It was an eventful weekend for Bitcoin. The price of BTC reached a new yearly high on Sunday, peaking around $9,150 before plummeting to roughly $8,650 less than twelve hours later.

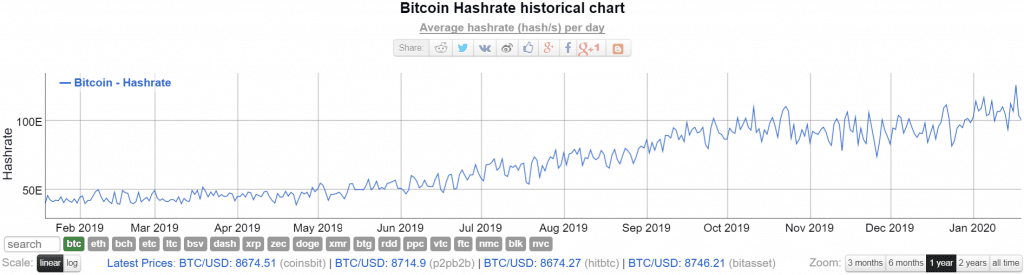

The price Volatility came just two days after Bitcoin’s Hash Rate hit a new all-time high of 126 Exahash, or one quintillion (126,000,000,000,000,000,000), hashes per second, according to data from BitInfoCharts.com. By comparison, Bitcoin’s hash rate was just under 38 quintillion hashes per second at this time last year.

Source: BitInfoCharts.com

Bitcoin’s hash rate is a measurement of the amount of computing power that miners are putting into the network at any given time. In order to mine BTC, miners use powerful computers that solve cryptographic equations by guessing the answer, or the “nonce,” to each equation. Each guess is one “hash.”

Hash rate could be indicative of BTC price trends

Examining trends in Bitcoin’s hash rate is important because these trends can be indicative of BTC miner confidence in the future of the network. A higher hash rate also means that the network is more secure since it would be more difficult for a hacker to gain control of more than fifty percent of the network’s computing power (a 51% attack).

The rise in the network’s hash rate in the run-up to the next Bitcoin “halvening” in May, or the halving of the Bitcoin network’s mining rewards, could also be indicative that a growing number of miners are joining the network--which, at first glance, may seem odd; after all, why would more miners be joining the network now, if the mining reward will literally be cut in half within a few months?

One theory behind this phenomenon is that the influx of hash power--and the miners behind it--is a sign that these BTC miners are expecting a major upswing in the price of Bitcoin.

On the other hand, however, the upswing of miners could also be the result of a rush to profit off of BTC’s current price highs and higher mining reward before the halvening.

Does a higher hash rate indicate the arrival of a higher price?

These two theories represent two sides over a debate in the Bitcoin community about how Bitcoin’s hash rate and price are related. Some analysts believe that price follows the hash rate; others believe that it’s the other way around.

Price does not follow hash rate.

Price follows supply & demand. Hash rate follows perceived mining profitability. — Alex Krüger (@krugermacro) September 24, 2018

However, historically speaking, it seems that the latter theory is closer to the truth--although it can take a significant amount of time with Bitcoin’s price to catch up with its hash rate.

Price follows hashrate and hashrate chart continues its 9 yr bull market. #Bitcoin pic.twitter.com/Rh49V9gaJw

— Max Keiser, tweet poet. (@maxkeiser) August 8, 2018

For example, the price lows that BTC experienced near the end of 2018, and the recovery it experienced during 2019 were precipitated by changes in its hash rate.

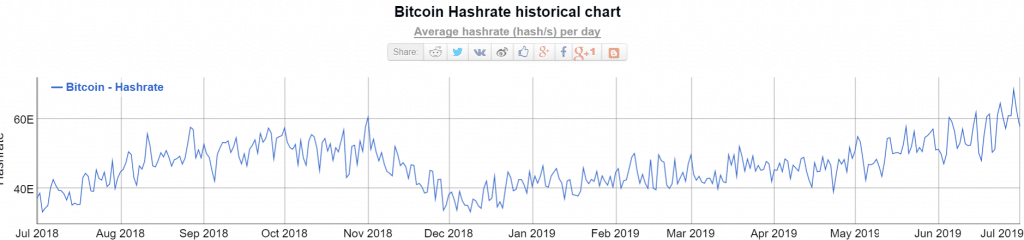

Indeed, in September 2018, with a hashrate around 56 Exahash per second (EH/s), the price per BTC was roughly $6,500 per coin. From September to December 2018, the BTC network’s hashrate fell to 31 EH/s; by December of 2018, the price of Bitcoin had fallen between $3,200 and $4,000.

Source: BitInfoCharts.com

Then, from December 2018 until the spring months of 2019, BTC’s hashrate increased to the same levels it held in September of 2018, roughly 56 EH/s.

Bitcoin prices didn’t start to recover until the end of March 2019, but they did eventually rise, and have been on a general upward trend ever since. However, whether or not history will repeat itself in terms of the relationship between price and hash rate remains to be seen.