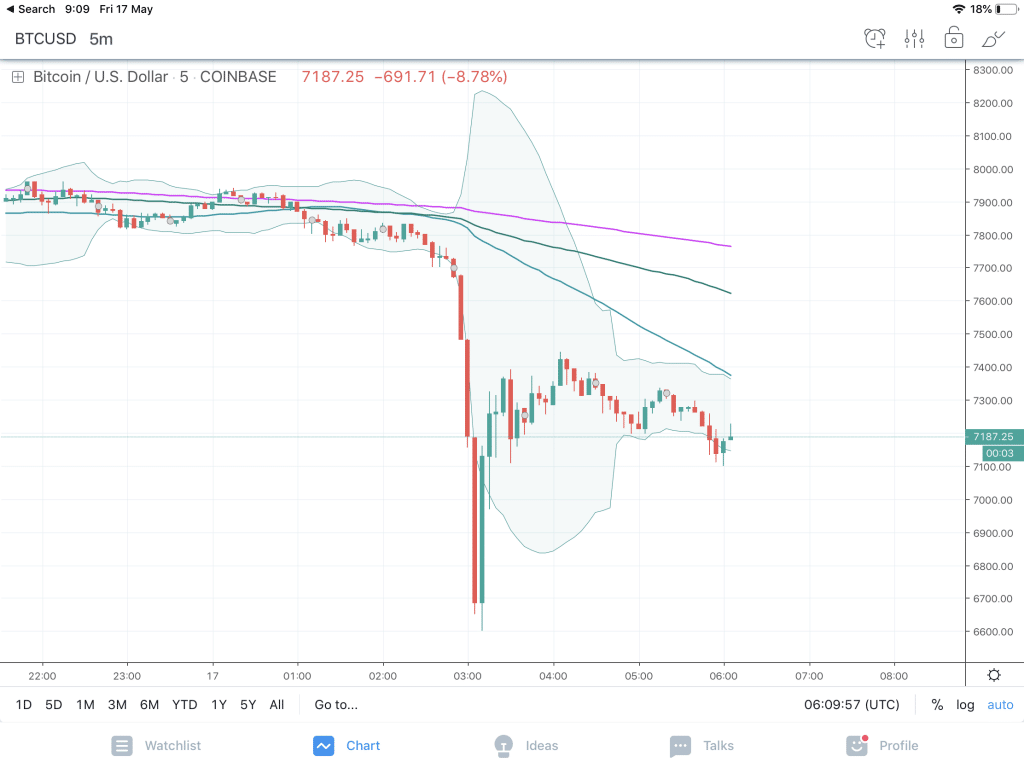

Just as the mood across cryptocurrency markets was striking an upbeat tone, a sharp turnaround last night flipped a switch. A flash crash in the price of Bitcoin allegedly starting with a big sell order transacted via the Bitstamp exchange crashed any positive sentiment that had built up before.

The most-popular cryptocurrency shed over $1000 in 15 minutes from $7,700 to around $6,600 before stabilizing just above $7,000 as of writing. The news comes amid increasing pressure on Cryptocurrencies markets following the entanglement of Bitfinex and its sister company Tether into an investigation by the NY Attorney General.

Bitcoin flash crash price action, Source: TradingView, Coinbase feed

Flash Crash Market Making Challenge

The selloff started at Bitstamp with over 5,000 bitcoin being exchanged between 03:45 and 04:15 London time. The lowest print on the exchange was at $6,178. Speculation that the main reason for the crash of prices on Bitstamp is the 50% share of the price formation on BitMEX.

The high leverage used by traders on BitMEX is prompting sharp market moves that are wiping out holders of derivatives contracts purchased using leverage as high as 1:100. While regulated retail brokers are less exposed, the events show that despite the development of the crypto market over the past several years, risks of sharp and unexpected moves remain ample.

Bitfinex and Tether Saga Continues

Last night The Supreme Court of New York ordered Tether to stop loaning money to Bitfinex. The embattled cryptocurrency trading venue has been experiencing financial difficulties after its partnership with a Panama-based firm called Crypto Capital went south.

Bitfinex has been attempting to get its finances on track, with the latest batch of news focused on launching its own Initial Exchange Offering (IEO) ). Those plans, however, have been scrapped in light of the investigations against the firm.