The European Securities and Markets Authority (ESMA) has been advised to regulate cryptocurrency under existing regulations, according to CoinDesk.

Source: esma.europa.eu

"Most crypto-assets are covered..."

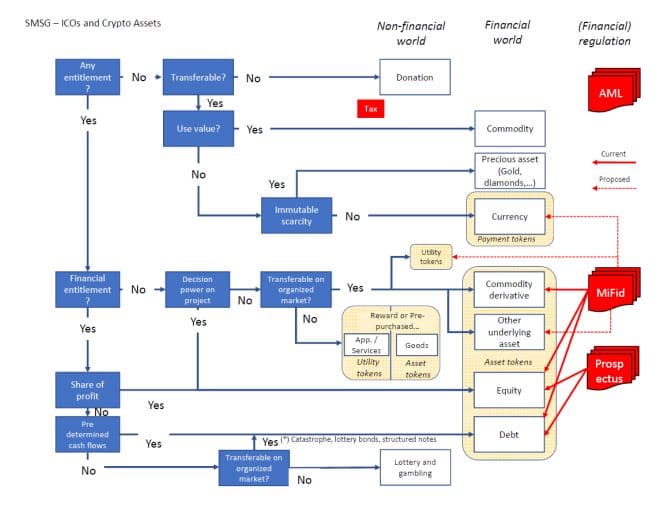

The Securities and Markets Stakeholders Group, which provides the EU financial regulator with technical advice on policy development and implementation, concluded: "Most crypto-assets are covered by the Unfair Commercial Practices Directive (UCPD 2005/29/EC), to the extent the issuer is a business undertaking and the buyer of the crypto-asset a consumer."

Token definitions

The advice came in the form of a 36-page report, published on the 19th of October. The document identifies that different kinds of crypto-tokens have different purposes and should have different legal definitions. It says:

Payment tokens are not currently covered by existing financial law (MiFID II). The SMSG urges ESMA to consult with the European Commission to change the law to include cryptocurrency.

Utility tokens are also not covered - the SMSG suggests that if such tokens are transferable, they should be included in financial law because they could become investments.

Asset tokens can be split into several sub-groups. If they give the holder a right to a return, either financial or in kind, and are transferable, they resemble securities/shares and should be included in the law. In all, the report identifies eight sub-definitions of asset tokens.

Worrying trends

The report recognises that crypto-assets "might also provide innovation in the field of finance" despite presenting a possible risk to financial stability.

The Financial Stability Board, which advises the G10, recently came to the conclusion that this risk is far more imminent.

In keeping with its appreciation of innovation, the SMSG "advises ESMA to provide guidelines with minimum criteria for national authorities which operate or want to operate a sandbox or innovation hub."

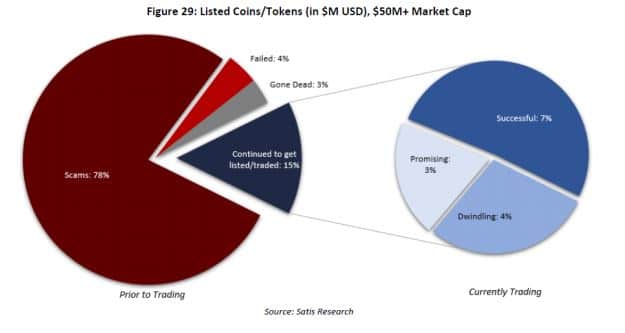

The report also identifies some worrying trends in the cryptocurrency sphere. For example, in the following graph it shows that ICO success is fairly dire:

Source: esma.europa.eu

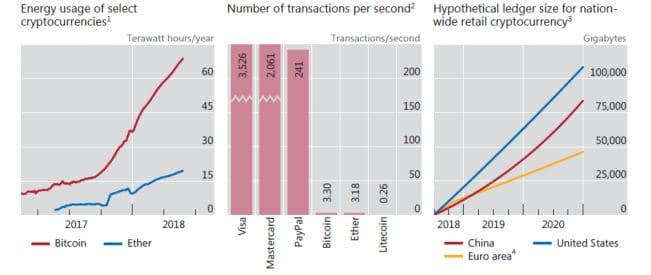

In the next, it implies that the energy need is expanding exponentially, while the payment utility is negligible:

Source: esma.europa.eu

Regulation in the EU

All countries in the union have a slightly different approach to cryptocurrency. There are those that wholeheartedly embrace the business it could bring (Malta, Gibraltar), those that are cautiously allowing the industry to operate (the UK), and those that are dead against it (Finland).

On its part, ESMA ruled in December 2017 that all member countries order local companies to require that customers identify themselves, thus making anonymous transactions illegal, within 18 months. However, it reneged on this to some extent in June 2018 with the Fifth Anti-Money Laundering Directive (Directive (EU) 2018/843). This law does not completely end anonymous transactions, but does greatly extend the powers of financial intelligence units to retrieve information from private businesses.

In July, the European Parliament’s Committee on Economic and Monetary Affairs reported decided that cryptocurrency is not a threat to banks.

In January, ESMA enacted an update to union-wide financial law - MiFID II - that imposes harsh restrictions on the operations of foreign Exchange companies. This includes limits on the amount of credit that can be extended to customers, given that the latter lose money on the vast majority of trades. These companies have been complaining that the new laws have driven their customers to use unlicensed, offshore firms.