The week began on a high note for the DeFi space, led by ETH, with a number of Cryptocurrencies across the board posting impressive gains. That is, until today. Today, markets are seeing red across the board. Still, a number of analysts believe that the bull run that began around the turn of the year is far from over.

Indeed, yesterday morning, the price of ETH reached a new all-time high of roughly $1,475. Even though the price had cooled to roughly $1320 at press time, the price of ETH is still up nearly 80 percent from $735 where it was on January 1st. By comparison, the price of Bitcoin is up roughly 8% from where it was at the beginning of the year.

However, ETH’s gains, impressive though they may be, pale in comparison to some of the price jumps that other popular altcoins have seen since the beginning of the year.

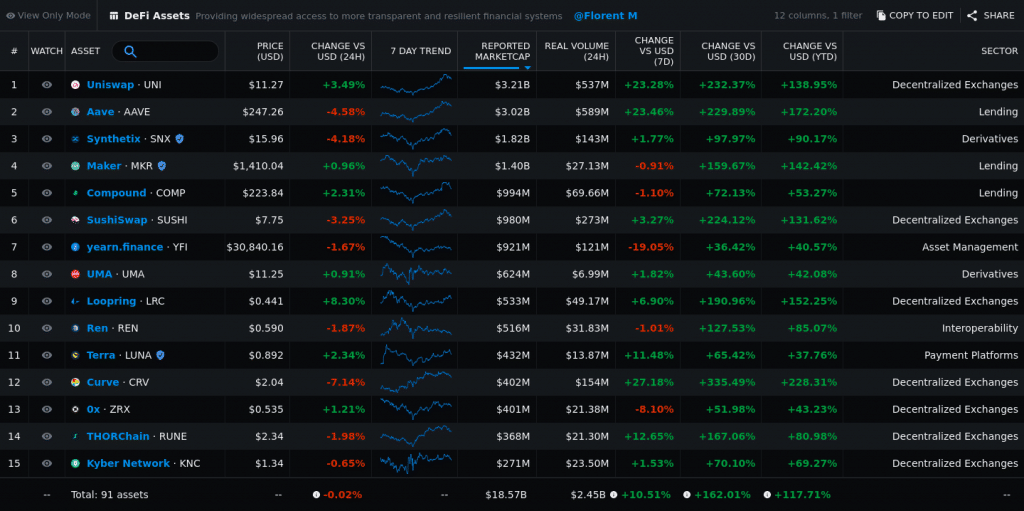

For example, Aave (AAVE) had started the year at $57; at press time, Aave reached $257, which is an increase of 184%. Similarly, Sushiswap (SUSHI) is up 163%; Uniswap (UNI) is up 167%; Maker (MKR) is up 135%; Synthetix (SNX) and Chainlink (LINK) are up roughly 100%.

Certain lesser-known projects have seen even more explosive returns. For example, data from Messari shows that BAO token (BAO) is up 1033% since the beginning for the year. yAxis (YAX), Perpetual Protocol (PERP), Alpha Finance (ALPHA), DODO (DODO), Meta (MTA), Curve (CRV), MCDex (MCB) and ZKS (ZKS) have all shown gains between 200% and 450% since the beginning of the year.

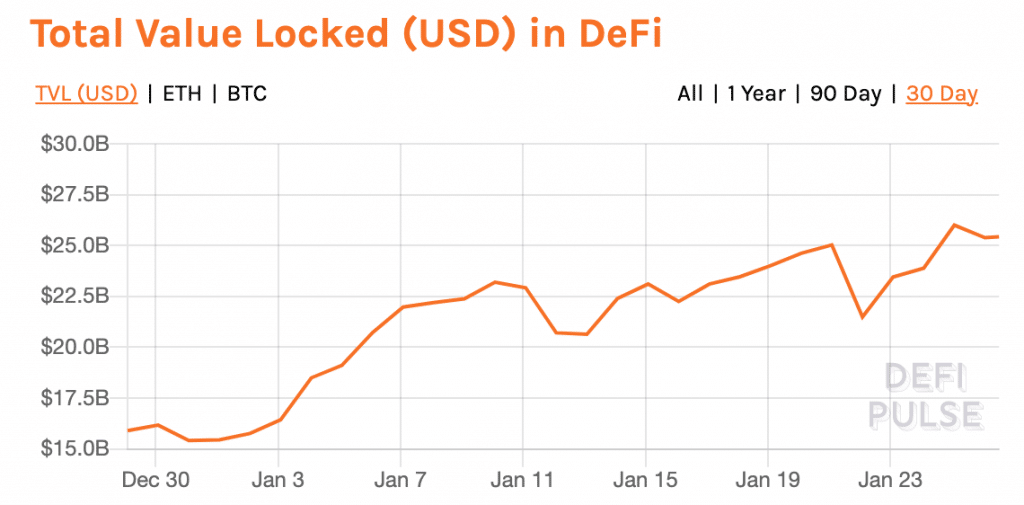

All in all, the total value locked (TVL) in the DeFi ecosystem has veritably exploded since the beginning of the year. On January 1st, DeFi's TVL stood at $15.45 billion; today, that figure has increased to $25.43 billion, an increase of nearly 65%.

Which DeFi Tokens Are Worth Buying?

These figures are almost mouth-wateringly good, which is why investors seem to be continuously drawn to DeFi even as BTC has flatlined over the last few weeks. Additionally, certain parts of the news media seem to have increasingly focused their coverage on the DeFi space. There has been an observable increase in the amount of articles detailing the viability of the 'top 5' DeFi tokens that may be of interest to investors.

For example, Forbes published an article on 5 'Blue Crypt' (a play on the phrase 'Blue Chip') DeFi tokens that one should consider purchasing. These included Chainlink (LINK), Uniswap (UNI), Aave (AAVE), Compound (COMP), and DAI (DAI).

Each of these five, along with other DeFi projects with relatively large market caps, are some of the largest and most well-known projects within the DeFi space. They have been around long enough to have earned fairly positive reputations within the cryptocurrency space.

Moreover, each of them has received much coverage and attention, and as a result, each of them has seen massive returns since their inception: for example, data from CoinMarketCap shows that Aave’s total ROI 48926.43%; Chainlink’s is 14603.66%. By comparison, Ether’s ROI is 46870.17%, and Bitcoin’s is 23697.46%.

Choosing DeFi Assets to Invest In

Therefore, while DeFi as a whole is still considered to be in its earliest stages (and is arguably, therefore, an even riskier investment than Bitcoin, Ether, and other large cryptocurrencies), these projects may be slightly less risky than some of the brand-new DeFi projects that have the lowest token prices currently available.

As such, investors who are interested in purchasing DeFi tokens must consider the amount of risk that they are willing to expose themselves to before making any purchasing decisions, this is an important guiding principle when it comes to any kind of investment.

Beyond knowing your own appetite for risk, it is also important to make sure that you know a few things about any asset before investing in it, including (but not limited to):

- What the asset is used for;

- Whether the asset is compliant with relevant regulations;

- Who created the asset, and who is guiding the asset’s development;

- Whether or not reputable investors and VCs have endorsed the investment;

- Which exchanges the asset has been listed on, and whether or not it had to undergo a vetting process to be listed on that exchange;

- What the asset’s long-term usage trajectory is;

- And, whether or not the asset’s native technology can withstand the force of massive usage and attempting hacks.

This final point may be particularly challenging because of a chronic lack of auditing in the DeFi space. Robert Leshner, Chief Executive of Compound, told CoinTelegraph that “the biggest challenge facing new DeFi projects is code security & auditing.”

“Auditors are stretched thin, and most developers are writing Solidity for the first time,” he said. And indeed, there have been a number of examples of incidents where DeFi protocols lost funds because of technical weaknesses that were exploited by malicious actors.

Is Bitcoin's 'Run-off' Effect Boosting DeFi Token Prices?

Part of the risky nature of the DeFi space is the fact that the DeFi market is so volatile. While there are some important differences, a number of analysts have drawn parallels between DeFi and the ICO market of late 2017. The DeFi space has already seen at least one major 'pump' cycle, and it seems that we may be in the midst of another.

But, are the price levels that DeFi tokens are currently reaching toward sustainable? And, what is causing this massive pump across DeFi markets in the first place?

A number of analysts agree that the rise in DeFi token prices has something to do with the rise in the price of Bitcoin. However, the terms of the relationship between Bitcoin and the DeFi space are not entirely clear.

For example, some analysts believe that Bitcoin generally has a sort of 'run-off' effect into altcoin markets. In other words, Bitcoin tends to grab a lot of headlines and institutional investors, and as such, brings in large amounts of new capital. However, after the hype around Bitcoin dies down, investors start to roll some of their BTC gains into altcoins, hoping to increase their chances of further gains.

Jeremy Musighi, Head of growth at Balancer Labs, explained the phenomenon to CoinTelegraph this way: “I think there’s a natural progression for newcomers gravitating to crypto: first they learn about Bitcoin, then they find their way to Ethereum, then they find their way to DeFi,” he said.

“From a market mechanics standpoint, during crypto bull runs we often see profits taken from Bitcoin appreciation cycled into other crypto assets. During this run, we are seeing this rotation from Bitcoin into Ethereum and DeFi tokens.”

Bitcoin Is Becoming an Increasingly Important Part of the DeFi Landscape

And indeed, this phenomenon seems to have contributed to recent rises in ETH and other altcoin projects. After all, Bitcoin hit a new all-time high on Friday, January 8th; since then, BTC has seen a fairly rocky but persistent decline.

And, as BTC has continued to fall, the token prices in DeFi markets have continued to increase fairly steadily.

However, declines in the price of Bitcoin do not necessarily equate to rising prices in DeFi tokens. And indeed, certain DeFi protocols benefit from a higher Bitcoin price and market cap because of the ways that Bitcoin is used on their platforms.

For example, Scott Stuart, Co-founder and Chief Product Officer of Blockchain developer, Kava Labs, told CoinTelegraph that a healthy Bitcoin price is a good sign for the DeFi space. “DeFi requires a healthy amount of collateral to be used in products,” he said.

Therefore, “the more valuable BTC is, the more collateral, and thereby the greater the usage in DeFi.” In other words, it is a win-win situation; BTC gets boosted by its usage in DeFi protocols, and increased usage of DeFi protocols boosts the tokens that are associated with them.

However, the amount of Bitcoin that is currently being used in the DeFi ecosystem may not be enough to have a significant effect on the price of Bitcoin. Currently, the amount of Bitcoin used in the DeFi ecosystem (159,710 BTC) is just under 1% of Bitcoin’s circulating supply (18,610,887 BTC). At press time, this equated to roughly $5.1 billion. DeFi’s total value lock (TVL) was $25.09 billion.

As DeFi Grows, Ether Is Increasingly Seen as a Store-of-Value

While the relationship between DeFi-based altcoins and Bitcoin may not be entirely clear, the relationship between DeFi platform tokens and the price of Ether (ETH) seems to be much more clear-cut.

Indeed, this relationship is partially demonstrated by something rather problematic. As the DeFi ecosystem has continued to grow, the Ethereum network itself has struggled under its weight. This is because Ethereum is the primary blockchain on which many DeFi protocols operate and is likely to maintain that position for some time to come.

This is evidenced in part by the fact that Ethereum’s struggles, which include high transaction fees and slow transaction speeds, are currently being addressed with the network’s upgrade to Eth2.0. This has been designed to support a higher number of transactions and offer lower fees. However, while the Eth2.0 'Beacon Chain' went live in December of 2020, the network will not be fully launched for several years.

Still, because of the growth of the DeFi ecosystem on the Ethereum network, it seems that investors are increasingly viewing ETH as a store-of-value instrument, similar to Bitcoin. However, unlike Bitcoin’s value as a 'digital gold' and 'hedge against inflation', Ether’s value is derived from the financial services ecosystem that is being developed on top of it.

Indeed, Coinbase’s annual review of 2020 found that more institutional investors are seeing Ether as a store of value. Specifically, Coinbase reported that “a growing number” of its institutional clients have taken positions in ether, the same clients that predominantly purchased Bitcoin in 2020.

None of the content in this article constitutes investment advice.