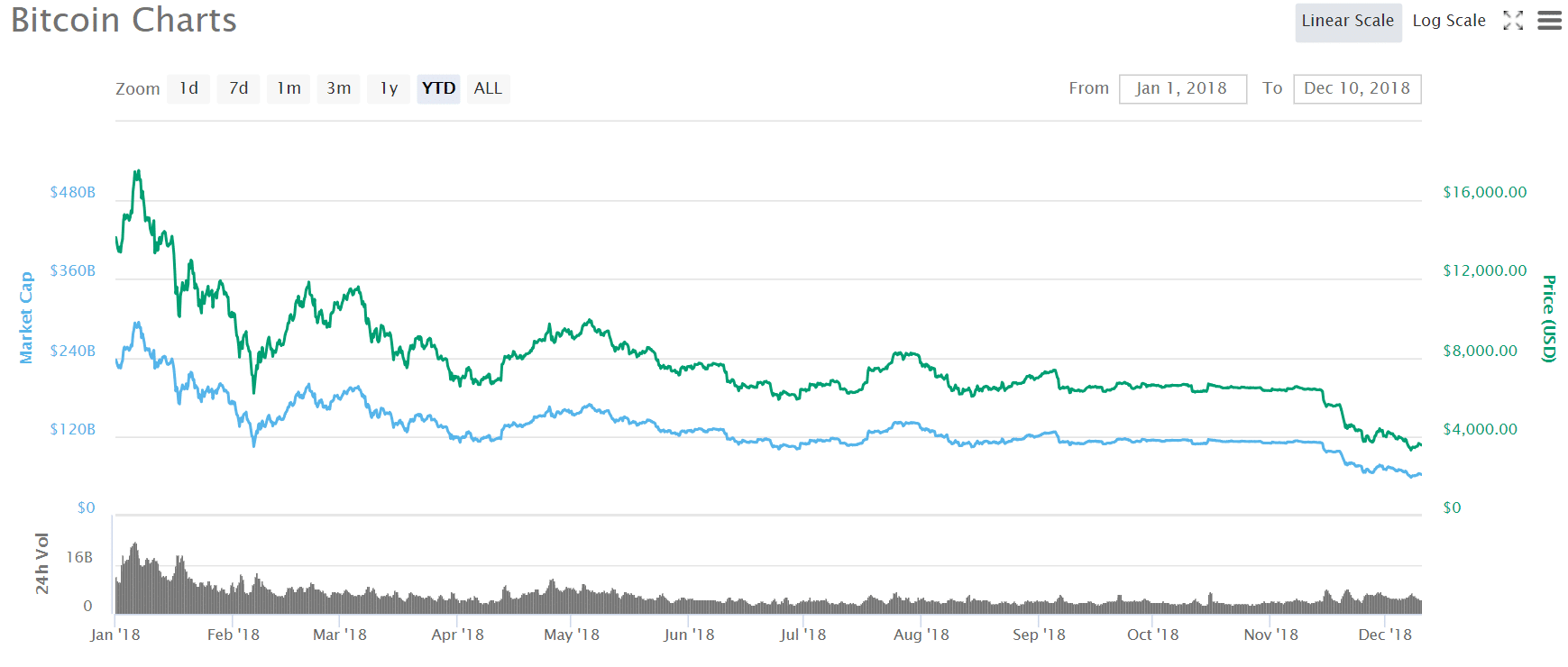

There are plenty of people who argue that the bear market that has plagued Bitcoin throughout this year is nothing more than a temporary problem--John McAfee blamed Bitcoin’s downfall on “artificial” pressures; others claim that this decline is nothing more than a maturation, a normal part of the lifecycle of any asset.

However, perhaps it’s not a coincidence that most of the people who see the light at the end of Bitcoin’s tunnel are widely known to be hodlers themselves--and of course, it’s foolish to buy medicine from a sick man.

For as many analysts and other figures in the financial community that claim that Bitcoin is going back up, there are just as many who see Bitcoin heading down with no sign of substantial recovery. Could there be any validity to what these Bitcoin bears are claiming?

The Mining Calamity

Perhaps one of the biggest threats to Bitcoin is the failure of the industry that runs the network. New Bitcoins are created through a process called “mining”, wherein expensive computers solve incredibly complex mathematical equations in order to confirm transactions and add them to the Blockchain (a public ledger.) In exchange for their work as miners, these computers (and their owners) get rewarded with Bitcoins.

If Bitcoin goes to zero, does that mean shorters get infinite BTC? ? https://t.co/gVdn0VTl6z

— Rhett Creighton (@HeyRhett) November 25, 2018

By design, the process of mining Bitcoins becomes more difficult as more Bitcoins are mined. Therefore, the amount of electricity and quality of the equipment necessary to mine Bitcoins also increases. In other words, Bitcoin becomes more and more expensive to mine.

This is all well and good as long as the price of Bitcoin increases in tandem with the mining difficulty. However, this is currently not the case. When the Bitcoin Cash hard fork sent the price of Bitcoin into a free fall several weeks ago, reports emerged from China saying that some mining operations were selling their equipment by the kilo.

If mining Bitcoin continues to become less profitable, we can expect that there will be fewer and fewer miners. As miners continue to leave the game, the network will be less and less capable of processing transactions. The fewer transactions the network can process, the fewer people will use the network. The less that the network is used, the less that Bitcoin will be worth.

And so on.

It’s true that higher hash rates (rates of computer power used to power the Bitcoin network) have been indicative of imminent price increases in the past. However, as hash rates have continued to rise throughout this year, valuation has continued to fall. The situation could improve if the cost of mining is decreased; however, some theorists argue that Bitcoin has already entered into a “death spiral” based on the elimination of mining profitability.

Bitcoin’s First-Mover Advantage Could Be At Risk If It Doesn’t Clean Up Its Act

In an article for MarketWatch, professor of finance at Santa Clara University Atulya Sarin said that one of the reasons that Bitcoin has been so successful in dominating the market is because of its formidable first-mover advantage. In other words, one of the reasons that Bitcoin may be so successful is simply because it was the first of its kind.

However, Sarin argues that a “me-too” piece of technology could eventually dominate Bitcoin, saying that this is a common phenomenon in emerging markets. The first-mover enjoys short-lived success, and is then overtaken by a better piece of technology that has improved upon its faults. Case in point: ever heard of AltaVista? Perhaps not. It was the first major internet search engine. But I’ll bet that you’ve heard of Google.

You don’t have “money” in #bitcoin

Your money went to an early adopter smart enough to sell You don’t have an investment in $BTC bc it’s not a company or an asset. It is electrons on a screen For BTC to be worth more than you paid new buyers have to come in & pay more than you pic.twitter.com/LuklAplkC4 — OCCUPY WISDOM (@OccupyWisdom) September 6, 2018

Atulya does have a valid point. There are plenty of problems with the Bitcoin network that are far from solved.

Perhaps most famously, Bitcoin has an extremely limited ability to scale--the network is capable of processing three or four transactions on average. By comparison, the Ethereum network can process around 15 transactions per second; the Visa payment network can process thousands of transactions each second. Despite a growing number of efforts to make Bitcoin more scalable, the Bitcoin community has been unable to agree on any single solution. Thus, nothing has changed.

The Bitcoin network is also much less anonymous than most people believed that it was. Once any connection between an individual’s public wallet address and their identity has been established, it’s possible to see every transaction that person has ever made associated with that address.

Despite the fact that the cryptocurrency markets have slowed somewhat, there are more and more Cryptocurrencies being born all the time--cryptocurrencies that are far more scalable, more anonymous, and much easier to use than Bitcoin. None of them has managed to truly threaten Bitcoin’s royal status, but some come closer and closer.

Yale Economists Say That Probability of a Total Crash is Only 0.4%--But It’s All Relative

Despite the threats to the Bitcoin network, Bitcoin may not be in danger of total disaster anytime soon. A report by two Yale economists, professor Aleh Tsyvinski and Ph.D. candidate Yukun Liu, published in August of this year said that the probability of Bitcoin heading to absolute zero is just a 0.4 percent chance. This was slightly lower than XRP’s 0.6 percent chance and Ethereum’s 0.4 percent chance.

By comparison, however, the chances that these three cryptocurrencies would be sent to zero were much higher than the chances of the Euro (0.009 percent), the Canadian dollar (0.005 percent), and the Austrailian dollar (0.003 percent).

The price of Bitcoin will never go to zero because if worse come to worse I will buy everyone's bitcoins at 0.01$ for sentimental value. 200,000$ to own all the bitcoins? Totally worth it. https://t.co/LQwmsoQe7L

— Francis Pouliot ?₿ (@francispouliot_) November 20, 2018

The odds were calculated based on price data from all three currencies collected between the years 2011 and 2018.

“On one hand it sounds small, on the other hand, it is still orders of magnitude larger than the probability that [a traditional currency] is going to become worthless,” Tsyvinski told CNBC. “So you can take the glass half full or the glass half empty.”

Bitcoin Just Isn’t a Currency

VanGuard Economist Joe Davis said all the way back in May that there’s “decent” chance that the price of Bitcoin is headed to zero. He argued that Bitcoin simply doesn’t meet the criteria required for it to be an actual currency; he said it was nothing more than a dubious instrument of exchange and that is high levels of volatility do not make it into a reliable store of value.

Davis said that as such, he does not believe that Bitcoin or other cryptocurrencies represent any serious threat to banks or traditional financial systems. However, Davis does believe that banks will eventually adopt the usage of their own digital currencies.

Market Manipulation Could Lead to Destruction

Chairman of Roubini Macro Associates Nouriel Roubini, also known as “Dr. Doom” for his bearish economic outlooks, tweeted his beliefs that Bitcoin is headed into oblivion all the way back in February of this year.

Bitcoin crashing now to $6,100. And the US Hearing on cryptoscams is only a day away. So a $5K handle looks highly likely unless the crypto-manipulation gangs starts pumping and dumping or wash trading again. So HODL nuts: be ready for a 75% loss from recent peaks.

— Nouriel Roubini (@Nouriel) February 6, 2018

As expected Bitcoin now crashes below $6000. Now the $5K handle is reached. And the US Congressional Hearing on Crypto-Scams is still a day away. HODL nuts will hold their melting Bitcoins all the way down to ZERO while scammers and whales dump and run...

— Nouriel Roubini (@Nouriel) February 6, 2018

Roubini cited market manipulation as one of the factors that will ultimately lead to Bitcoin’s demise, asking if the CFTC and SEC would be looking into the wash trading that he alleged was happening in the Bitcoin markets.

As Bitcoin crashes to a $5K handle the wash traders move rapidly into action to prop it up...price and quantity action now clearly consistent with criminal wash trades...will the SEC and CFTC start looking into these criminal activities?

— Nouriel Roubini (@Nouriel) February 6, 2018

There has been a widespread belief that the Bitcoin markets are subject to widespread market manipulation from the very beginning--”whales,” or individuals that hold a lot of BTC, have been accused of throwing their weight around in order to profit off of panic. While there is no definite proof that this has ever taken place, there is still reason to believe that it might have happened.

The Future is Unclear

There’s no telling what the reality of Bitcoin will be in 2019. These perspectives seem grim, but Finance Magnates reported just yesterday on individuals who believe that Bitcoin’s best days are yet to come.

If you’re not a professional analyst, though, the old adage might provide a source of wisdom here: hope for the best, but expect the worst.

What are your thoughts on where Bitcoin is headed next year? Leave a comment below. We’d love to hear from you.