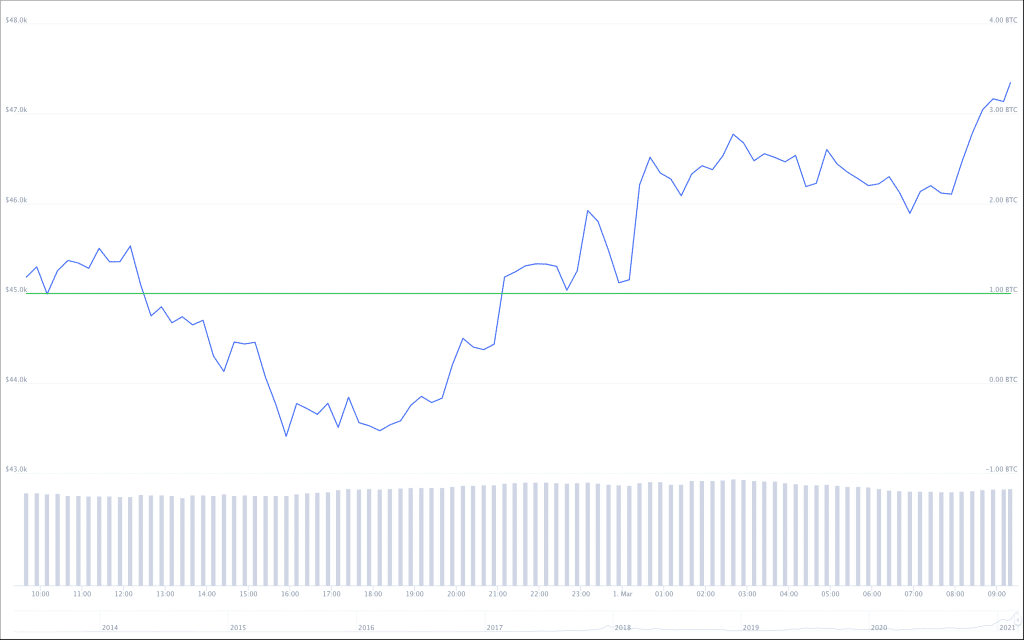

Bitcoin ’s sink to ~$43,400 on Sunday, February 28th, was its lowest point in roughly three weeks. Although the price had corrected to levels above $47,480 at press time, some analysts believe that Bitcoin could be in for further drops in the next few days.

Indeed, CoinDesk reported that yesterday’s drop to $43K may be the continuation of a downward trend that emerged last week as a result of concern over rising US Treasury bond yields.

Bitcoin's 24-hour price chart, via CoinMarketCap.

Some analysts believe that the increase in yields could cause the Federal Reserve to tighten its monetary policy in an attempt to stem the rising tide of inflation. However, such tightening could cause a sell-off in risk-on assets, which include Bitcoin and other Cryptocurrencies .

“This Is Still a Dip Buyer's Market.”

In any case, the drip to $43K was seen by many as an opportunity to scoop up some BTC on the cheap.

Matt Blom, Head of Sales and Trading for the digital-asset exchange firm, EQUOS, was quoted by CoinDesk yesterday, saying that “this is still a dip-buyer's market.”

"Profit-taking has led to liquidations, which has led to more profit taking. $41,800 will be the first test,” he said. Beyond that, "the next level is $38,100."

"On the upside, a close above $45,000 will change the theme. $48,200 will be the first target to be chased down, and back above $50,000, everyone will forget last week ever happened and will be shouting for a return to the all-time highs," Blom explained.

Jameson Lopp also pointed out on Twitter that the drop to $43K may not be so significant in the grand scheme of things, though last week was Bitcoin’s worst performance since March of 2020.

“Bitcoin has crashed to 10 times the value of what it crashed to a year ago,” he wrote.

Altcoins See a Short-Term Recovery, but Not Enough to Change Slightly Longer-Term Trend Lines

Beyond Bitcoin, other cryptocurrencies also saw red over the weekend, though Monday seems to have brought a wave of short-term recovery to altcoins. Still, the recovery has not yet been strong enough to change the weekly trends for most coins.

For example, Ether (ETH) has recovered nearly 10 percent over the last 24 hours, though its seven-day trend is still down roughly 22 percent. Additionally, Binance Coin (BNB) was up roughly 20 percent in 24 hours with a seven-day drop of 17 percent; XRP, Litecoin (LTC), and Chalink (LINK) were all down more than 20 percent in seven days, showing gains of less than 10 percent in the last 24 hours.

Of the top 50 cryptocurrencies listed by market cap, only a handful were showing positive trends over the last seven days: Cardano (ADA) up 20.81 percent, NEM (XEM) up 3.5 percent, Solana (SOL) up 36 percent, Voyager Token (VGX) up 6 percent, Fantom (FTM) up 45 percent, and UNUS SED LEO (LEO) up 32 percent.