Binance.US, the United States arm of the Binance cryptocurrency exchange, is launching trading of Tezos (XTZ) on Monday, March 16th. According to a post on Binance US's blog, trading for XTZ/USD and XTZ/BUSD will open on Monday, March 16th, at 9.00 am EST.

Binance.US began accepting deposits of XTZ on Sunday, March 15th. However, withdrawals will not be enabled until trading is live. Binance.US also says that to deposit or exchange USD for XTZ, users are required to pass fiat verification in addition to basic and advanced identity verification on the platform.

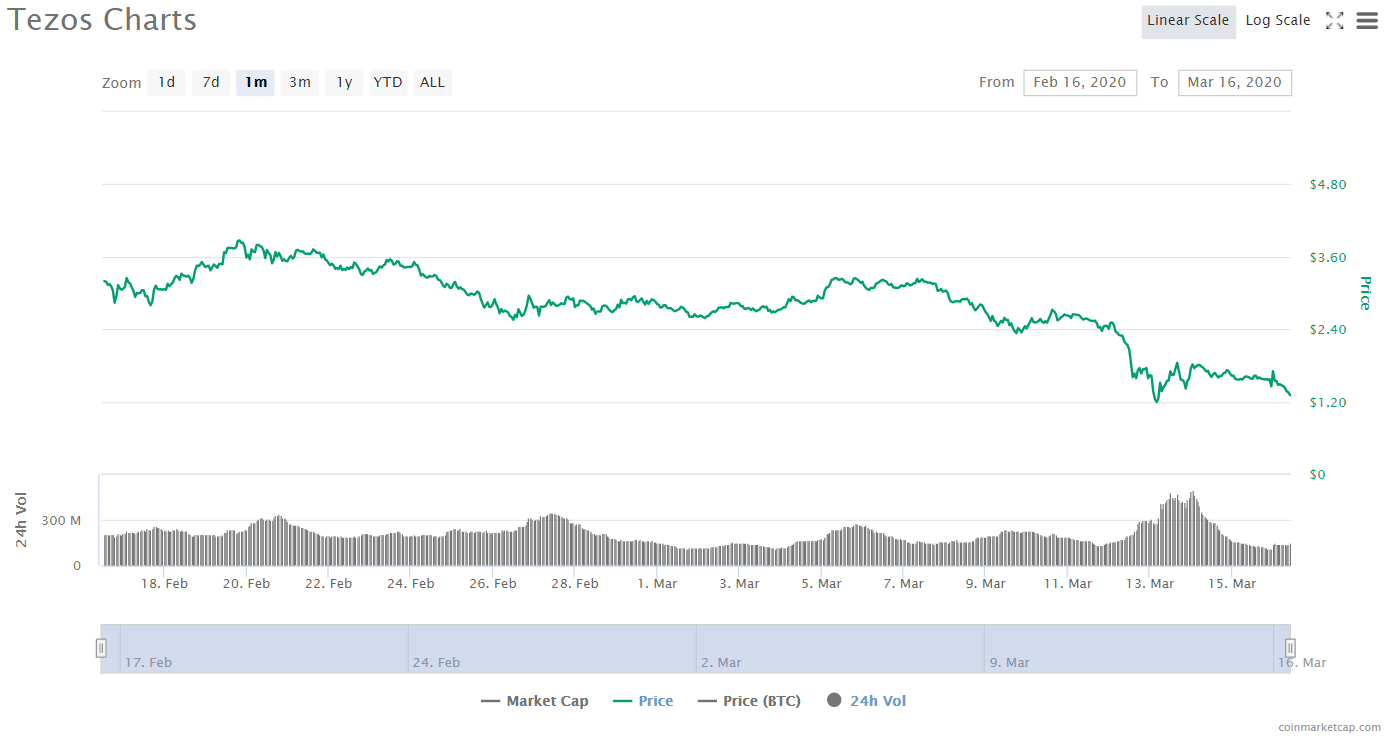

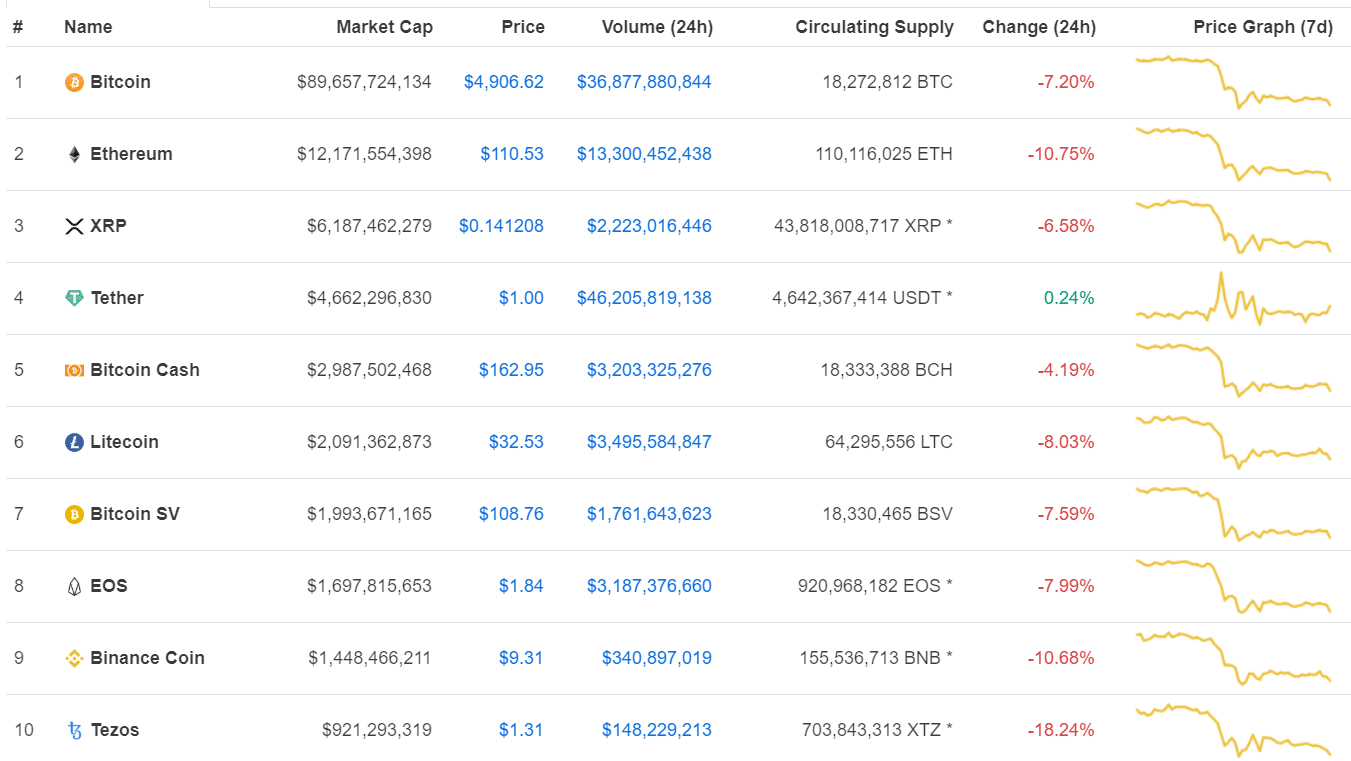

At press time, Tezos was worth $1.31 per token, after having fallen more than 18 percent in the last 24 hours, and more than 50% since its all-time high of roughly $3.90 in February of this year. Tezos also held the spot as the tenth-largest cryptocurrency by market cap.

Coinmarketcap, accessed ~10.00 am EEST 16/3/2020.

Tezos' recovery put on the rocks as crypto markets falter

Tezos was originally conceived in 2014 by Arthur and Kathleen Breitman, who went on to found the Tezos Foundation, which was incorporated as a nonprofit in Switzerland. The Tezos ICO, which was held in July of 2017, was record-breakingly successful, bringing in a whopping $232 million.

Tezos' operations were structured so that the Tezos Foundation would be able to hold the majority of Tezos' funds and pay Dynamic Ledger Solutions, a US-based firm that handled Tezos' operations. The structure was intended to allow Tezos to avoid paying taxes, but CoinTelegraph has reported that this wasn't effective.

The Foundation ran into trouble in 2018, when Johann Gevers, the former head of the Tezos Foundation, became embroiled in a highly-publicized spat with the Breitmans. The dispute temporarily set the project off its course and its timeline and caused the firm to be hit with several class-action lawsuits.

However, by 2019, the project showed signs of recovery--garnering support by high-profile investors such as Tim Draper and increased interest in its staking component. Cointelegraph also reported that a number of investors are interested in projects that are either already developing on top of Tezos' protocol, or will soon be developed on the protocol.

In particular, there is interest in Tezos as a platform for Security Token Offerings, or STOs. Recently, Tezos Commons community member and ReactCrypto journalist Will McKenzie posted a study claiming that Tezos will outperform Ethereum in terms of STOs. He cited, Mason Borda, the CEO of TokenSoft, who told McKenzie that within a year, 25%–35% of all STO issuances through TokenSoft would be on Tezos.

However, Tezos seems to have lost some of its gains as crypto markets continue to react negatively to the spread of the coronavirus outbreak.

CoinMarketCap, accessed ~10.00am EEST 16/3/2020.