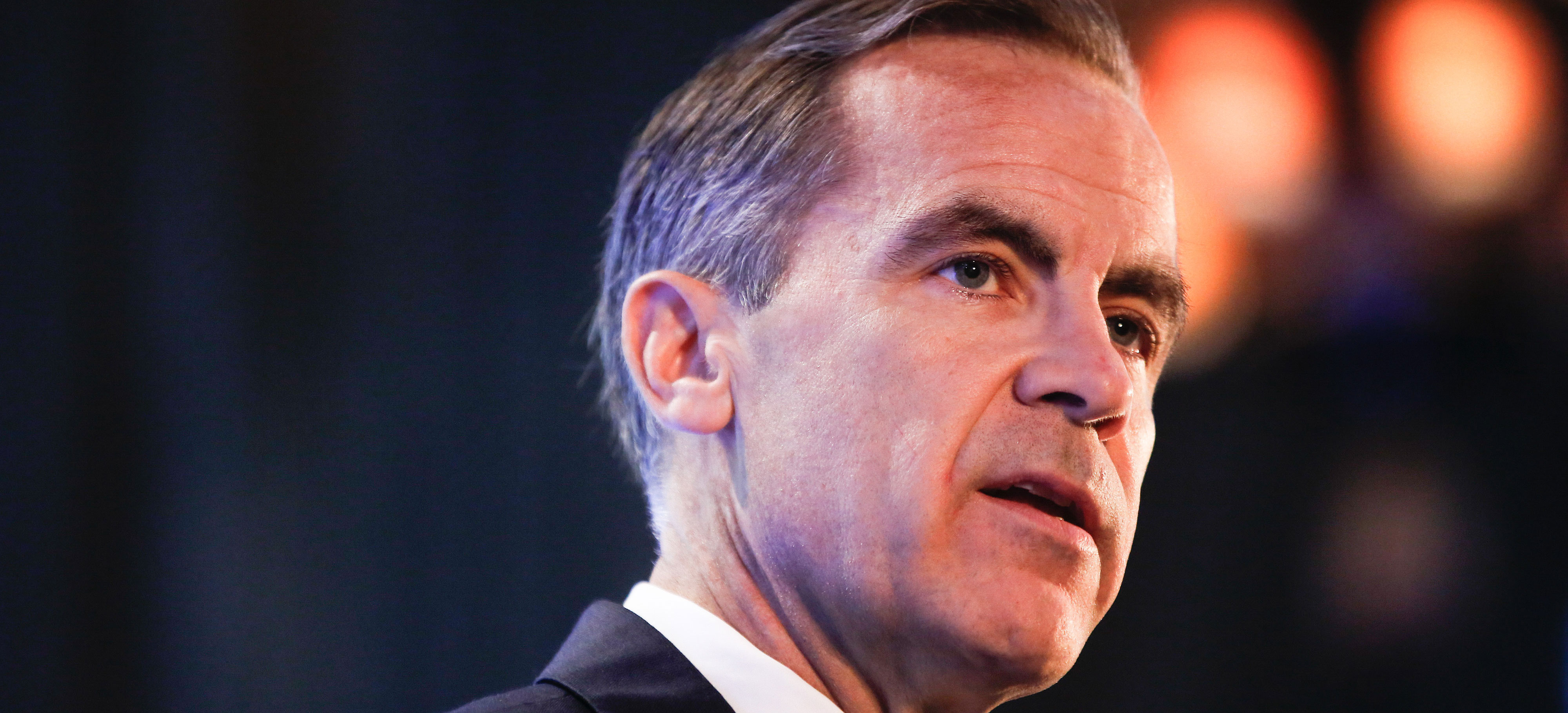

The unit is expected to report back within the next 12 months, though the endgame is far from clear. According to local media, if the new digital currency does achieve the status of legal tender, BoE’s governor Mark Carney would prefer a restriction to limit use to transactions between central banks.

However, since this would place the new digital currency under government regulation, it is uncertain if it would still be considered a cryptocurrency, which is inherently free of regulation and control. The central bank could clone or improve on Bitcoin’s technology, but it may fail to duplicate the cryptocurrency’s established lead in adoption and the large ecosystem of applications that have been built up around it.

Public interest in cryptocurrencies has exploded this year, but the largely unregulated assets have drawn increasing calls for rules to protect investors and safeguard the established financial systems.

But if the BoE decides to go through with the idea of creating a Bitcoin-style currency, making it available to retail transactions, the new initiative will open the door to British citizens to keep their digital money with the central bank, dispensing with the need for a retail bank. The government-backed digital coin, which has already carried out initial work in some areas, could facilitate a drastic change in the way financial transactions are conducted, as they could happen in nanoseconds.

Mr. Carney told a Treasury Select Committee before Christmas that he had “participated in discussions with the major central banks on this issue,” adding that those meetings would resume in January. The head of BOE also stated: “The underlying technology is actually of a fair bit of interest. We are working with it at the Bank of England. Most interesting application that would be beneficial for financial stability and efficiency would be using the Blockchain technology for ‘settlements’ between central banks. We are on the case.”