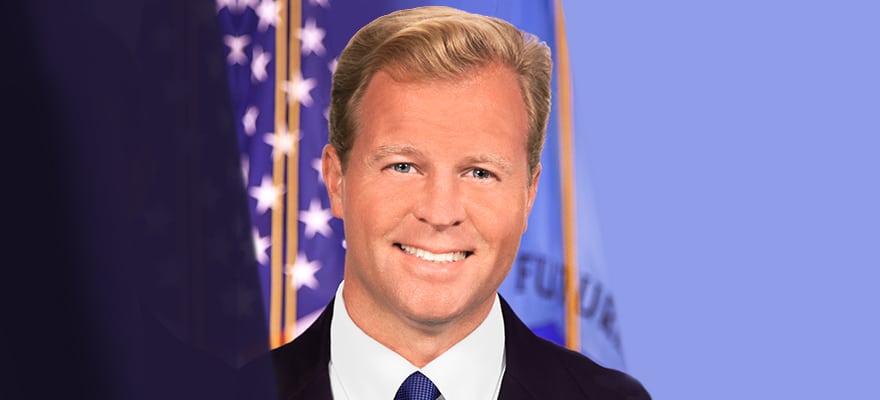

Brian Quintenz, a commissioner at the US Commodity Futures Trading Commission, revealed his take on smart contract Regulation at the Gulf Information Technology Exhibition in Dubai.

He expressed in no uncertain terms that the law of the land presides over any code, and revealed who he thinks is responsible for in cases of illegal smart contract use.

Struggling with definitions

The CFTC is the regulatory body that oversees the commodities, futures and options markets in the US. Much like the Securities and Exchange Commission, its fellow watchdog, it is still struggling to codify a conclusive definition of exactly which cases of cryptocurrency business fall under its jurisdiction (the latter is concerned with crypto-tokens that could be defined as shares in a company).

It should be noted that Quintenz stated that his views were not necessarily those of his employer.

How should the CFTC enforce its regulations against a software code?

Beginning positively, Quintenz made it clear that he understands the usefulness of smart contracts ("almost limitless in their applicability,"), identifying a couple of examples of their use.

There are many smart contracts which would not be relevant to the CFTC at all. However, he said that where a smart contract is used to undertake an activity which is both illegal and under the jurisdiction of the CFTC, it must be policed. Quintenz gives the example of contracts used to sell financial/event prediction software which is used to make a profit.

He asked: "How should the CFTC enforce its regulations against a software code, rather than a registered intermediary or an exchange?"

Think of someone asking you to borrow the keys to your car because they want to rob a bank

He noted that the first step is to identify the relevant actors. There are the core developers of the Blockchain , users that validate (mine) the blockchain for payment, the developers of the smart contract code, and the users of that contract.

The core developers of the blockchain are out. Despite the fact that they retain some measure of control over their nominally open-source creation, in his opinion it would be "unreasonable" to punish them: "They may not even be aware that this particular type of smart contract has been deployed."

This means that in the case of illegal activity, only those specifically involved with the smart contract are liable - the developers and the end users.

It would be natural for the former to pass responsibility to the latter. Quintenz, however, considers that going after the users would be an "unsatisfactory, ineffective course of action" because it may not be possible to effectively stop people from using an open code.

This leaves him with the smart contract developers. In the opinion of Quintenz, these are the people who a liable for illegal use.

"Think of someone asking you to borrow the keys to your car because they want to rob a bank. If you let them borrow your car, it would be reasonable for the government to hold you partially responsible for the ensuing criminal activity," he explained.

The question that the CFTC should ask, Quintez argued, is "whether these code developers could reasonably foresee, at the time they created the code, that it would likely be used by U.S. persons in a manner violative of CFTC regulations."

Ideally, he said that developers would engage with the CFTC to check if something is legal or not. Chairman Giancarlo set up LabCFTC in May 2017 for exactly this purpose - Quintenz said that in its first year, the department had seen 200 meetings with start-ups and relevant people.

"I would much rather pursue engagement than enforcement – but in the absence of engagement, enforcement is our only option."

Jeff Bandman. Source: LinkedIn

Jeff Bandman, Founding Director of LabCFTC and Lecturer in Global Affairs at Yale University, thinks that Quintenz' main purpose was to inspire discussion on a complex subject: "I read his speech as conducting a thought experiment in plain sight of his audience about how to apply the CFTC’s regime to a smart contract whose behavior looks a lot like a future, swap or option. He is breaking new ground."

Regarding Quintez' comments on users not being culpable, Bandman said: "The “who is responsible” question goes beyond the CFTC. It depends on what the activities are that the smart contract performs. Normally enforcement might focus on a registered business owner, but in the future decentralized world they may need to look elsewhere. It would still be necessary to meet the elements of civil or criminal liability, which ultimately a court would have to determine."

Commodity or security?

In September 2018, a federal court ruled that the watchdog can consider cryptocurrency to be a commodity for the purposes of a case that it is pursuing.

Defending lawyers had argued that the CFTC had had no authority in the case because the token in question did "not have future contracts or other derivatives trading on it, [and thus] is not a commodity.” The judge ruled, however, that it is a commodity because it could theoretically be used to support such derivatives.

Bandman said that while the ruling "bolsters the position of the CFTC against anyone who asserts that these are not the type of instrument that can fall within the Commodity Exchange Act," it has no bearing on the fact that crypto-tokens can also take the form of securities and thus fall under the responsibility of the SEC.