For much of the world, 2020 was such a bad year that it has almost become a joke. The pandemic caused chaos in our personal, professional and social lives.

The financial and fintech worlds were turned completely upside down. Companies were forced to adapt to a rapidly-changing set of restrictions and challenges; customers had an ever-evolving set of needs and companies needed to learn quickly how to meet them with limited resources.

As a result, a number of major changes quickly unfolded in fintech. Now, with mass-distribution of COVID vaccines, it seems as though there is a light at the end of the tunnel: the end of the pandemic may be in sight. However, many of the trends that developed in the fintech world as a result of COVID are likely to stay long after the virus loosens its grip on global society.

What are these trends? Here is what the experts have to say.

#1: Alternative Assets Are on the Rise

One of the most significant trends that the fintech industry has seen so far in 2021 is the growing popularity of alternative assets–namely, Cryptocurrencies .

Cryptocurrencies have steadily been gaining popularity since their inception around 2010. This growth was accelerated in late 2017 with the initial coin offering (ICO) boom and the short-lived Bitcoin run to $20,000. However, since the start of the COVID-19 pandemic, changes in monetary policy around the globe have led a growing number of individuals and institutions to seek new ways to protect and grow the value of their savings.

Of course, the most prominent example of this is Bitcoin (BTC). Since late 2020 and into the start of 2021, a number of major corporations have added Bitcoin to their balance sheets, including Tesla, Square and MicroStrategy. Additionally, a number of major banking institutions have begun to offer Bitcoin-based investment products to their clients.

Moreover, Cryptocurrencies beyond Bitcoin have gained popularity in mainstream financial and cultural spheres. Controversially, Dogecoin (DOGE) became a favorite of many retail investors after Tesla Founder, Elon Musk began to promote the coin on Twitter.

Snoop Dogg, Gene Simmons, Soulja Boy and a number of other celebrities have followed suit. Additionally, a number of companies have latched onto DOGE: for example, Slim Jim and Snickers, two US-based snack food corporations, have both Tweeted some iteration of “Dogecoin to the moon.” Trading app Robinhood began offering Dogecoin investing to its users in April.

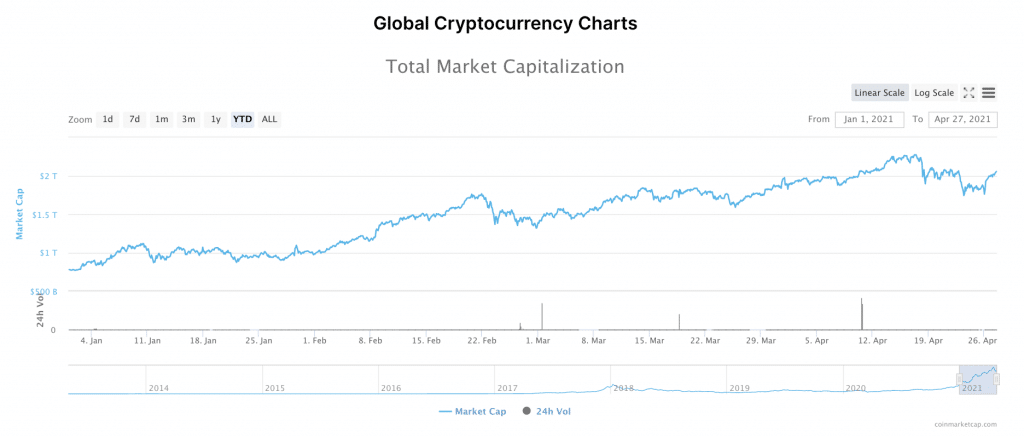

As a result, the prices of Bitcoin, Dogecoin and cryptocurrencies across the board have risen considerably since the beginning of the year. At press time, Bitcoin (BTC) was up roughly 86% since the beginning of the year (from ~$29K to $54K); Dogecoin was up a whopping 6650% (from $0.004 to $0.27). As a whole, the total market cap of all cryptocurrencies was up roughly 73% (from $776 billion to $2.05 trillion.)

#2: Non-Fungible Tokens (NFTs) Are Finally Having Their Moment

A prominent part of the rise of cryptocurrencies and other alternative assets has been the rise of non-fungible tokens or NFTs.

These tokens are unique digital collectables that can be tied to anything from digital kitties, to multi-million dollar works of art, to homes, to live event tickets and more. Anything that can be collected in the 'real world' can be made into an NFT.

In addition, NFTs can provide new ways to 'own' pieces of art or other creative work. While non-fungible token tech has been around for several years, it is the NFT cases in the art world that have truly caused their popularity to explode.

Eloisa Marchesoni, NFT specialist.

It all started in March when a number of high-profile celebrity artists began launching NFT 'drops' where they could market their wares. Canadian musician Grimes pulled in several million dollars for the sale of several digital works of art; since then, some NFT works have sold for as high as $69 million.

However, some analysts believe that the NFT art craze may not survive into the future, at least, not in its current form. “Since the majority of today’s NFTs neither make much sense nor provide much value, we’ll see the hype die down and the prices of many non-fungible tokens plummet,” explained Samson Mow, Chief Executive of Pixelmatic, to Finance Magnates earlier this year.

Samson Mow, CEO of Pixelmatic and CSO of Blockstream.

NFT specialist Eloisa Marchesoni told Finance Magnates that: “NFT artworks should only be purchased because the work in question has artistic value to the buyer and not because of potential future profits.”

“As with any purchase, consumers should consider whether they get good value for money, in terms of how much an NFT is worth to them, but I wouldn’t bet on selling it at a profit. That doesn’t mean you won’t be able to have a profit, but that shouldn’t be your main motivation.”

#3: The Rise of DeFi: 2021 Could See the Lowering of Barriers to Entry into DeFi

Decentralised Finance, or DeFi, has been on the rise for the past several years–even since before anyone had even heard of COVID-19. However, the growth of the DeFi ecosystem has been explosive since the time that the pandemic began.

However, DeFi still has some rather high barriers for entry. Primarily, many analysts argue that the majority of DeFi platforms are hard for the average person to use. Beyond that, GoodFi Founder, Piers Ridyard told Finance Magnates that the high amounts of collateral on some DeFi derivatives act as another high barrier to entry. GoodFi is a non-profit organisation with a mission to get 100 million people to put at least $1 into DeFi by 2025.

However, Ridyard believes that a solution to this second barrier-to-entry is on its way. “Capital efficient derivatives are coming in 2021,” he told Finance Magnates.

“So far, derivative protocols like Synthetix require very large amounts of collateral to create a derivative instrument (7x collateral); however, lower collateral derivatives are coming,” he said. “Once we have capital efficient derivatives, it is quite likely that the nominal value of traded instruments on DeFi will explode from where it is now, potentially even 10x.”

Piers Ridyard, Founder of GoodFi.

#4: Collaborative Fintech: Remote Work Is More Popular than Ever–and So Are the Risks That It Brings

“Fintech's trend to look out for in 2021 is the Enhancement of Digital Collaboration,” said Jake Smith, Managing Director of Absolute Reg. “Most of the financial sector has adopted remote work arrangements for the near future in reaction to the COVID-19 pandemic.”

“As a result of the change, there is a high demand for digital tools that can help people collaborate more effectively and safely,” he continued. “Not only must physical documents be transferred to digital format, but companies must also figure out how to make such files accessible to remote workers without compromising data protection or creating version uncertainty.”

And indeed, there are quite a few kinks to work out when it comes to cybersecurity and remote work. “Rather than introducing a dedicated, all-in-one solution, organizations often rely on a number of incompatible software applications and improvised workarounds to satisfy their viewing, editing and document management needs,” he said.

“Unfortunately, these haphazard solutions introduce inefficient third-party dependencies, expose data to unnecessary risk and increase the likelihood of human error,” Smith explained.

How might it be possible to mitigate these problems? “Fintech developers may use SDKs and web-based APIs to combine these features into a single application,” Smith said.

#5: New Types of Fraud Have Forced Fintech Companies to Find New Solutions

Creating applications that can improve cybersecurity in fintech organizations is increasingly important as fintech companies face new kinds of cybersecurity challenges.

Steve Maloney, Executive Vice President of Acuant, told Finance Magnates that: “there were new types of fraud introduced during COVID, but some that will continue to be pervasive are synthetic fraud and muling.” According to Investopedia, synthetic fraud happens when a criminal combines real and fake information to create a new identity. Muling is when people are recruited as money laundering intermediaries for criminals and criminal organisations, often without knowing it.

Steve Maloney, Executive Vice President of Acuant.

How will companies handle these evolving security threats? “[With] more robust, fraud-fighting KYC/AML solutions that can truly verify an identity and uncover the associated risk, essential to doing business,” Maloney explained. “AI-powered risk-decision making with real-time Analytics can place trusted users in the fast lane, while suspicious users will be flagged. This will be the basic standard,” he went on.

Amber Morland, CEO & Founder of WinCope, told Finance Magnates that a collaborative approach is necessary to effectively handle these new kinds of threats. “The challenge posed by cybercriminals and fraudsters will result in common threats that must be handled collaboratively across the financial system.”

“This is the route that fintech companies should take to become more cyber stable. They must deliver safe properties, form trusted commercial relationships with well-established companies, and adhere to regulations in the jurisdictions where they work.”

What are your thoughts on trends in the fintech world in 2021? Let us know in the comments below.