Yesterday, we reported on a study published by economics professor John M. Griffin in which he claimed that the price of Bitcoin was routinely manipulated last year by way of Tether (USDT), a cryptocurrency supposedly tied to the US dollar.

The study also implicated Bitfinex, a major cryptocurrency exchange, by pointing out that this is the main conduit for USDT. Bitfinex shares much of its management team with Tether. Bitfinex CEO JL van der Velde unequivocally denied the supposition in a statement emailed to Bloomberg.

The study was originally covered by the New York Times and picked up by many media outlets (including this one). Coming as it did in the middle of a major cryptocurrency market downturn, it gained a lot of attention.

Many in the cryptocurrency community, expressing themselves through Twitter and Reddit, have roundly criticised the study.

The main stream media - controlled by the existing power structure - reports that price manipulation was involved in Bitcoin's price rise last year. Manipulation did happen, but it was a conspiricy to push the price of Bitcoin to the absurd low level that you see today. Wise up!

— John McAfee (@officialmcafee) June 14, 2018

Criticism

A reddit user called Priest_of_Satoshi said that all the study proves is that "people minting Tether are exceedingly good at "buying the dip" and they probably bought about 50% of the dips".

Whalepool, a Twitter account with 36.7 thousand followers describing itself as a "community of daytraders focused mainly on bitcoin and other Cryptocurrencies ", called the article FUD - cryptocurrency lingo for ungrounded pessimism.

However, it also said "This is a coordinate FUD attack against all of crypto", and it used the term 'fake news', so make of that what you will.

Another major cryptocurrency-focused Twitter account had this to say:

"Bitcoin’s Price Was Artificially Inflated Last Year, Researchers Say" - The tldr; when the price was dipping people bought bitcoin with Tether. Damn manipulation! https://t.co/M2Zf9svIzj pic.twitter.com/wcQTy81Sdk

— WhalePanda (@WhalePanda) June 13, 2018

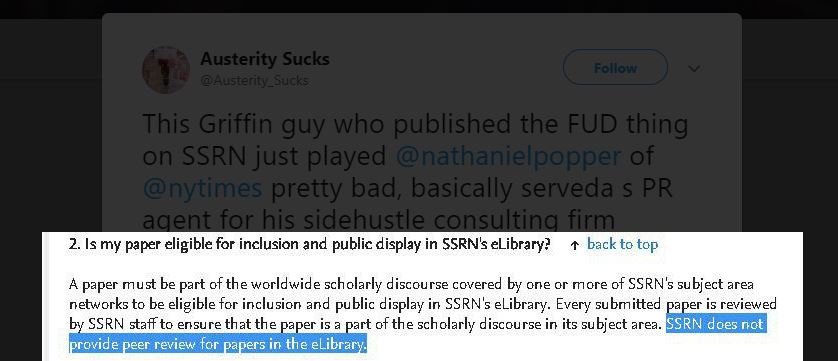

One user pointed out that Griffin works at a consulting firm specialising in fraud cases, and pointed out that papers do not require peer review to be displayed in the SSRN library (where the paper was published).

Source: Twitter

Another Twitter account under the name Matt Odell, described as "Bitcoin & distributed systems" and boasting 13.7 thousand followers, posted a more educated critique.

He wrote that the paper does not prove manipulation or lack of reserves. When the price of Bitcoin falls, people sell it for Tether dollars, which causes the price of Tether to rise, and so Tether issues more tokens to bring the price down to one dollar.

Thus, the fact that the supply increases during market decline is "exactly what should happen". In November 2017 the same user wrote that both Bitfinex and Tether have "always been sketchy", and called Tether a "a centralized stop-gap solution until connections to fiat are unneccesary [sic]".

What has repeatedly been pointed out is that Tether may be holding fractional reserves for its cryptocurrency in the same way that banks hold fractional reserves for their own responsibilities. However, Tether by necessity cannot be transparent; if it revealed where it keeps all its money, it could be shut down. While this doesn't inspire confidence, it also doesn't categorically prove that the reserves don't exist.

BitMEX, a Bitcoin trading exchange, reached a similar conclusion when it investigated the same subject back in February 2018, saying that while there are uncomfortably close ties between Bitfinex and Tether, lack of transparency does not necessarily indicate fraud.

Meanwhile, Bitcoin fans worldwide relax as the coin seems to have passed its recent nadir:

Source: coinmarketcap.com