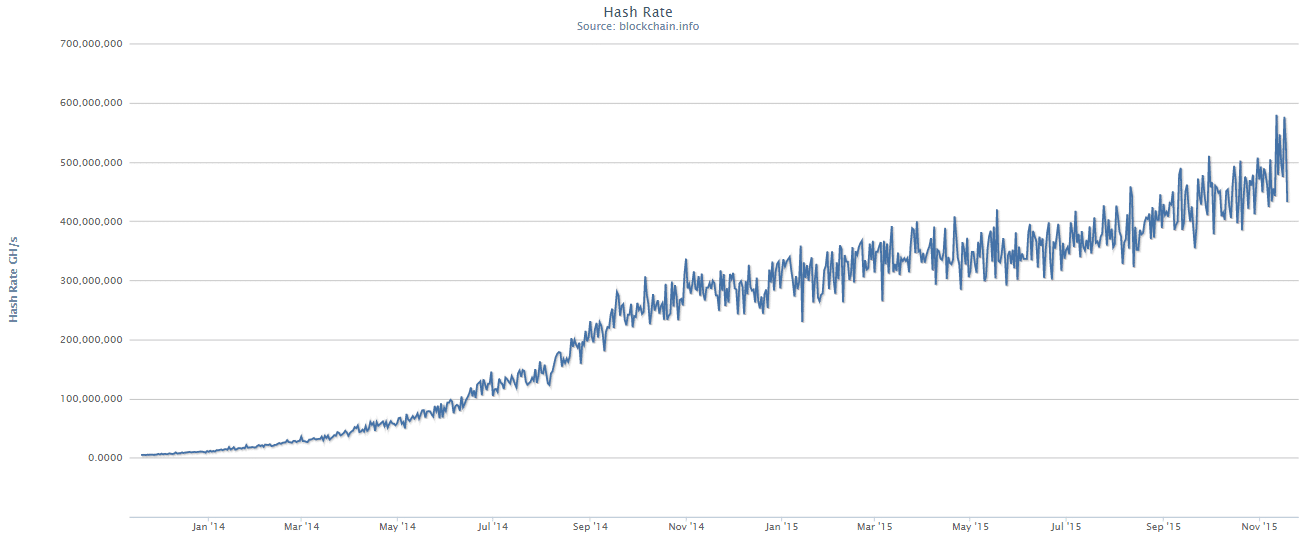

The Bitcoin mining network’s total Hash Rate has pushed markedly higher in recent days, hitting new all-time highs above 575 PH/s (1 PH = 1 petahash, or 1015 encryption calculations) yesterday and one week ago.

Higher bitcoin prices are a key factor. Currently trading at $335, bitcoin did shed the bulk of its gains from the volatile rally to $500, but is still trading more than 40% higher than two months ago. It has also held onto these gains for long enough to make it worthwhile for miners to come back online and have a reasonable chance of staying profitable.

The markedly higher value of bitcoin has allowed the hash rate to grow at a faster rate than in previous months, during which it solely relied on the gradual advances in hardware efficiency while bitcoin prices were mostly flat.

Still, at its current pace, the hash rate is likely to at best double in 2015. In years prior, the hash rate grew exponentially- partially because of the exponential increases in bitcoin prices, but also because the network was not yet saturated with hardware.

In the absence of other factors, the total hash rate gravitates towards an equilibrium of slight profitability. High profitability brings more equipment into the network until the increasing difficulty makes it no longer profitable to do so. Conversely, when prices unexpectedly drop, hardware may depart the network until slight profitability is restored.

Previous predictions anticipated a 1 EH/s (1 EH = 1 exahash, or 1018 hashes) rate by July 1 this year, and 2 EH/s by the beginning of 2016. This assumed a bitcoin price of $400, roughly 20% higher than the current value. More recent predictions foresee the rate reaching between 700 PH/s and 1 EH/s by year’s end, assuming a bitcoin price of $250.

The mining difficulty level is currently near 66x109 and is forecast to jump to 71x109 upon the next increase.