With the recent boom in the demand for Cryptocurrencies , a certain set of firms have enjoyed massive profits – the cryptocurrency exchanges. However, the rapidly rising number of tokens on the market, including many fake ones, has made it very tough for exchanges to choose the right coin to list for trading.

According to a recent analysis conducted by Dier regarding the performance of cryptocurrency exchanges, Binance and Bittrex list better performing coins when directly compared to HitBTC, Huobi, and OKEx.

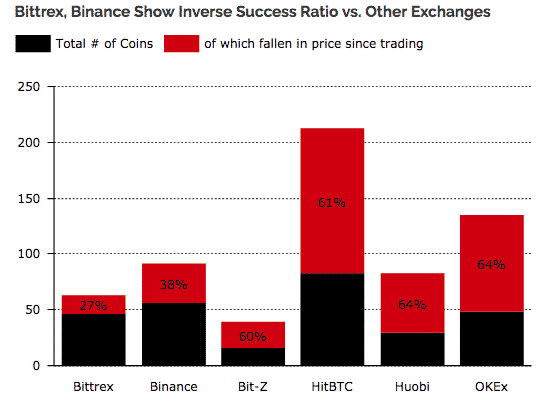

According to the study’s findings, the inverse success ratio of new tokens generated via an ICO is 27 percent for Bittrex and 38 percent for Binance, while for both Huobi and OKEx, the ratio is 64 percent. HitBTC, which lists the maximum number of new tokens, meanwhile has an inverse success ratio of 61 percent.

Inverse Success Ratio of Exchanges, Dier

Given the large amount of coins on the market, choosing the right one to list can be like finding a needle in a haystack. This caused Binance to build a dedicated team to review the coins that apply to be listed, the company’s CEO Changpeng Zhao is quoted as having said in the study.

“Binance has a team that is dedicated exclusively to reviewing applications for new tokens,” the text reads. “Mr. Zhao stressed that the sustainability of the project is very important to Binance as they review the teams behind the project and their working history.”

Moreover, rising regulatory woes in countries like the USA has made it even tougher to scrutinize the coins, as local regulations forbid exchanges from listing any ICO tokens that can be considered as securities.

Earlier this month, the Securities and Exchange Commission (SEC) even issued a warning to exchanges allowing the trading of such tokens, stressing that it sees this practice as the unregistered offer and sale of securities.

Binance as well as Bittrex, which is currently the only exchange offering ICO tokens in the US, consult with lawyers prior to listing any token to determine whether the digital asset is a security or not. The tokens also need to pass their due diligence test which checks whether the project has an innovative use case.

“Bittrex uses a robust digital token review process to ensure the tokens listed on the exchange are compliant with U.S. law and are not considered securities,” the Dier report quoted a Bittrex representative as saying.