The world economy has seen its share of booms and busts, sure. However, ricocheting asset valuations, market dives, and overnight fortunes have never been so commonplace as they are in the world of cryptocurrency.

In fact, the greased-lightning pace at which cryptocurrency markets operate has caused a recent report by Morgan Stanley to compare the recent moves of the Bitcoin network to the ca. 2000 boom and bust of the Nasdaq, only at 15 times the speed.

The report specifically recalls the Nasdaq's 278-percent climb that took place over 519 days, ending in March of 2000; Bitcoin rose 248-percent in 35 days, peaking at roughly $19,500 before beginning a long journey down the mountain.

There are a few different theories as to what is causing the decline.

Similarities in Bear Market Drops and Rallies

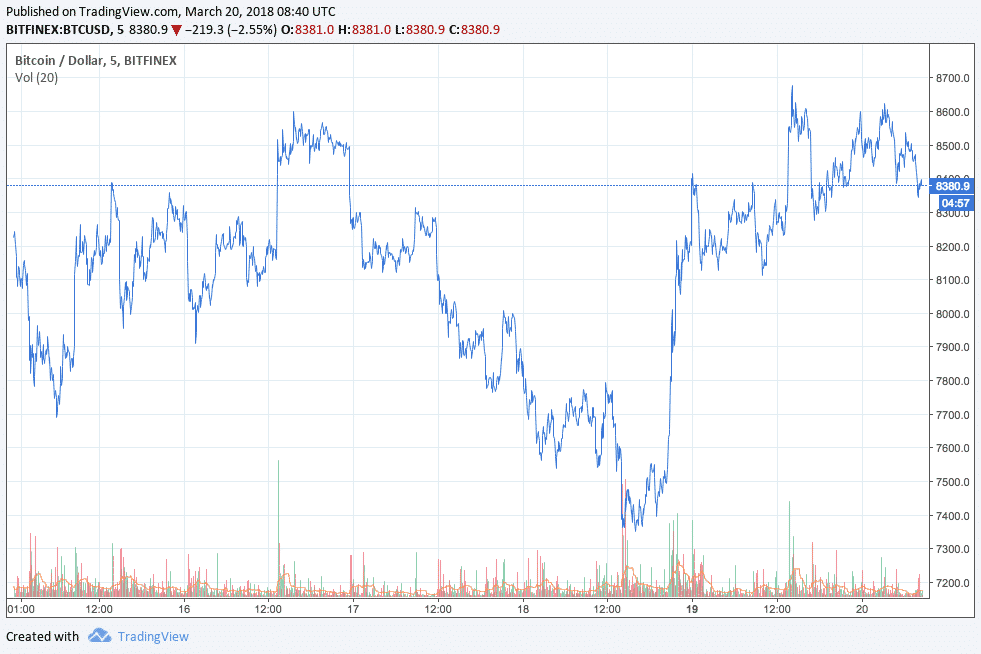

Bloomberg reports that the decline of Bitcoin has not been exactly linear, similar to the fall of the Nasdaq. Since December, the price of Bitcoin has taken three sharp falls to the tune of around 50-percent before recovering. The Nasdaq also fell roughly 44-percent five times in its bear market.

There are also similarities in bear market rallies--the Bitcoin bear market has twice spiked up around 43-percent; the Nasdaq’s bear market rallies averaged out around 40 percent.

The report added that Bitcoin’s decline in value has been accompanied by a jump in trading volume. However, Morgan Stanley analyst Sheena Shah wrote that “rising trade volumes are thus not an indication of more investor activity but instead a rush to get out.”

What’s Next for Bitcoin?

The crypto markets may be on the pathway to recovery after shedding billions of dollars over the past several days. After bottoming out at around $275 billion on Sunday, March 18, the total market capitalization has climbed up to roughly $330 billion, but still has a ways to go until $380 billion, where it was a week prior.

In the past, Bitcoin’s bear markets (which have been plentiful) have lasted roughly five months. According to a Bloomberg report, valuations during these periods have dropped anywhere from 28 to 92 percent. According to Morgan Stanley, the most recent decline of 70 percent is “nothing out of the ordinary.”

However, Sheena Shah added that “the small number of historical examples and variability of each of the bear markets make it difficult to assume that the current bear market may take the same time period.”

At the time of writing, a single Bitcoin was worth roughly $8,750, recovering from a weekly low of around $7,400.