2019 was an important year for Singapore’s “Smart Nation” initiative: the country’s national bid to become “a leading economy powered by digital innovation” by growing and supporting the implementation of technological innovations across a number of different sectors.

Specifically, Singapore’s fintech sector attracted quite a bit of international attention, and quite a bit of capital from investors at home and abroad. According to market research firm Accenture, the amount of money “the total value of fintech deals in the nine months [that ended by] Sept. 30 jumped 69% from the prior-year period, to US$735 million from US$435 million.”

Indeed, by the end of September, fundraising in fintech had exceeded the “US$642 million raised in all of 2018.”

Over the same nine-month time frame, the number of fintech deals fell by almost one-third--to 94, from 133 in the same period in 2018--signaling consolidation and maturation in the industry: “investors made larger bets into fewer deals as startups grew their business,” Accenture’s report explained.

The country’s fintech sector is slated to continue to grow this year, in part because of the implementation of Singapore’s Payment Services Act (PSA), which brought a renewed bout of attention to the nation as an international hub for the cryptocurrency and fintech industries.

Sukhi Jutla, chief operating officer of Blockchain -based gold jewelry platform MarketOrders, said that the passage of the PSA is part of Singapore’s bid to “position itself as the go-to place for the Fintech community.”

Sukhi Jutla, co-founder and chief operating officer of blockchain-based gold jewelry platform MarketOrders.

“Singapore has long been a leader in terms of business on the world stage making it the most competitive Asian country and the world's easiest place to do business,” Jutla explained. “Singapore benefits from its strategic location by being a leading port for those looking to enter Asian markets and also has a pro-business environment.”

Now, the country seems to be attempting to follow in the footsteps of “countries such as Malta, Switzerland and Gibraltar,” which “have been leading the way by providing clear regulations,” and, in some cases, “driving direct inward foreign investment.”

What exactly does the PSA do? And could this legislation provide a solid ground on which to build Singapore’s cryptocurrency and fintech industry?

An attempt to bring clarity

The PSA, which went into enforcement in January of this year, brought cryptocurrency-related businesses under the jurisdiction of the Monetary Authority of Singapore (MAS): it mandated the implementation of a licensing program that applies to Singapore’s private financial sector, including “digital payment token services”--in other words, all platforms that deal with cryptocurrencies, including exchanges and payment providers.

The legislation was reportedly designed in consultation with digital asset service providers, and as such, the MAS is planning on offering these providers legal advice to support compliance.

Loo Siew Yee, assistant managing director for policy, Payments and financial crime at MAS, described the PSA as forward-looking and flexible” and said that the “activity-based and risk-focused regulatory structure allows rules to be applied proportionately and to be robust to changing business models.”

Perhaps most important, however, is the Act’s basic function: to bring clarity to cryptocurrency industry regulation. To varying degrees, nations the world over have struggled to create regulations that are flexible enough for an industry that is changing and developing at such a rapid rate.

Clearer regulations help the crypto and fintech industries to grow

In some areas of the world, this has seriously held the development of the industry back--for example, Asish Singhal, chief executive and co-founder of

CRUXPay and CoinSwitch.co, pointed to the EU, which has taken a more monolithic approach toward crypto and finance with one of its latest piece of legislation: “the [PSA] is in contrast with the Fifth Anti Money Laundering Directive (AMLD5), the European Union act which [has caused] the closure of some crypto companies and forced others to relocate,” Singhal explained.

Asish Singhal, chief executive and co-founder of

CRUXPay and CoinSwitch.co.

The PSA, by contrast, “doesn't follow a ‘one size fits all’ model,” explained Mr. Singhal. Instead, the Act “allows companies to choose any one of the three license types, based on the applying entity's activity.”

As such, Singapore--like other countries and regions that have managed to provide the regulatory grounds for the crypto industry to flourish--has a sort of “first-mover advantage” in terms of attracting crypto businesses to come and sprout in their soil.

Before the PSA, there were the Money-changing and Remittance Businesses Act and the Payment Systems (Oversight) Act; the passage of the PSA may stand to elevate the country’s international status as a crypto and fintech hub.

Indeed, Ashish ‘Singhal commented that “the MAS has done a commendable job and has ensured that Singapore becomes an attractive country for crypto companies to start their businesses.”

The passage of the PSA may cause Singapore to be more attractive to new companies on an international level

The PSA has already caused at least one crypto-related company to expand into Singapore. Adrian Przelozny, CEO and founder of Sydney-based cryptocurrency exchange Independent Reserve, said that as the exchange decided to expand its trading services to users in Singapore that “the response we’ve received so far from the Singapore market has been overwhelmingly positive.”

Similarly, Malta-based cryptocurrency exchange Binance--which had already established an entity in Singapore--eagerly applied to register for the license associated with the PSA. “We submitted the application pretty fast,” said Changpeng Zhao, the exchange’s chief executive, to Bloomberg.

“Binance’s Singapore entity has been in close touch with the local regulators, and they have always been open-minded,” Zhao commented.

Sukhi Jutla noted that because “Binance is very influential in the crypto scene and is seen as a company trying to do the right things by abiding by relevant legislation,” its quick and public compliance with the PSA “is a vote of confidence from Binance in the Singaporean Fintech landscape as a welcoming place to do business.”

This, in turn, could bring more crypto companies to Singapore: Sarah Amundsson, Senior Business Developer at Sweden-based identity verification service provider Shufti Pro, explained to Finance Magnates that “since Binance is one of the largest crypto platforms, this action will boost confidence and encourage other fintech platforms to operate in Singapore.”

Sarah Amundsson, Senior Business Developer at Shufti Pro.

The PSA has lent legitimacy to the crypto industry in Singapore--but does this mean that locals are using crypto-related products and services?

The establishment of the PSA also requires companies who wish to comply with it to invest more resources into their presence in Singapore, a factor--which, if the news cycle around Binance’s compliance tells us anything--will bring, at the very least, more attention to the country as a crypto and fintech hotspot.

And of course, the Act also lends more legitimacy to crypto companies who comply with it. Ashish Singhal said that the Act “is actively trying to help legitimize businesses...the PSA will help to legitimize the cryptocurrency industry in the country and weed out fraudulent companies leading to better user fund protection.”

Singhal also pointed out that the passage of the PSA “also shows that the regulators in Singapore are very confident about cryptocurrencies in general,” a factor that could also encourage Singaporeans to avail themselves of the cryptocurrency-related products and services that are becoming increasingly available in the country.

Indeed, Suhki Jutla told Finance Magnates that “ann increasing number of locals are using crypto,” and that in general, the “Asia-Pacific area was already ahead of the curve in terms of crypto [usage]; South Korea, Hong Kong, and China were early adopters of crypto and blockchain technology.”

“So, there’s little surprise that Singapore is quickly emerging as another leader in this space,” Jutla said.

However, Ella Qiang, the Southeast Asia Manager for the Bitcoin Association, had something different to say on the matter: “cryptocurrencies are not being used by average Singaporean consumers today,” she commented to Finance Magnates. This is because “they are still being considered as speculative assets for the most part.”

Ella Qiang, the Southeast Asia Manager for the Bitcoin Association.

“With that said,” however, “interest and adoption of the blockchain technology has been widely explored across industries [in Singapore], particularly in the financial services sector.”

Fintech and crypto companies may have big opportunities in Singapore

And the financial services in Singapore have been rife with financial services-related innovation even beyond crypto. Indeed, Ashish Singhal so that he believes that Singapore “has become the epicenter of fintech development.”

And even if crypto isn’t yet being used by locals in Singapore, this ‘everyone is a bank’ narrative very much fits the Asian market as well,” Singhal explained, referring to the phenomena in which companies across all different industries are beginning to offer financial services to their customers.

This is for several reasons: “Singapore fintech startups are tapping into the tech-literate but financially under-served populations of China, Indonesia, and India,” Singhal explained.

Singhal cited a report by global accounting and consulting firm EY that states that “69% and 52% of adult users with internet access in China and India respectively are early adopters of Fintech technology.”

“The region is rife with the active digital consumers of services such as payments, [as well as] transfers and borrowing money,” he said. “In fact, most users in Asian countries prefer financial services provided by Fintech companies over banks due to the processing speeds, competitive rates, and favorable terms.”

Singhal also said that while “payment services form the larger chunk of the fintech market” in Singapore, “investment and insurance offerings by Fintech companies are on the rise.”

Additionally, fintech in Singapore is also fueled by the remittance industry, which Singhal is a huge part of the economies of a number of Asian countries. “For many migrants, remittance is the primary source of income for their families in their home country,” he said.

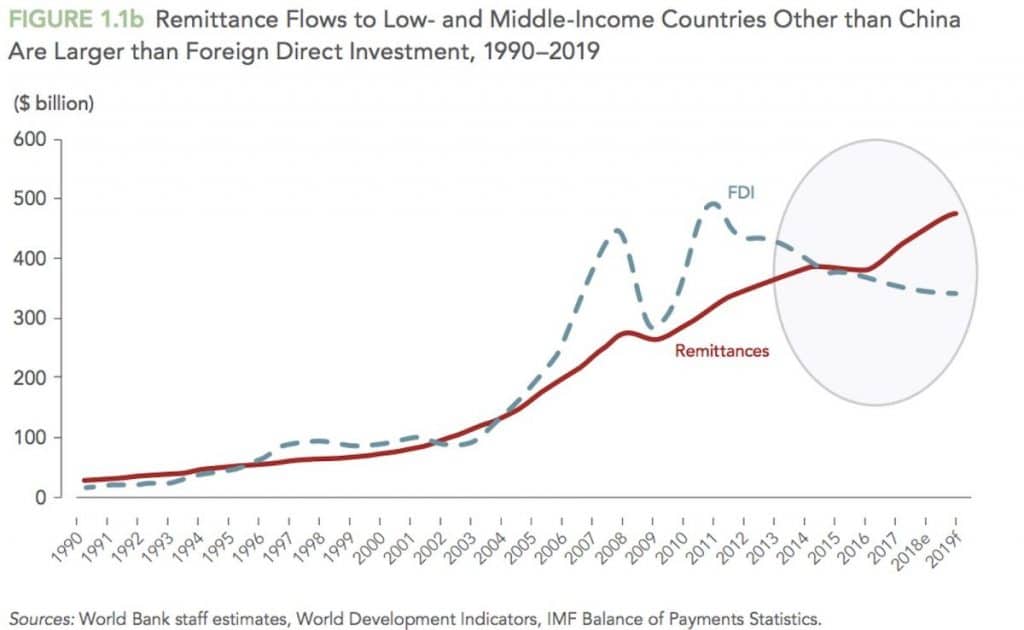

Indeed, data from the World Bank last year showed that worldwide, remittance flows add up to be greater than foreign direct investment to middle and low-income countries (excluding China).

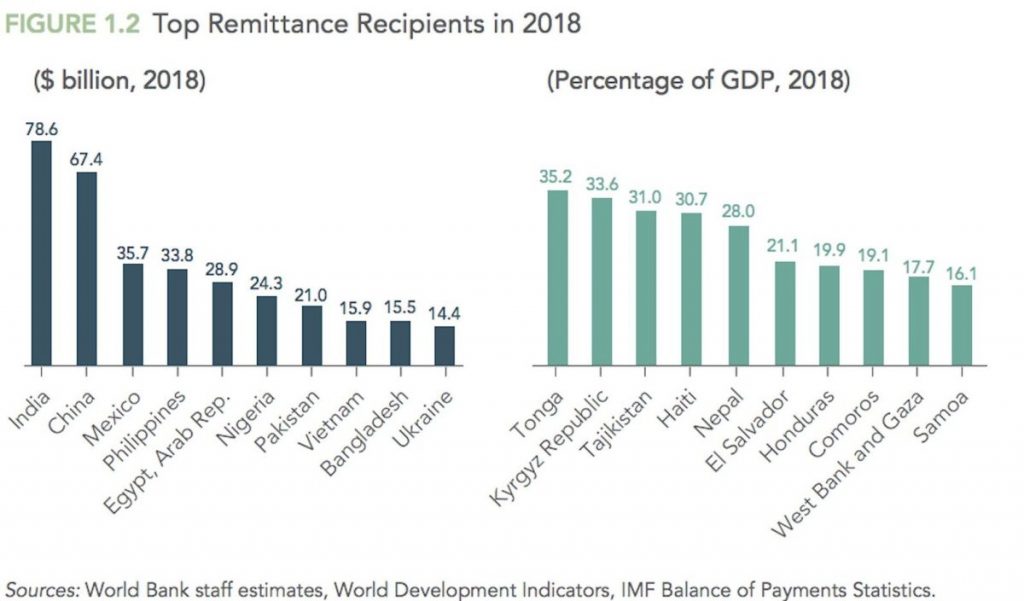

Additionally, in 2018, remittances comprised roughly 5.4% of Bangladesh’s GDP, 6.6% of Vietnam’s, and 6.8% of Pakistan’s; that figure rose as high as 28% in Nepal, and passed 30% in Kyrgyzstan, Tajikistan, and Tonga.

This presents crypto and fintech companies with an opportunity: “however, most of the remittance happens through traditional banking channels, which is inefficient and on an average cost up to 11%.”

“These drawbacks attract a lot of Fintech companies, especially blockchain-based Fintech companies who are playing a pivotal role in the remittance industry in Singapore and beyond by offering an efficient and cheap alternative to the banking channels."

Signs for the greater community

Sukhi Jutla also pointed out that "Singapore defining clearer legislation for the crypto scene is an indication that even successful and wealthy countries such as [itself] are anticipating that Fintech and crypto will become an increasingly larger part of consumers lives.

Therefore, "it only makes sense to embrace new technologies whilst they are still young."

What do you think Singapore's apparent embrace of crypto and fintech signals to the rest of the world? Leave your thoughts in the comments below.