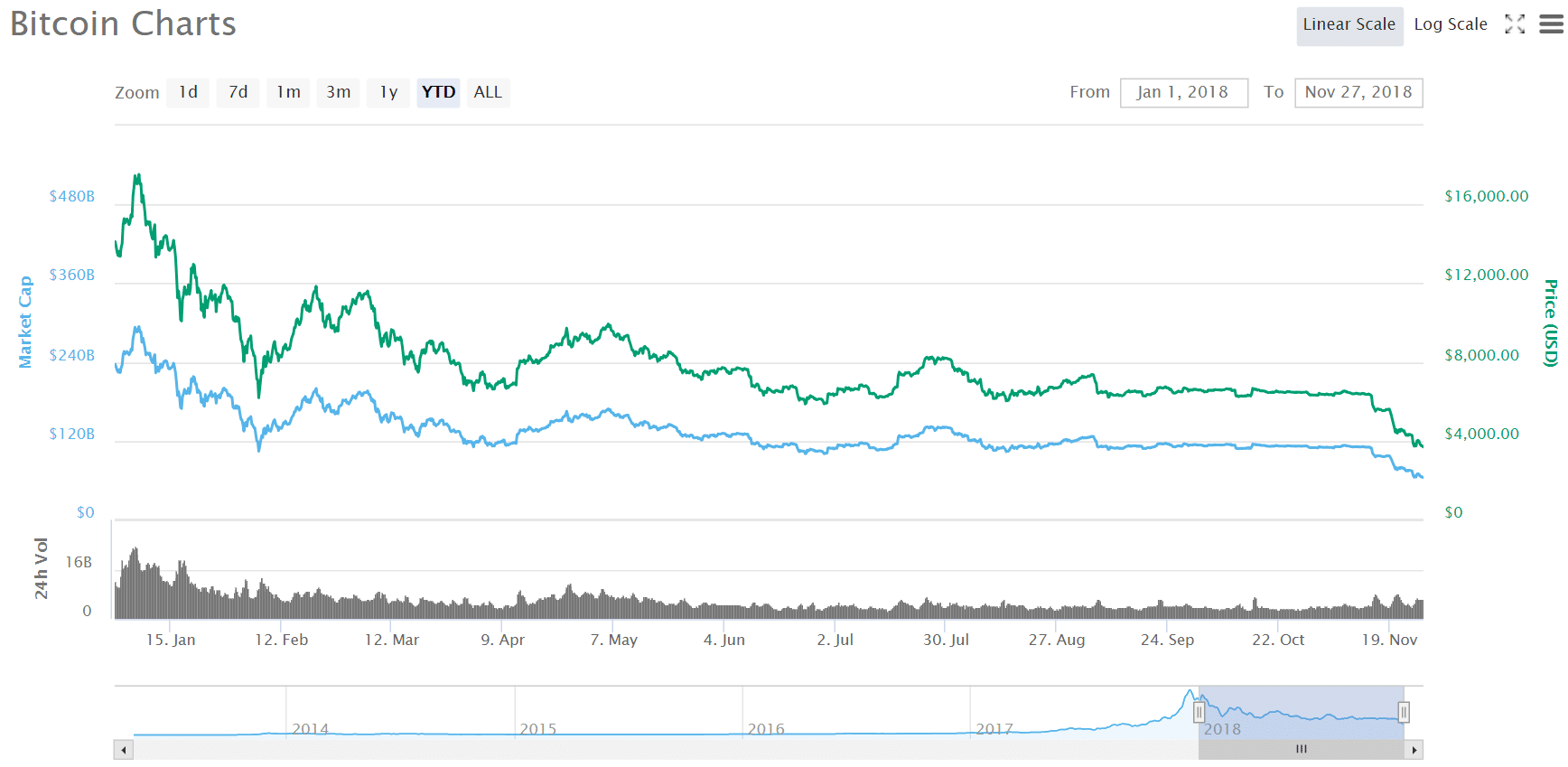

The cryptocurrency markets are in a tailspin. Bitcoin is lower than it has been in over a year, and bearish analysts and snooty relatives alike are saying, “I told you so.”

At the same time, governments around the world are continuously seeking to establish methods of properly regulating cryptocurrencies. The consensus in the US, the UK, and much of Europe is that more regulation is necessary both to protect consumers and to encourage further industry growth.

For example, the firms that comprise self-regulatory organization CryptoUK have called for more regulation. According to Ryan Zagone, Ripple’s head of regulatory relations, the key will be to find the balance between “capturing risk and enabling innovation.”

“We’re at that time now where we need more clarity and rules and we need more certainty,” he said in April of this year. Similarly, self-regulatory organizations have sprung up in the US, Japan, and across Europe; many of them have been working to create regulations with their respective governments.

”The Idea That a ‘Proper Regulatory Environment’ is Required for the Software Industry to Flourish is Absolutely False”--Or Is It?

However, not everyone agrees that playing by the rules is the best practice. Indeed, a number of figures in the cryptocurrency industry see regulations as far more of a hindrance than a help.

“The idea that a ‘proper regulatory environment’ is required for the software industry to flourish is absolutely false,” Akin Fernandez, founder of the Bitcoin Startup Azteco, told Finance Magnates. “The World Wide Web on the Internet grew without any regulation at all, and the same thing will happen with Bitcoin, which is nothing more than a new database and communications protocol.”

Akin Fernandez is the founder of the Bitcoin Startup Azteco.

Fernandez argued that therefore, cryptocurrency companies would seek to establish themselves in legal jurisdictions that are less-regulated rather than more. He pointed to BitMEX as an example: “[companies] will select free market territories like Hong Kong to incorporate in, just as BitMEX has. BitMEX is the extremely innovative and hugely profitable world-beating service that has just moved into two floors of the most expensive office space in the world they serve users all over the world and are not under any special regulation.”

His sentiments were echoed months before by Bharath Rao, founder and CEO of Leverj. In an interview with Finance Magnates conducted earlier this year, Rao argued that “the competitor who goes toward the unregulated market will make more profit,” he said, “and be able to capture what is currently feasible. The person who goes through the regulated market–two years later, when he gets approval, his product will be obsolete,” Bharath explained.

Bharath Rao, Founder and CEO of Leverj.io.

“The easiest way is to go where it is simple and fast to get regulatory approval,” Rao said, “and then to use the history of running [the company] successfully as a way to enter the established markets.” Bharath explained that essentially, for most crypto startups, attempting to incorporate and establish a presence in a large country like the US is “the wrong way to go about it.”

“Crypto is a global market,” he said.

“You’re not going to be able to comply with 200 countries and god knows how many provinces–it’s just not very feasible.”

“On the other hand, I think we actually have a happy middle ground in Blockchain technology where you can comply with the spirit of the regulations in [essentially] all jurisdictions, even if you’re not complying with the letter [of the law]," he added.

Law Enforcement Doesn’t Take Legal Evasion Lightly

Jim Angleton, President and CEO for Aegis FinServ Corp.

But is it really feasible to establish a company in an unregulated market in order to access customers who reside in a regulated jurisdiction?

Jim Angleton, President and CEO for Aegis FinServ Corp, doesn’t think so. Aegis owns BitcoinBankUS, and provides cryptocurrency/bitcoin companies, miners, exchangers, retailers, wholesalers with compliance consulting plus operational banking.

“Many who have subscribed to this theory only get into trouble and on the receiving end of Law Enforcement, Regulatory and Central Banker issues,” Angleton said in an email to Finance Magnates. This is because both company operators and customers are likely to be held liable for their actions, even if the company they are engaging with is based outside of their home domicile.

“Government wasn’t going to be intimidated by a bunch of libertarians and anarchists -- in the next year or two, we’ll see more than just enforcement actions.”#ICOCrackdown #CryptoRegulation #SEC https://t.co/bjscugNF7V

— GAEA Derivatives Exchange (@GAEATrading) November 20, 2018

“Even if you locate outside of the US, if you live in this country you have jurisdictional issues to overcome and are still liable for all actions. In fact you might be compounding your problems by the addition of the host country you operate within,” he explained.

He went on to say that the devil is in the details--careful planning and a deep understanding of the law could protect entrepreneurs and consumers. However, entrepreneurs “who do not confer with experts [can] get into trouble in so many ways. BSA-AML-KYC Rules are globally enforced so the notion of offshoring will only attack anti-money laundering inquiries than if they were operational in the US.”

Indeed, “Law Enforcement does not take kindly to avoiding US or Global/International Laws,” he said. “The Panama Papers certainly laid claim to what happens when you offshore, hide or conceal operations. Risks include Civil and Criminal proceedings, massive fines and penalties plus forfeiture, and then you have FACTA Law/Rules plus other Money Rules to abide by.”

Whatcha Gonna Do When They Come for You?

Even though engaging with companies established in loosely-regulated or unregulated domiciles may be a risk, it may be difficult to avoid. In a piece for Forbes, CEO of AMLT and compliance platform Coinfirm, Pawel Kuskowski wrote that it’s essentially impossible for anyone operating on any level within the crypto space to completely avoid interacting with companies who are established in loosely-regulated or unregulated jurisdictions.

“Whether you’re making Payments in crypto, are involved in initial coin offerings (ICOs) or using any blockchain-based payment processes, companies and exchanges might say they operate in Hong Kong or Japan but look deeper, and there will be a contracting third party, with an office registered in Bermuda or the Channel Islands,” he wrote.

Since this is so prevalent, exactly how risky is it to engage with companies who may have some of their business conducted offshore, either as part of their own legal entity or by a contracted third-party?

As of yet, the answer is unclear, although Jim Angleton also told Finance Magnates that he could not say with certainty that any company was doing absolutely everything right with its offshore dealings.

“Many [companies] claim to operate within the letter of laws,” he said. “However once our firm conducts pre/post audits and exams prior to regulators, we find every company to be out of compliance, not registered with FinCEN and do not have licenses or bank accounts.”

Massively significant from #SEC "There is a path to compliance with the federal securities laws going forward, even where issuers have conducted an illegal unregistered offering of digital asset securities."#cryptocurrencies #cryptoregulation #crypto #ICO #marketmoving ?? https://t.co/leMZoA1b9U

— CryptoCuria (@CryptoCuria) November 16, 2018

Angleton said that even the industry gold standard couldn’t be declared as totally kosher. “I wish we could say that CoinBase was thee one to do business without any hesitation, however, cannot. (sic)”

”These Assets Will Be Monitored by Law Enforcement for a Long Time”

Even if things are alright on paper from a compliance standpoint, Angleton pointed out the industry’s Achilles heel. “Crypto has an element to it that not many get right and that is cybersecurity. 99% of all crypto/bitcoin operators at one time or another are hacked, ransomware malware installed and they take all consumer info, ID, steal their coins, and many do not carry insurance. To this point, we regret to say that this space is so young that it literally learns day by day.”

Indeed, a number of high-profile, multi-million dollar hacks have plagued the cryptocurrency space throughout 2018, although they have slowed in frequency. Additionally, Lilita Infante, an agent at the US’s Drug Enforcement Administration, said that the amount of illegal activity involving Bitcoin transactions had greatly decreased as of August 2018.

Still, “until the nefarious operators are weeded out, Blockchain vulnerabilities are completely addressed and metrics to aid in value pricing for a bitcoin is fully understood, these stealthy ‘assets’ (we use the word assets as IRS calls bitcoin an asset) will be monitored by law enforcement for a long time,” Angleton explained.

“If you have a complaint registered by a Consumer to a certain [law enforcement] agency you can expect auditors and examiners unannounced to enter your offices and they do NOT make appointments. They walk in and demand to see ‘xyz’ data,” he said. “If you do not cooperate you can expect a very difficult time.”