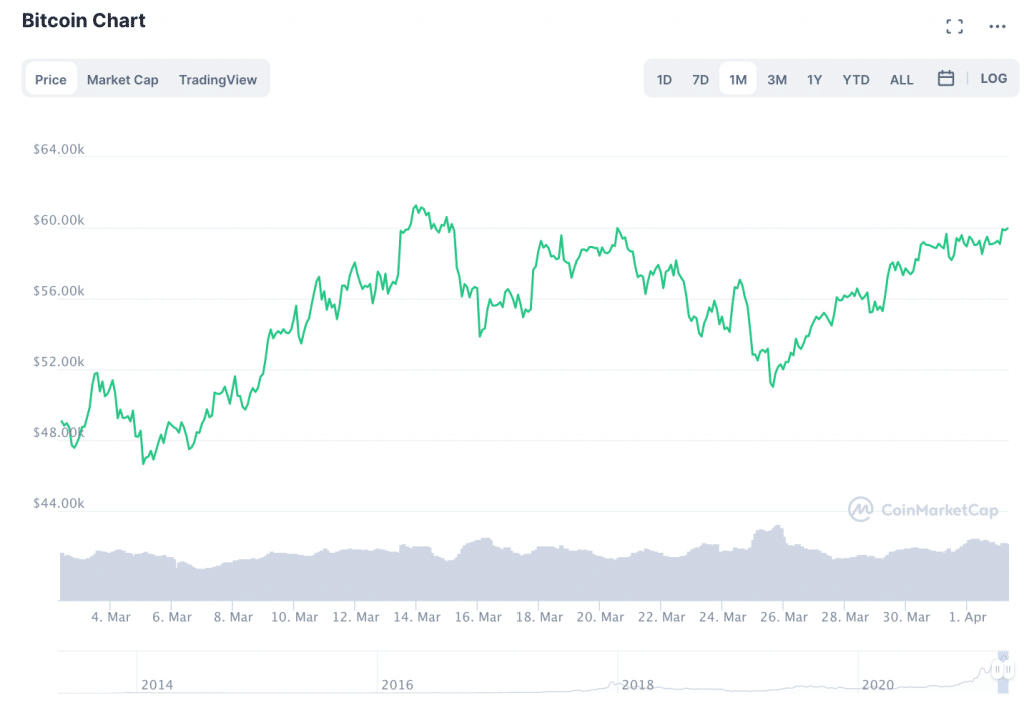

After a sharp pullback at the end of last week, Bitcoin seems to be on the road to recovery.

The pullback began on Thursday, March 28th. The day prior, Bitcoin peaked just over $57K; by the end of the day on Thursday, the price of Bitcoin had fallen to nearly $51K. A number of analysts pointed out that the correction was particularly surprising because of the record amount of options expiry that were due on Friday, March 29th.

The price correction caused many analysts to question whether or not BTC was at the beginning of a larger bear cycle. However, after BTC’s price drop bottomed out last Thursday, Bitcoin has been on a path of steady gains. The rise appears to have been bolstered by news this week of both Visa and Paypal announcing plans to enmesh themselves further into the crypto world.

Now, the big question on everyone’s mind is what will happen in the coming month. Will Bitcoin manage to recapture $60K and beyond? Or is another pullback in the cards before Bitcoin can regain steady ground?

Bitcoin Has Been Bolstered by Positive News throughout 2021

Doug Schwenk, Chairman of Digital Assets Research (DAR) told Finance Magnates that he believes Bitcoin may have further to go before another pullback.

“BTC has just bounced back from $51k around options expirations a week ago to approach the $60k level again,” he told Finance Magnates. “There are clearly strong tailwinds on price given the speed of recovery.”

What is causing these tailwinds to blow so strongly? In addition to the recent news about PayPal and Visa, Schwenk pointed out that: “we continue to see positive news in institutional adoption, such as Goldman Sachs plans to offer wealth to clients and continued ETF filings and approvals in Canada and Brazil, as well as filings in the US.”

“It's easy to imagine BTC breaking the psychological $60k barrier and moving higher if there continues to be mostly positive news,” he said.

Beyond the world of institutional investors, markets could potentially be boosted by positive regulatory news in the United States. “The entire industry is waiting to hear what Gary Gensler as the new chair of the SEC and what other new regulators at the CFTC and OCC will say about clarity and support,” Doug pointed out.

However, this anticipation could go both ways: “any comments that appear negative could easily drag BTC back in the short term, as could positive progress on a Central Bank Digital Currency (CBDC).”

Large Institutions Are Accumulating Bitcoin at Record Speed

Even if a pullback is possible in the short-term, Justin Hartzman, CEO and Co-Founder of CoinSmart, pointed out to Finance Magnates that: “analysts [have been] calling for much higher prices this year.”

Justin Hartzman, CEO and Co-Founder of CoinSmart.

“I think as we see more institutions enter the market and inflation as a result of printing of money across the world, the more the mass market will enter the crypto space. From there, it is simply a matter of supply and demand,” he said.

Indeed, as COVID stimulus relief continues in the United States, the USD’s status as the world’s default currency may be faltering. While there is still some debate about whether or not Bitcoin is a true “hedge against inflation,” the fact that more investors, particularly those of the institutional stripe, are buying and hodling more BTC than ever before.

Marcin Kolago, Chief Executive and Founder at Coinerro, told Finance Magnates that: ”a significant amount of Bitcoins is regularly removed from the market.” In other words, a growing number of investors appear to be purchasing Bitcoin and then moving it into “cold storage,” making it more difficult to sell.

“Such accumulation is an argument we are far from a market crash as such crashes are preceded by more liquidity flowing into the market from long term hodlers,” Kolago said.

As More Institutions Accumulate Bitcoin, How Will Its Famous Volatility Be Affected?

Kolago also pointed out that if the trend of large-scale accumulation continues, there could be a fundamental shift in the way that Bitcoin operates in crypto markets.

“It will be interesting to see if Bitcoin sustains its volatility in the future,” he said, referencing this “unprecedented corporate accumulation.”

“While past peaks and crashes were strongly driven by retail runs and panic, it remains to be seen if corporate holders react to market developments in a less emotional way,” he said. “Corporate Bitcoin ownership has reduced the general level of market leverage, thus already increasing stability.”

Marcin Kolago, Chief Executive and Founder at Coinerro.

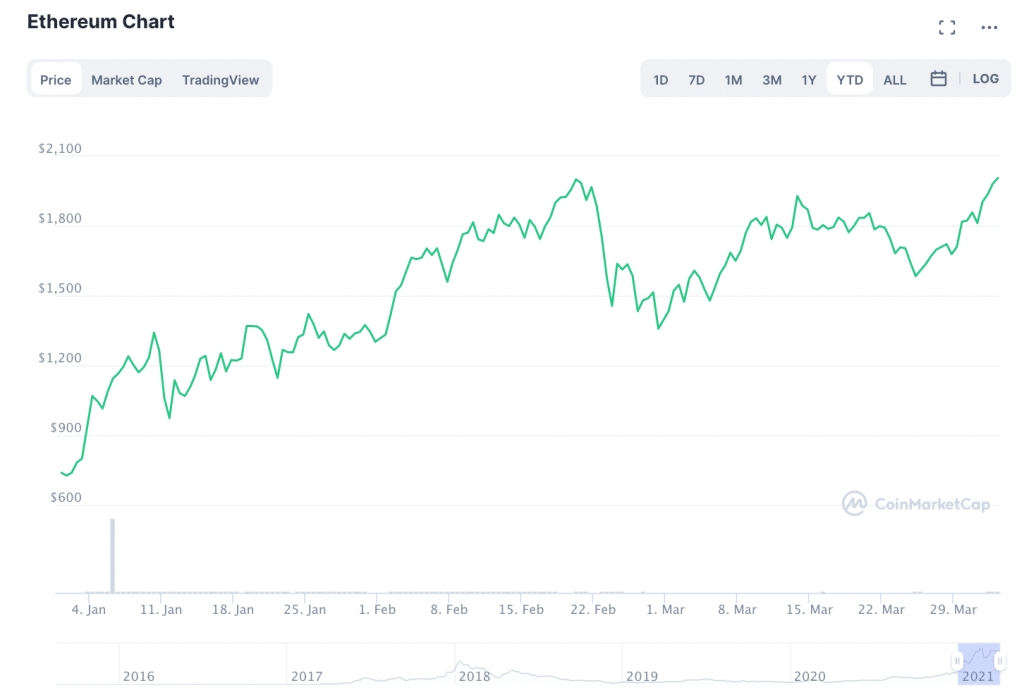

ETH Approaches a New All-Time High

As Bitcoin continues to stabilize levels above $50K, other Cryptocurrencies appear to be riding along a bullish trend as well.

For example, Ether (ETH), the native token of the Ethereum Blockchain , was closing in on its previous all-time high of $2,036 with a price of $1,998 at press time.

What is driving the price of Ether up?

However, the Ethereum network is still facing some significant limitations to how often it can be used. Transaction fees on the network have been sky-high for months and do not show signs of coming down anytime soon.

The network is currently in the process of migrating to a Proof-of-Stake (PoS) consensus algorithm, which developers say will lower transaction fees and increase the number of transactions per second (TPS) on the network. However, the process of migrating to the new algorithm may not be completed until 2022.

ETH Hangs in the Balance of the Ethereum Network’s Future

Therefore, Ethereum’s price may be approaching a point of limitation in the short term. Schwenk explained that currently, “ETH is trapped between the adoption of DeFi and high transactions costs and limited transaction bandwidth.”

“DeFi has been a hot space over the past six months and has largely been built on Ethereum given its brand and smart contract capabilities,” he said. However, “as gas fees rise and maximum throughput constrains the network, Ethereum shows some fragility and pushes innovation to other blockchains.”

Still, in spite of these possible limitations, there is a path for ETH to make more gains in the short-term: “with a planned Canadian ETH ETF and the best known smart contract brand, it's likely that ETH continues generally upward until the network problems are solved or a clear consensus replacement emerges,” Schwenk explained.

In the meantime, Ethereum’s technical holdups may have cleared a path for the rise of other smart contract-enabled blockchains (and their native assets.)

Kolago explained that: “Ethereum is an asset with significant potential, currently hamstrung by high gas fees.”

“This has spurred competition like the Binance Smart Chain, which is centralized, but significantly cheaper to use,” he said. “Once a credible solution to the Ethereum gas fee issue appears on the close horizon, the market will start discounting it and we can expect price movement. Till that time there is space on the market for competitors, it remains to be seen if any of them establishes itself as the new go-to solution.”

Regulators Are Turning Their Attentions toward the Growing DeFi Ecosystem

Indeed, the DeFi ecosystem is continuing to grow at an explosive rate, and will likely continue to do so, with or without Ethereum.

CoinSmart’s Justin Hartzman explained that much of this growth has been spurred by increased interest in “crypto interest-earning products” in the DeFi space.

“Some of these products boast interest rates between 8-25%,” he said, adding that “investors should be sure to take note of the risk involved in these new and often ‘too good to be true’ offerings since DeFi products still have a certain level of risk involved.”

DeFi’s growth is also being “amplified with the ever-growing extremely popular NFT market,” he said.

While there may be “exciting times ahead” for DeFi, regulators are increasing their attention to the DeFi space – a factor that may cause some hiccups in the growth of the space.

Specifically, Kolago pointed to “the new FATF (Financial Action Task Force) draft guidance," which appeared last week.

Kolago explained that the appearance of the guidance implies that: “regulators are adjusting to rapid DeFi growth and will drive more compliance and AML measures in the industry.”

“While such measures are hard to implement in a decentralized network, they might lead long-term to market consolidation and the increasing importance of crypto regtech,” he said. “While crypto crime might be shrinking year to year, as shown in the Chainalysis crypto crime reports, rest assured DeFi will be an area impacted by regulation in the coming years.”

None of the content of this article constitutes accurate price predictions or investment advice. Before investing in Bitcoin or any other crypto asset, carefully consider your appetite for risk; never invest more than you can afford to lose.