The coronavirus has had a very strange effect on time--certain aspects of our lives have been sped up, and others have slowed down; in many ways, the same thing that can be said for crypto: the coronavirus crisis has been a sort of ‘stress test’ for the industry on many levels--as a result, we’ve seen wild Volatility , infrastructural issues, and generally, the vulnerabilities of the crypto ecosystem have been laid bare; at the same turn, the path forward for crypto may be clearer than ever.

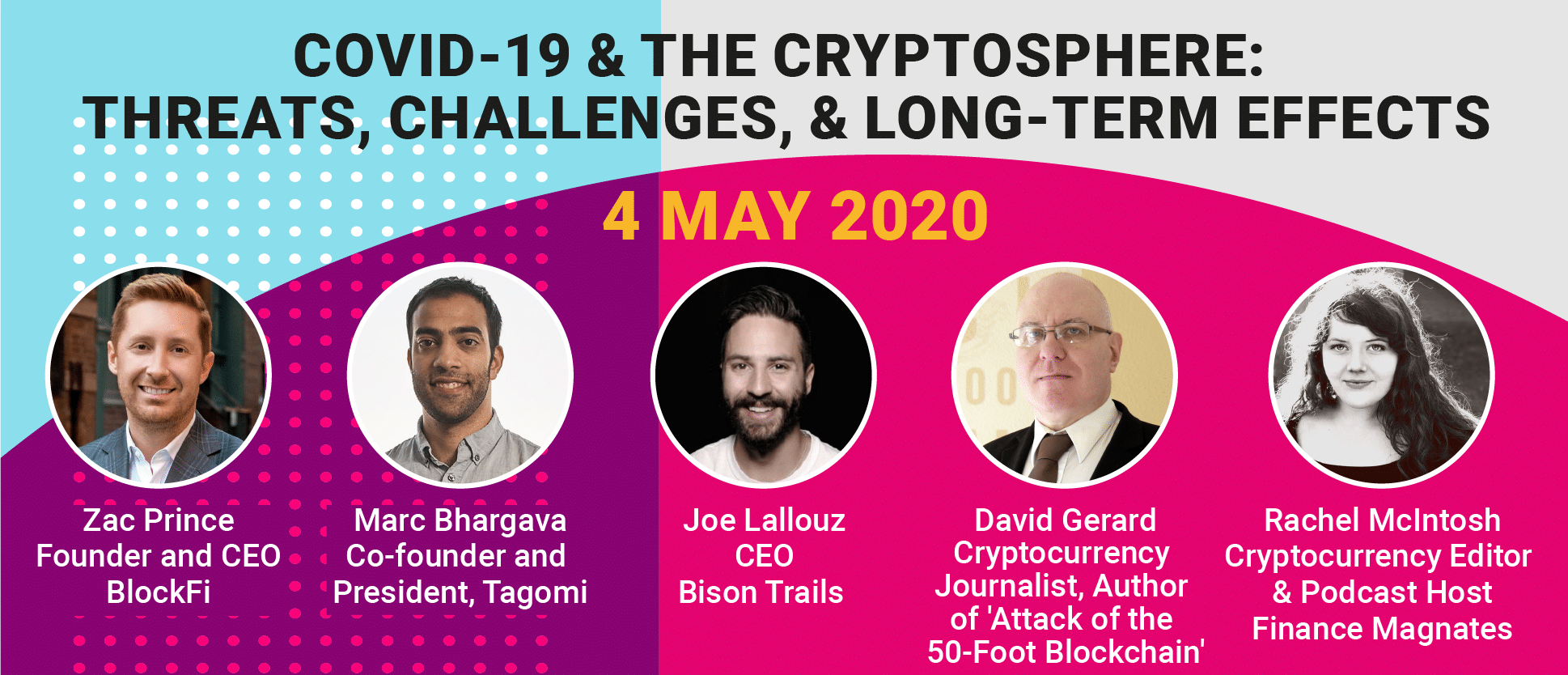

Finance Magnates is pleased to announce the completion of first-ever in a series of online cryptocurrency-focused webinars. On Monday, May 4th, we discussed the coronavirus and its effects on cryptocurrency with four leading experts in the crypto space. To listen to the full discussion of the session, which was entitled 'COVID-19 & the Cryptosphere: Threats, Opportunities, & Long-Term Effects," click the SoundCloud or YouTube links below.

Two of yesterday's panellists are leaders from companies that are members of the Libra Association, the organization that supports the development of Facebook’s Libra network: Joe Lallouz, founder and chief executive of blockchain infrastructure firm Bison Trails, and Marc Bhargava, president and co-founder of cryptocurrency prime brokerage Tagomi.

The panel also featured two experts from other prominent aspects of the cryptocurrency industry, including Zac Prince, chief executive of NYC-based cryptocurrency lending firm BlockFi, and David Gerard, author of Attack of the 50-Foot Blockchain . David is also a prominent cryptocurrency journalist and historian.

David Gerard: Crypto is "functionally a bit of a dollar derivative.”

The discussion began with a discussion about what has been revealed about the cryptocurrency ecosystem as a result of the economic fallout from the coronavirus.

“The thing about the COVID-19 crisis is that it was the end of the ‘long bull run’: after the 2008 crisis, we basically had a decade where stocks just went up. That ended all of a sudden in one, big bang,” David Gerard said.

“Everybody took all their money out of everything else, and put it into the ‘asset of last resort’ in a crisis, and that asset turned out to be dollars--buying up treasuries, or just getting cash.”

David Gerard, author of Attack of the 50-Foot Blockchain.

Additionally, conventional markets “just completely went nuts--nobody knows what anything is worth anymore. Stock prices make no sense at the moment.”

And “crypto crashed as well.”

David explained that this is because “the great difficulty that crypto continues to have is that there really isn’t really a crypto economy--there’s no circular flow of income; no one ‘lives their lives’ in crypto. As an investment, it’s functionally a bit of a dollar derivative.”

“[...] So, the lesson there is that everything crypto did, it did during the best possible conditions: when markets were going up, investments were all looking good...now, it’s the bad times, and crypto really has to make a case--and I’m really not seeing it make one at the moment.”

Zac Prince: Dollars are "sucking the life out of everything else.”

Zac Prince responded: “I think you brought up a really interesting point about the flight to dollars--that’s very accurate...dollars are going to be the biggest thing moving around the crypto economy or the crypto ecosystem over the next one to five years.”

“Historically, it’s been kind of a challenge in the industry for some folks to square that as a concept, because a lot of the most hardcore cryptocurrency believers will say things like, ‘cryptocurrency is going to replace the dollar’ and ‘fiat currencies are total trash’--I believe the exact opposite.”

In fact, “I believe there’s a great sucking sound in the world economy, and it’s dollars sucking the life out of everything else.”

However, “what’s unique about the cryptocurrency industry, and specifically the payment rails that are created by some of these networks (like Ethereum), is that it enables people to move dollars around at a speed and scale that was simply not possible using the traditional banking ecosystem.”

Zac Prince, chief executive of NYC-based cryptocurrency lending firm BlockFi.

As a result, “you’re going to see more and more people do things that the used to do more expensively with the traditional banking system, or not be able to do at all with the traditional banking system--[they’ll] move into the traditional crypto world, [and] get one step closer to Bitcoin.”

Zac also pointed out that Bitcoin is nearly back to the price point that it was hovering around in the pre-corona days: “[Bitcoin] has rebounded better than the stock market, performed better than gold this year...there might be a big benefit to Bitcoin for not being as connected to the traditional system as other assets are.”

Joe Lallouz: The upcoming Bitcoin halving may be heavily influenced by trading infrastructure

With regards to Bitcoin’s price, Joe Lallouz also shared his thoughts about the possible effects of the upcoming Bitcoin halving or ‘halvening’ that is scheduled to take place next week. Halvings are regular occurrences in which mining rewards on the Bitcoin network are cut in half; some analysts believe that these events inevitably lead to price increases.

Joe Lallouz explained that “Compared to previous halvings, where folks are looking at the history and saying ‘look at the previous halvings--[they resulted] in serious price adjustments, most of which were upwards,’” which is to say that “the Bitcoin price has been mostly tied to the activity in the network.”

However, the Bitcoin trading landscape has evolved since the last halving, which took place in 2016. “Right now, a lot of the activity is margin trading in places like BitMEX,” Joe said.

Joe Lallouz, founder and chief executive of blockchain infrastructure firm Bison Trails.

In other words, “in previous halvings, there wasn’t the infrastructure around trading that we have today, and so there wasn’t the opportunity for margin trading on BitMEX to dictate the price [when the last halving occurred.]”

“It’s a different world, and we’re seeing it progress,” he added.

However, “what’s actually a good thing is that we are seeing the markets sort of adjusting to the platforms that exist, the trading activity that exists, the mining activity that exists, the purchasing activity that exists.”

How will this affect the price of BTC? “[...] It’s very possible that the halving is already priced in, or that the trading activity is dominating any kind of mining activity that would be dictating the price--we don’t actually know.”

Marc Bhargava: The halving will have an important "narrative effect" on Bitcoin

Marc Bhargava also brought up the similarities and differences in circumstances surrounding Bitcoin halvings in the past.

“If you look at the last halving in 2016 and the year that followed,” that time period “was also the rise of Ethereum,” he said. “There was a lot of excitement around it: the community, the building--those two things were so clearly connected, and kind of moved prices together in the subsequent year of 2017.”

“So, I think that in terms of the halving in and of itself, there definitely can be a positive narrative [with] a lot of press; it can also be a negative narrative (i.e. ‘nothing’s happening during the halving, I thought that was supposed to be the moment--should we all get out of this?’)”

“There certainly will be a narrative effect--a PR effect--and that could go either way, in my opinion; I think more important are other confounding variables that could come in around use cases, around tech and development and things like that.”

Marc Bhargava, president and co-founder of cryptocurrency prime brokerage Tagomi.

“If there are those things, and there is an increase in demand, then, of course, a cutback in supply could cause a very noticeable change,” Marc continued. However, “I guess I’m a bit more ‘demand-focused’ on it in terms of use cases and daily trading activity.”

Marc specifically pointed to “what’s going on on BitMEX and some of the exchanges that are tied to the index BitMEX uses.”

“It’s very true that [this trading activity] drives a lot of the volatility, but I think in terms of longer-term price trends...you find that there’s a base community [of users and traders] to take into account.”

This is an excerpt. To hear the full panel discussion with Tagomi's Marc Bhargava, BlockFi's Zac Prince, Bison Trails' Joe Lallouz, and author David Gerard visit us on SoundCloud or YouTube.