With Bitcoin going up at astounding rates many crypto CFD clients are simply entering long positions and sitting on them. CFD and FX brokers don’t like this type of trading. They only earn a small amount of commission/mark-up on the entry.

These brokers are forced to carry an open losing position on their balance sheet. This is not as lucrative as the typical two-way shorter-term flow that they are accustomed to with FX and CFD’s.

Is liquidity for cryprocurrency relevant for your business?

Because of this situation, certain brokers are either suspending crypto CFD’s all together or implementing heavy restriction and/or unfavourable trading conditions to deter their clients from trading cryptos.

Their mistake is simply looking at cryptos as just another CFD product instead of a disruptive technology that will change the world. Some brokers that are willing to withstand the current high volatility and upward bias of Bitcoin and continue to have an attractive crypto offering. In our opinion these brokers will reap massive rewards compared by taking advantage of this explosive market

In this article we will address the advantages of staying in the game and some ways for brokers to mitigate the risk of the one sided crypto flow.

Why take advantage of the crypto-craze

Marketing

The first and probably the biggest reason for brokers to take advantage of the crypto crazy is marketing. Simply put, by offering cryptos you can accumulate a ton of new clients really fast and cheap. One of the huge benefits of Bitcoin skyrocketing up is that everyone wants to get it.

Once you get leads in the door you can nurture them to trade many instruments, not just buy Bitcoin if you properly set up your conversion funnel. At Nekstream, we can help you with crypto lead accumulation and conversion methods simply contact us at info@nekstream.com.

Long-term play

Is it a fair bet to make that 20 percent of the world will be using some kind of cryptocurrency within the next twenty years –that is approximately 1.4 billion people. If you agree with this idea then why not take advantage of it if you already have the infrastructure?

Some of the smart brokers are adding physical delivery or physical exchanges to their product suites. Setting up a turnkey physical exchange is very simple and inexpensive and there are companies and Physical LP’s that do all the heavy lifting while you earn revenue.

If there are tons of clients knocking at your door that want to buy cryptos and you already have the infrastructure in place why not let them and earn commission on it?

If physicals are not for you, at least realize that just dropping cryptos is just not the way to go. You need to figure out how to deal with the current situation so that you can reap the rewards later.

How brokers are dealing with the current situation

When cryptos first became popular many of the brokers started looking at them as just another CFD. They started to instantly worry about offering tight spreads and very high leverage thinking that this would give them a competitive advantage over the competition.

This is the wrong way to approach the situation. High leverage let’s clients take huge long positions on Bitcoin with very little up front margin. Brokers now carry this open loss on their balance sheets and have to hedge it off. Which can be hard to do because of the long bias.

Because brokers wanted to offer very tight spreads they limited the revenue captured on the trades. This makes the whole situation not attractive or exciting.

In order to deal with the situation brokers made super unattractive SWAP requirements, which truly deter people from trading because now there is a heavy cost of carrying a position. With these crazy swaps clients are more likely to go to exchanges and the brokers will lose the business.

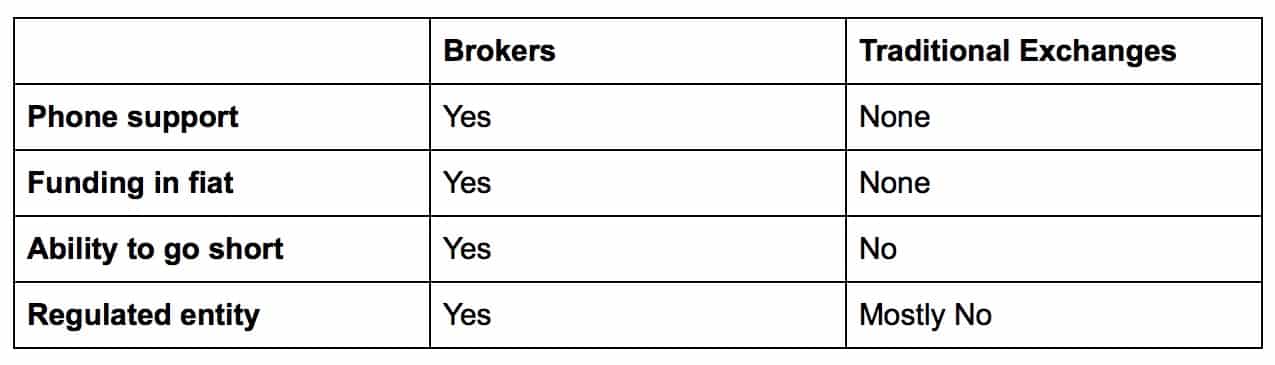

What the brokers are failing to realize is that cryptos are so popular right now and that trading via a broker is so much better than trading through a crypto exchange that clients are going to come in anyways regardless of leverage of transaction costs. Let’s look at a comparison:

With all of these advantages and the simplicity of working with a broker clients will have no problem paying a premium. The following are ways to mitigate one-sided flow and increase revenue on crypto traders:

Commission

Why not add a commission? Most exchanges charge their clients a commission of around 20 basis points. That is $2000 per million. However, brokers are offering the product commission free.

While still having tighter spreads and higher market depth than the exchanges. What is the point of that? It’s just leaving money on the table without any good reason behind it. People are just looking to get in on the crypto crazy. They are not comparing dollars per million, execution quality or any of the other matrixes that FX traders compare. You will get plenty of business if you charge a commission and increase your revenue at the same time.

Offer Altcoins

Many brokers are “starting out” by offering their clients only Bitcoin. What this does is concentrates the flow into one instrument. And essentially increases risk. If you offer other, in demand, cryptos like Ethereum, Dash, Ripple, and Litecoin you can spread your risk. Nekstream works with LP’s that provide alt coin Liquidity and can help you get this set up.

Educate your clients on Crypto Trading

Most brokers have great FX education sections on their sites. Sometimes they even have market commentary services like Daily FX and BK Forex. Why not add something like that for Cryptos. By doing this and providing clients with day and swing trading strategies brokers can encourage shorter term trading and eliminate the upward bias risk.

There are plenty of info product publishers that are offering crypto education and newsletters and they would be happy to JV with brokers on these projects and even send their own leads to the broker. At Nekstream we work with a lot of the info product publishers and can help you facilitate an educational/newsletter product - feel free to contact us here.

Proper Risk Management

This section can be a whole other separate article. But here are some things you can do to mitigate risk from one-sided exposure. Have multiple LP’s – there are no perfect LP’s right now as crypto CFD’s are new.

Some LP’s are even changing trading conditions on their clients. Don’t put your eggs in one basket and spread your flow out. This way you mitigate counterparty risk and trade risk.

Consider hedging with Futures - CME and CBOE just rolled out a Bitcoin futures product. At Nekstream we will work to make these products available to clients as a hedging instrument. At this point with no minis in place the futures hedge is especially interesting to brokers that are making markets on cryptos themselves.

Offer lower leverage - 1:3 or 1:5 max is plenty. There is no need to go higher clients will still want to trade with you at those levels Consider hedging with physicals - if most of your clients are going long can it be a play to actually buy Bitcoin? or hedge with physical crypto liquidity providers?

Conclusion

In our opinion not offering cryptos with the current demand is simply a bad business decision. In order to deal with the current upward bias brokers need to stop looking at cryptos as just another CFD and see them for what they really are.

They need to make some adjustments to their offering try to withstand the current volatility and upward bias and use the current situation and this exciting new product to grow their business.

Alex Nekritin is the Managing Director of Nekstream Global, a liquidity and technology consulting company helping brokers, HFT traders and money managers to find proper liquidity and tools for their ventures. Alex has over 10 years of experience in the financial space. For any inquiries or questions, email us at info@nekstream.com