Bitcoin wallet and merchant services provider Coinbase reports that 2015 was a successful year, both for bitcoin and for the company.

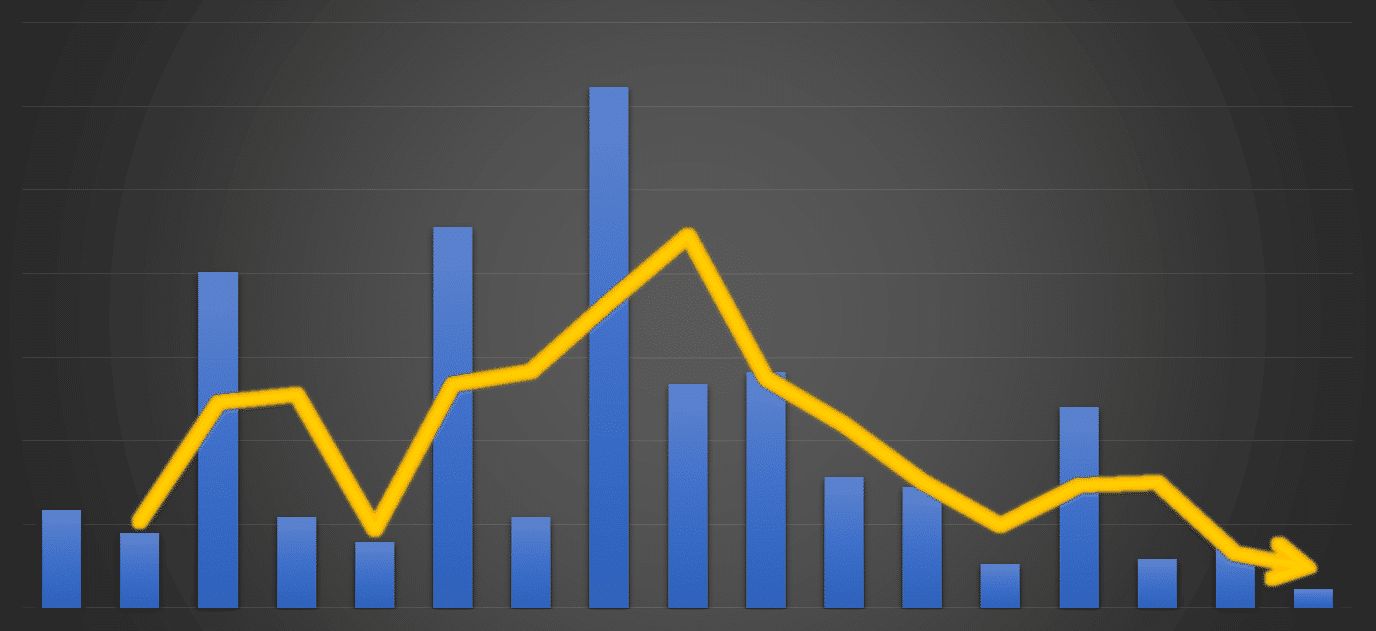

In a blog post, the company noted how the daily transaction count over the Bitcoin network more than doubled to over 200,000 during 2015.

One of the more notable highlights is Coinbase's successful expansion beyond the US. The startup moved into Europe not much more than a year ago. Now, the company reports, a majority of its users reside outside of the US. The proportion of international users grew from 44% to 51% during 2015. The fastest growing markets are Brazil, Philippines, and Indonesia.

Also mentioned was how bitcoin's price increased, yet volatility declined- a seemingly healthy sign for a currency whose obituary was written every time in crashed. The Bitcoin developer ecosystem grew by roughly 35% as well.

Not mentioned in the post were two of Coinbase's biggest accomplishments in 2015: its securing a then-record $75 million in funding, and the opening of its bitcoin exchange.

The latter may be the most financially significant for the company. The masses have yet to start using bitcoin for everyday shopping, and even if they did, Coinbase's fee structure for merchants does not bring in significant revenues. However, volumes on Coinbase's exchange have been solid and the commissions earned are adding up.

Bitcoin's struggles to evolve into an everyday currency may be well-reflected in the following statement by Coinbase: "Despite the strong growth in transactions, no single use case has broken out to the mainstream. This is something to keep an eye on in 2016 and beyond."

Bitcoin or Blockchain ?

One also can't help but wonder about Coinbase's position on the whole blockchain technology thing. Bitcoin's blockchain technology and distributed ledger systems inspired by it are envisioned to revolutionize the way stocks and fiat Payments are settled, among a plethora of other applications.

Coinbase has until now been a 'purist' Bitcoin company, in a sense, remaining faithful to the most popular digital currency and resisting what once was the popular trend of expanding into altcoins. Similarly, the company has yet to join the bandwagon of startups moving into various "blockchain" offerings or rebranding as blockchain companies while continuing to offer the same services.

"While much of the industry shifted to focus on blockchain technology this year, we remained focused on bitcoin and saw the ecosystem grow nicely," the company said in its announcement.

Coinbase's business development manager, Nick Tomaino, argues that bitcoin currency itself is a fine application of blockchain technology. He told Finance Magnates:

"Coinbase is in the blockchain technology race — bitcoin is the first application of blockchain technology with clear traction. There are a lot of non-payments applications of the blockchain that are exciting, but we remain most excited about Bitcoin."