Tesla’s $1.5 billion Bitcoin purchase that took place at the beginning of this week has had a major impact on the crypto industry: not only did the price of BTC shoot up by 25 percent overnight, but the world’s attention was, once again, tuned into Bitcoin.

Therefore, Bitcoin was able to maintain some of the gains that it had seen from the Tesla news cycle for several days. However, as the week has drawn on, the price of Bitcoin has started to cool off; at press time, BTC was hovering around $45,000, down from its weekly high of roughly $48,000.

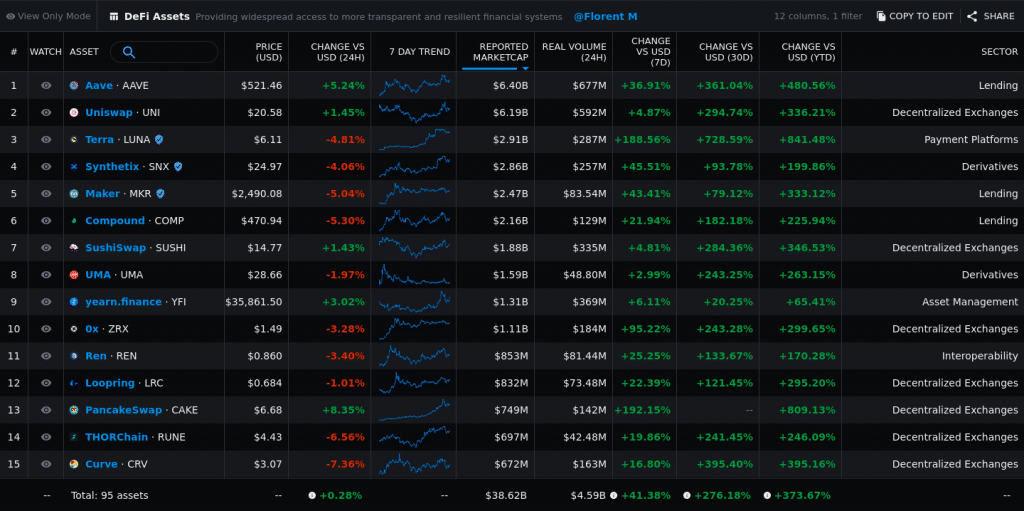

However, at the same time, a number of tokens belonging to decentralized finance (DeFi) protocols have seen gains in their prices. At least 27 of 77 DeFi tokens listed on Messari showed positive movement in the last 24 hours.

A number of analysts have explained this as the 'runoff' effect that Bitcoin seems to have after a rally: for example, Do Kwon, Co-Founder and CEO of Terraform Labs (TFL), told Finance Magnates that: “as the flagship cryptocurrency, Bitcoin tends to lead while the rest of the industry follows.”

“More media exposure for Bitcoin, and the more likely it is for prospective users to explore DeFi who jump down the rabbit hole from Bitcoin,” Kown said. “As Bitcoin continues to rally, we can expect further capital inflows into DeFi, which will expand entrepreneurship, innovation and increase DeFi’s market valuation and appeal to the mainstream.”

Eloisa Marchesoni, token-based fundraising advisor, told Finance Magnates that as such, “holders are anticipating ‘alt season’.”

Eloisa Marchesoni

“[They] want to use their bitcoin to leverage additional exposure to other opportunities within the crypto space, whether it be DeFi tokens or other layers, such as Ethereum, Polkadot, Solana, NEAR and many DeFi projects that right now have a lot of momentum and are well-positioned for investor participation.”

“Like Everything, Practice and Research Can Help Identify Good Investment Opportunities Early in DeFi.”

Therefore, if Bitcoin continues to cool off, there could be an influx of capital into DeFi tokens, largely, perhaps from new investors who may be exploring DeFi for the first time.

What do these investors need to know before they embark on their DeFi journey? “Like everything, practice and research can help identify good investment opportunities early in DeFi,” Kwon told Finance Magnates.

“Understanding good fundamentals about projects in DeFi is critical,” he explained. “Typically, for projects just ‘out of the gate’, this includes a strong team with a proven track record, venture capital funding, long-term lock-up incentives for team members and documented resources about their technology.”

However, Kwon pointed out that in the DeFi world, not every protocol has a small team of developers that are running the show.

“Some of the most popular projects in DeFi, such as Yearn Finance and Mirror Protocol, are community-owned,” he said. “The communities govern the development of the platform, tokens undergo a ‘fair launch’ model, and everyone contributes in some form or another, with rewards allocated from a community treasury. These types of platforms are promising and bode well for the democratized participation in DeFi.”

“Once a product goes live...monitoring on-chain statistics like total value locked (TVL), cash flows to token holders, volume, governance participation, token inflows/outflows, slippage of Liquidity pools, liquidity provider incentives, staking percentages, and more, become paramount.”

”Don't Expect Every Second DeFi Project to Be a ‘Unicorn’.”

Additionally, Scott Schulz, Chief Executive of Lendefi Protocol, recommends that in addition to examining “team representatives, partners and agreements with other companies,” investors should also “study the purpose of the project, the direction in which it will work.”

“See the reaction of the crypto community to the launch of the project,” he said “If this token is [listed] by centralized exchanges, this is a good signal. A high-quality and demanded DeFi project, especially in today's market, has a chance to grow.”

Scott Schulz, Chief Executive of Lendefi Protocol.

However, “Don't expect every second DeFi project to be a ‘unicorn’,” he said. “This is not [an advisable] long-term practice.”

Still, there are many projects that many analysts agree have quite a bit of promise: “Solana and Fantom are developing the infrastructure for decentralized finance,” Schulz pointed out.

“Uniswap, CurveFinance, and SushiSwap, which are developing decentralized trading, are attracting new capital to this market. Also, such projects as СhainLINK, MakerDAO, Aave, COMPOUND and some others. The industry is full of interesting projects that are just starting to rise,” he said.

“DeFi Projects Are Very Much Still in Their Early Stages and in a Phase of Discovery.”

However, even the most promising DeFi projects are not without risk. “There is risk in every corner of crypto markets,” Doug Schwenk, Chairman of Digital Asset Research (DAR), told Finance Magnates.

“DeFi projects are typically smaller than Bitcoin and less well known which creates a different set of risks than Bitcoin, which has strong brand recognition,” he explained.

Similarly, Steve Ehrlich, Chief Executive Officer and Co-founder of crypto trading platform, Voyager, told Finance Magnates that while “Bitcoin has proven that it’s here to stay, and is an essential part of our digital economic revolution,” DeFi is much earlier in its development: “DeFi projects are very much still in their early stages and in a phase of discovery,” he said.

Steve Ehrlich, Chief Executive Officer and Co-founder of crypto Trading Platform, Voyager.

Kwon added that: “yes, DeFi projects do not have the decade-long venerated record of Bitcoin and tend to be more volatile.”

“Bitcoin’s liquidity is also far superior to DeFi assets (and many traditional assets for that matter). Lower liquidity breeds more volatility, so it’s better to choose a basket of proven DeFi assets and invest for the long-term rather than trade speculatively in the short-term,” Kwon said.

“DeFi Still Has a Lot of Problems to Solve.”

And, there may be ways of managing the risk of investing in DeFi assets: for example, “with projects like Set Protocol on Ethereum, you can even invest in indexes of DeFi ‘blue chip’ assets like the DeFi Pulse Index (DPI) that grant exposure to several major DeFi tokens with reduced downside volatility compared to holding a single asset,” Kwon said.

Additionally, it will only be a matter of time before DeFi begins to earn its stripes. Schwenk explained that: “in the long run, DeFi projects, if successful in disrupting traditional financial services, will have demand and valuation metrics that are easier for many people to understand than Bitcoin today and should mitigate some important crypto risks.”

“However, as with all technology and regulatory innovation, it will take time for this to play out,” he said.

And, there are a few specific pain points that DeFi must overcome before any DeFi project can hold a position like Bitcoin’s.

“DeFi still has a lot of problems to solve, such as the need for over-collateralization,” Schwenk said. “DeFi clearly has come a long way in the last two years and will go through a number of phases in the next five. Predicting the future is always difficult, but it would be very interesting to see DeFi mature to manage appropriate regulatory frameworks and be bridged into traditional financial networks.”

Moreover, Kwon pointed out that: “one of the current barriers to DeFi adoption is the high cost and subpar UX. For example, on Ethereum, gas fees are exceptionally high right now, precluding most retail users from buying a DeFi asset on Uniswap when the transaction fee is close to $100.”

“Five Years from Now the Total Market Cap of DeFi Will Be the Size of the Current Crypto Market Cap.”

However, these pain points are already on the way to recovery, “over the next five years, those problems should be alleviated significantly as UX improves (more front-end developers join DeFi), and layer one congestion is ameliorated with layer two scaling solution,” Kwon said.

Do Kwon, Co-Founder, and CEO of Terraform Labs (TFL).

“Additionally, cross-chain solutions like Wormhole allow for assets to be ported from one chain to another, such as Solana to Ethereum, making the entire ecosystem interoperable. This is powerful.”

And, as such, DeFi’s market cap size should reflect these improvements. “Five years from now the total market cap of DeFi will be the size of the current crypto market cap, with a thriving ecosystem of new financial products that have low costs, low barriers to entry, and are easily accessible by the mainstream. Then DeFi will be firmly on its path towards democratizing access to a better financial system.”

”An Entirely New Marketplace Is Emerging.”

And, while DeFi may still have a long way to go until it has the name-brand recognition that something that Bitcoin does, it is important to acknowledge the power that DeFi has already had to influence the growth of the crypto space as a whole.

Schwenk told Finance Magnates that while DeFi may not “have the headline appeal of Tesla investing in Bitcoin,” it is “certainly important.”

“It creates demand for involved assets and platforms, such as Ethereum, to execute DeFi processes and the innovation potential brings new investors to those assets in parallel,” he said.

Similarly, Ehrlich wrote that: “DeFi has been a critical part to the market growth as has been the retail and institutional adoption of Bitcoin...the total crypto market capitalization has now surpassed over $1 trillion dollars and continues to climb.”

Indeed, “Decentralized Finance has been a critical component of driving up the market capitalization,” Ehrlich said.

“With the value of Ethereum hitting all-time high, so has gas prices to use the network, showing the power of DeFi while also revealing its growing pains. As more and more smart contract platforms like Polkadot, Avalanche and Tezos look to power DeFi applications, their value has been rising as an entirely new marketplace is emerging.”