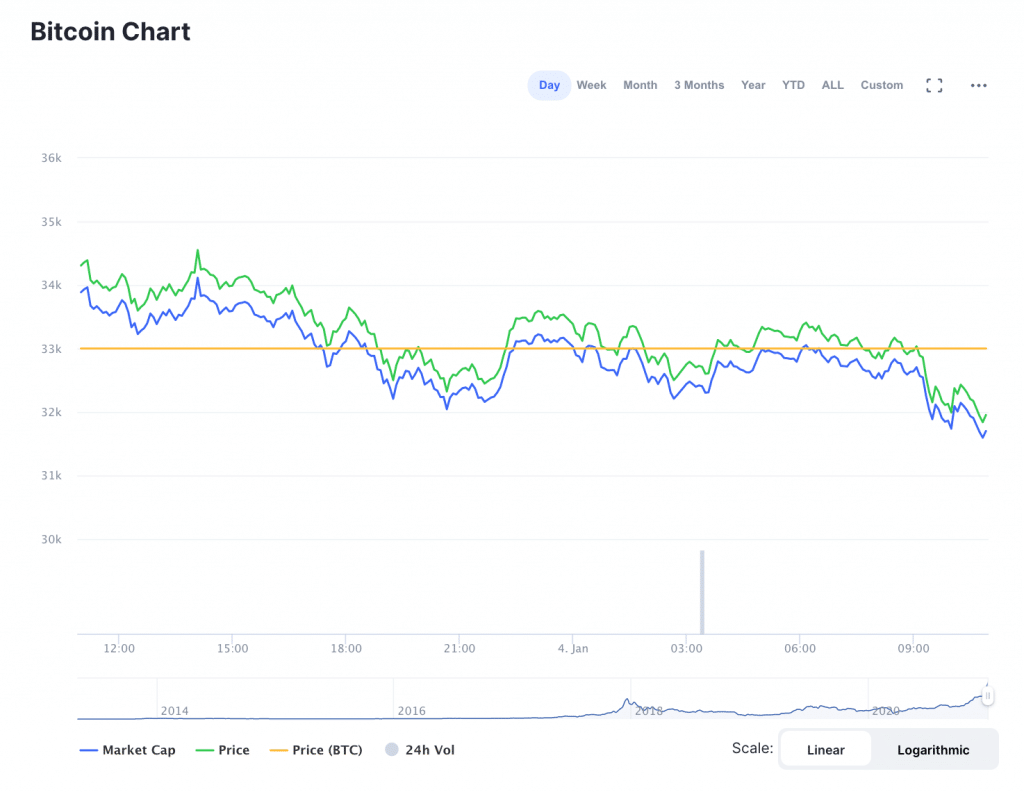

After hitting a new all-time high just over $34,000 on Sunday, the price of Bitcoin sunk to approximately $30,900 at press time, a decline of nearly 10.6 percent. While some analysts are saying that markets will shrug it off, others seem to believe that the end of the current Bitcoin rally is nigh (or indeed, that it is already here.)

“Welp. That's a wrap. See you all in 4 years!”, wrote crypto analyst, Joseph Young on Twitter after lamenting that “people will start blaming Asia again for this dip.”

Young also pointed out that “Coinbase is now trading $50 lower than Binance,” a factor that he believes points to a cooldown in retail energy. “This means the aggressive accumulation isn't there anymore,” he said.

”I Expect a Market Cooldown.”

By contrast, “a few days ago, Coinbase had a premium of around $150 to $350 at its peak,” Young explained. However, he believes that the downturn “doesn't have to be a correction,” but still, “I expect a market cooldown.”

“Whales in Asia have likely been selling $BTC heavily in the last few hours,” he added, pointing to an apparent “- 3,001 BTC (~$100 million) deposit into Bithumb.” At the same time, “all the while the futures market is very overheated and overcrowded.”

”Consider the Bad Scenarios Too”

Joaquim Matinero Tor, a cryptocurrency observer and Blockchain Associate at Roca Junyent, previously told Finance Magnates that he expected Bitcoin to see a serious drop in the month of January.

Specifically, “I think the price of Bitcoin will fall under 18,000 dollars and then rise back. Whale investors will sell once the financial year is over. So, January may be a rollercoaster ride for the cryptocurrency market,” he told Finance Magnates.

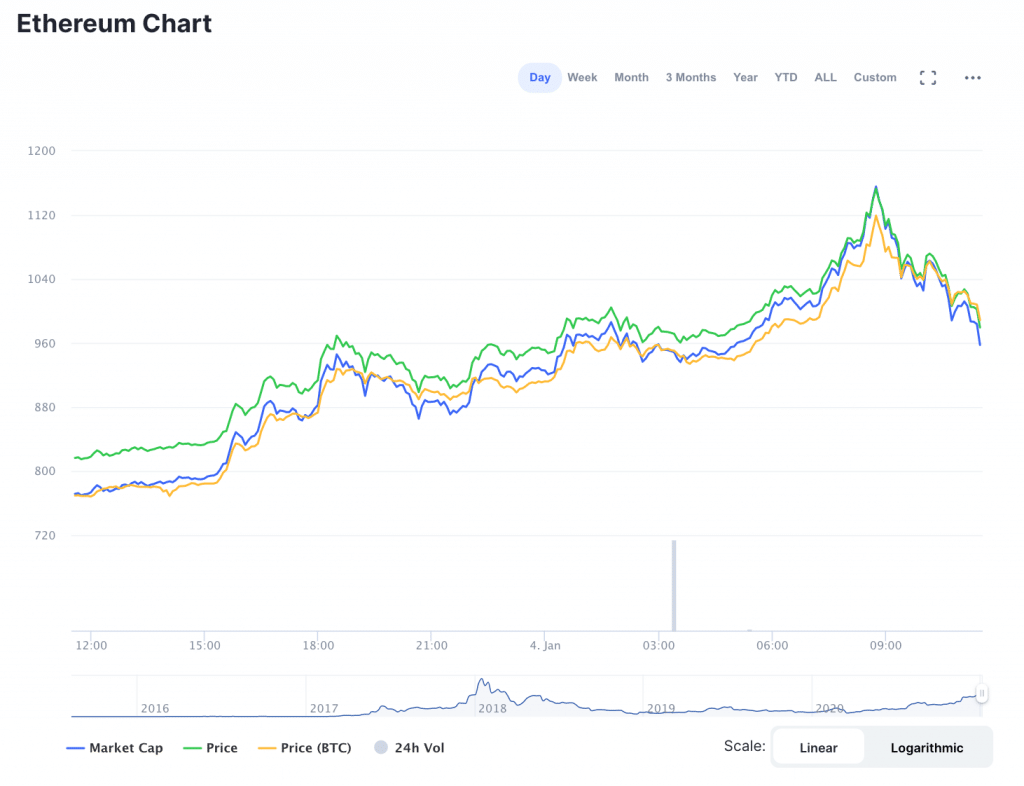

The decline in the price of Bitcoin also seems to be affecting the price of Ethereum. Ether’s rally is so strong that the total price is still up more than 20 percent over the last 24 hours. However, the price of ETH has shown a downward trajectory over the course of the last several hours.

Young tweeted that he believes a downturn in the price of Bitcoin could signal price drops in other parts of the cryptosphere later on.

“Bitcoin -> Ethereum -> alts -> DeFi bluechips -> correction -> DeFi mid caps,” he wrote on Twitter. “Beware of high Volatility , manage your risks. Consider the bad scenarios too.”

However, a downturn in the price of Bitcoin could give some hopeful investors the opportunity to jump into BTC at a lower price.