Confusion erupted last year when crypto holders who had made massive gains on their cryptocurrency holdings were suddenly faced with tax season.

With the lack of clear regulations and assistance for paying taxes, most of these taxes remain unpaid. A year later, has anything changed?

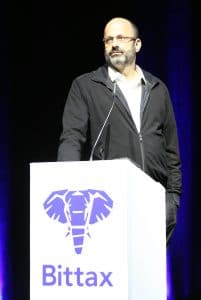

Recently, Finance Magnates spoke with Gidi Bar Zakay, CEO of Bittax, about his company, and how tax practices in the cryptocurrency industry have evolved over the past year, and how they will continue to evolve in the future.

”We identified the need for users in the crypto world to pay taxes in accordance with the authorities' position”

Before Bar Zakay got involved with the cryptocurrency industry, he spent years as a tax accountant. “In my profession, I am an accountant and jurist and I grew up in the Israel Tax Authority (ITA) until my last position as deputy director general of the Israel Tax Authority, where I was responsible, inter alia, for international taxation, exchange of information between countries and tax legislation,” he explained. He retired from the ITA in 2009.

Bar Zakay first discovered Bitcoin in 2016. “At a relatively early stage, we identified the need for users in the crypto world to pay taxes in accordance with the authorities' position, which began to move forward.”

“We have identified the current difficulties in data collection, processing and accurate reporting for the authorities, and to this end we have established Bittax, which is an innovative Platform built with a deep understanding of both Blockchain technology and tax laws in order to bridge the gap between these worlds.”

Turns out Israel's a thing in crypto. Who knew? Congrats @BancorNetwork @BlockchainIL @zen_protocol @COTInetwork @stx_coin can't wait to land in Tel Aviv on Dec. 6 https://t.co/4E9fG7YqOt

— Lou Kerner (@loukerner) November 24, 2017

The company is based in Israel, which Bar Zakay believes is an important hub for the global cryptocurrency industry. “Israel is a significant crypto power that exports many projects,” he said.

“The crypto industry in Israel is very active and full of life, and it grows rapidly and spreads its ripples around the world. I expect that this trend will continue and that we will hear about many Israeli projects that will contribute to the ecosystem, and I say it with great confidence.”

The company recently held a Bitcoin Summit in Tel Aviv. “The Bitcoin Summit was initiated by Bittax VP, Or Lokay Cohen, who identified the potential inherent in the crypto space at an early stage of our activity, as well as the potential of the Israeli industry to lead the crypto ecosystem forward,” Bar Zakay explained.

“Therefore, we decided to hold the conference in Tel-Aviv in order to state that despite the bear market, we are still here and the industry is flourishing more than ever.”

Gidi Bar Zakay at Bittax' Bitcoin Summit in Tel Aviv. (Taken by Nir Peretz.)

“This was evidenced by the tremendous response of companies and individuals around the world who came to the conference and filled the hall where you could find the best minds in of the industry, among them big names such as Nick Szabo, David Chaum, Jeff Berwick, Elena Vranova, Yoni Assia and other great speakers.” Zakay said that the company is already planning the next conference.

Will Crypto Holders Pay Their Taxes This Year?

In 2018, a number of reports emerged that cryptocurrency users around the globe who had profited off of the massive cryptocurrency boom in 2017 had no intention of paying taxes on their gains. However, Bar Zakay explained that much of this negligence could be attributed to ignorance.

“Indeed, many investors believed that Cryptocurrencies were not taxable and did not rush to regulate their status vis-à-vis the various tax authorities when they published their position on the new market,” he said.

“With the exception of those users who do not intend to report, most users want to work within the law and indeed approached themselves or with the help of professionals and submitted a report.”

For users who do intend to report their cryptocurrency gains and losses, however, challenges lie ahead. “Since there is still no absolute clarity regarding the various issues that arise in the tax issue, a situation arises where there is a partial and incomplete report that caused distortions on both sides, overtaxing from the one hand and uncertainty or [lack of] trust from the other side.”

Why is Paying Taxes on Crypto So Dang Difficult?

Bar Zakay explained that the reasons that understanding and complying with tax laws surrounding crypto is difficult for several different reasons.

“The main reasons for this lie in three levels,” he explained. “The first is the difficulty of collecting past data, since not all exchanges maintain all data over time.”

Indeed, without government prompting, record-keeping practices can vary significantly from one exchange and one user to the next: “in the absence of regulatory clarity, not all taxpayers kept all the data on their activity,” Bar Zakay said. “Data recovery is a complex task considering the nature of activity in the field, especially in cases where extensive activity has taken place.”

The following are not taxable:

- Buying crypto with fiat (e.g BTC for USD) - HODLing crypto - Transferring coins from one wallet or exchange to another - Gifting crypto (under 15K per person per year) - Donating crypto to a 501(c)(3) nonprofit organization — Crypto Tax Girl (@CryptoTaxGirl) February 8, 2019

The next set of challenges comes from different beliefs about which laws and formulas apply to cryptocurrency gains.

“The manner in which the data is handled and the manner in which the tax is calculated [matters],” Bar Zakay said, “since different calculation methods can lead to different tax results, and sometimes when the reporting entity is not sufficiently familiar with the technology, this can lead to inaccurate tax reporting.”

Individuals and companies are met with a third set of challenges simply based on the fact that the industry is changing so quickly. “[The market] requires close monitoring of the various developments in the field in order to adapt crypto taxation in a way that suits the nature of the different technologies,” Bar Zakay explained.

Things Take Time

But will clarity on tax regulations come anytime soon? Bar Zakay doesn’t think so. “I believe that it will take time for regulators to establish uniform rules to regulate the global cryptocurrency market,” he said, although he does believe that progress on this front is underway. “I believe that in the next few years, regulators will enter into the crypto space and formulate an international framework of rules.”

“The authorities around the world are studying and examining the issue in depth and are not shirking the current challenges, but are trying to develop a full understanding before implementing regulations in order to ensure constructive regulation that will find the potential of the crypto market and not bury it in regulation.”

Although Bitcoin took a 70% drop over the course of 2018, the silver lining is that traders can write-off their losses against capital gains in the stock market. Learn more here: https://t.co/MzdFfQ9tbk #cryptocurrency #cryptocurrencies #cryptonews #cryptotaxes #cryptotax pic.twitter.com/EQdQZiTB1w

— Get Crypto Tax (@Get_Crypto_Tax) February 8, 2019

Bar Zakay added that investors’ willingness to pay taxes on cryptocurrency gains is also something that will come with time--cryptocurrency has a long-running association with tax-free Libertarian philosophies: “I also believe that it will also take time for users to internalize that there is no contradiction between the Bitcoin vision and the payment of taxes and even vice versa.”

Even after clarity has been established and attitudes changed, Bar Zakay thinks that practical application of tax laws will also take time of its own: “I believe that it will take time until the taxation reality will infiltrate into the field and until then we expect phenomena such as non-payment of tax or partial reports.” He added that this practical implementation is why Bittax was created--to provide “a solution to the problem of Bitcoin and other Cryptocurrencies taxation.”

Companies Should See the “Big Picture,” Not Just Seek Tax Benefits “Here and Now”

Before cryptocurrency tax laws are fully established around the globe, however, Bar Zakay recommends that companies who are seeking to establish themselves in supportive regulatory environments should take time to review their choices.

“I would recommend that start-ups to considering their options thoroughly and before opening a company in a crypto friendly country start-ups should examine their ability to comply with international regulation, and not to seek only tax benefits here and now,” he said.

“If you want to set up a start-up in the crypto space, you do not want to work only within the borders of a particular country. Therefore, not only are tax benefits of importance, but also the ability to transfer funds internationally, subject to regulations for money laundering and taxes.”

The Bill has managed to clear its first minor hurdle by obtaining approval from a subcommittee on the House Executive Departments and Administration Committee. @KryptoMoneyhttps://t.co/TOrjV9gbGC#Taxes #Tax #CryptoTax #BitcoinTax #TokenTax #Crypto #Cryptocurrency #cpas #CPA

— BitTaxer (@bittaxer) February 9, 2019

“There may be places that sound like crypto paradise, but at the end of the day no country will want to transfer money to its territory from some countries, and therefore even if it is now easy to conduct it is not sure that this will be the situation in the future. And if one country should be noted for the better, Switzerland can be noted as a friendly country to crypto from regulatory aspects.”