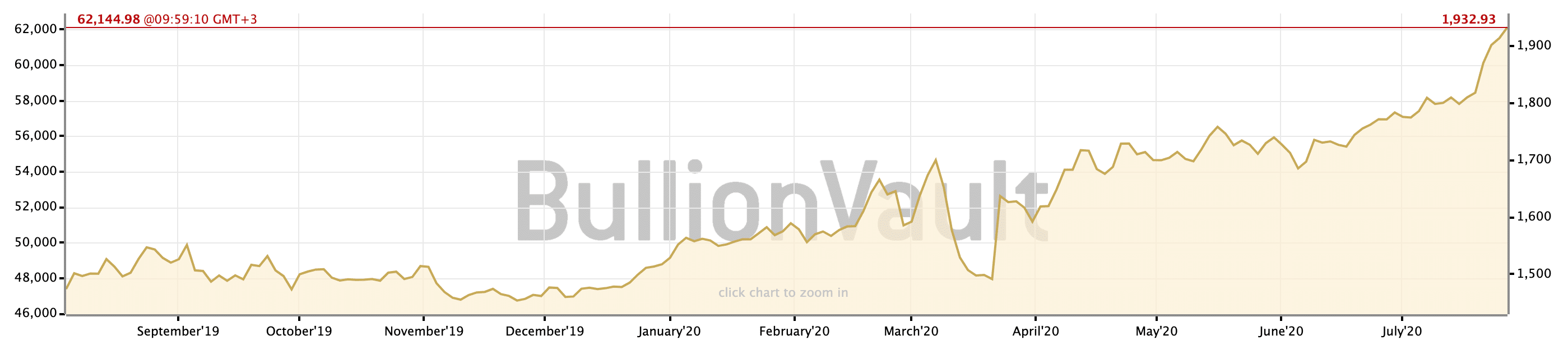

A number of gold-backed stablecoins seem to be approaching new all-time high price levels as the price of their underlying asset has hit its highest levels since September of 2011. At press time, an ounce of gold was worth approximately $1936, up from $1771 a month ago. Gold futures contracts were also bullish; data from Investing.com showed that gold futures contracts were trading at $1929.

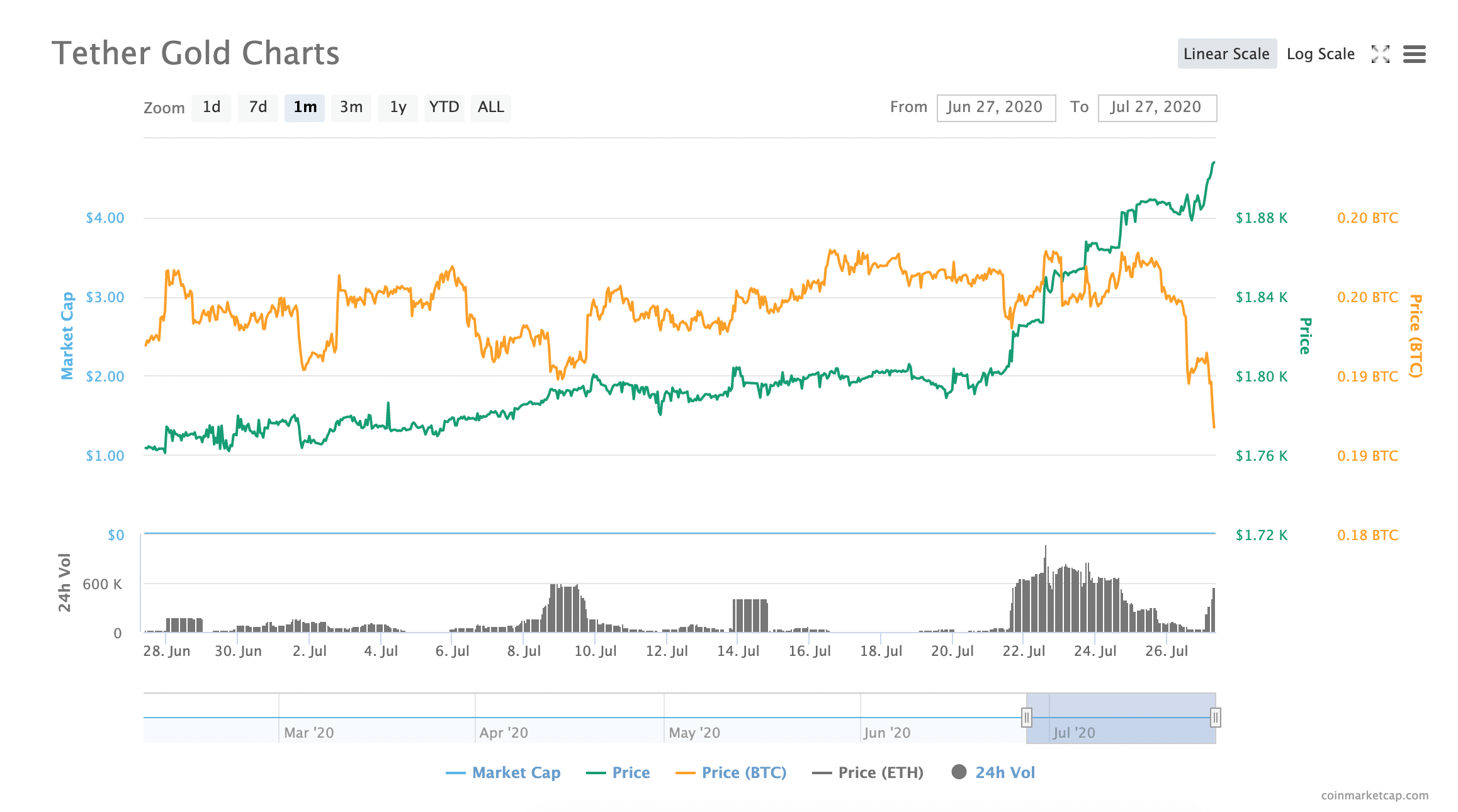

Accordingly, Pax Gold (PAXG) had reached $1,930, up from $1,770 a month ago; Tether Gold (XAUT) was up to $1,907 from $1,760. The Perth Mint Gold Token (PMGT) was up to $1945 from $1,643 a month ago. Each of these assets is backed by an ounce of physical gold kept in different locations around the world.

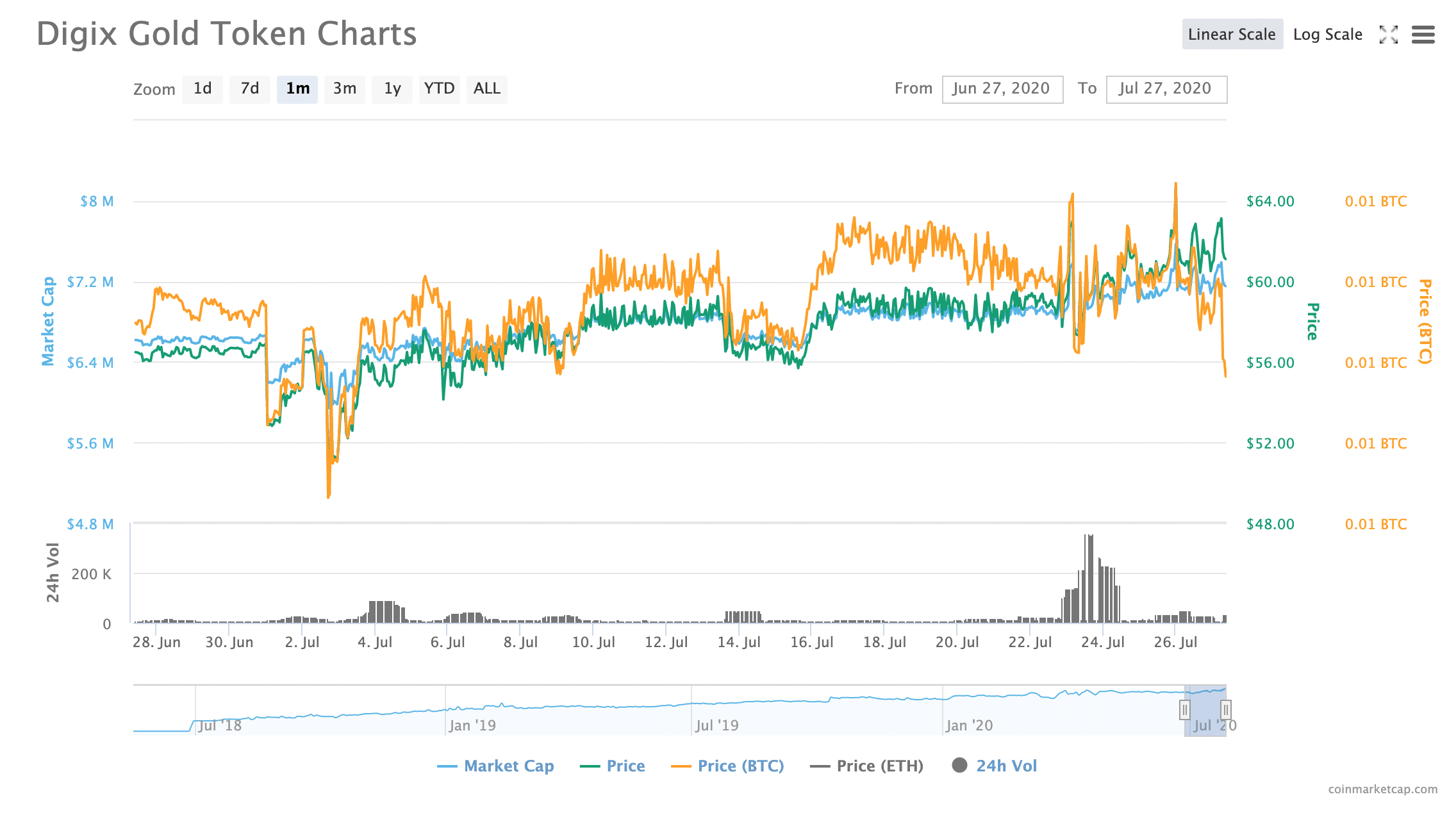

Additionally, the Digix Gold Token (DGX), represents 1 gram of physical gold, up from $56 to $61.

In accordance with the rise in the price of gold, each asset saw an increase in its market cap.

While the price of each of these gold tokens has increased, not all of them have seen increased demand from users: Tether Gold and the Digix Gold Token both saw spikes in their trading volume throughout the month of July; however, Tether Gold seems to be benefitting the most from gold’s recent price rally (according to data from CoinMarketCap.)

Indeed, a press relations representative of Tether told Finance Magnates in an email that Tether is reporting a 60x increase in the 24hr trading volume of Tether Gold over the past month.”

Increased interest in gold and gold-backed stablecoins has ensued since the start of the COVID-19 pandemic

The price of gold appears to have been driven up as more investors are turning to the asset in the face of the ongoing pandemic-related economic fallout as well as growing geopolitical tensions, particularly between the United States and China.

The increased interest in gold-backed stablecoins appears to be driven by increased awareness of the accessibility features they provide: gold stablecoins often offer access to gold without storage fees or other additional costs.

Paolo Ardoino, chief technical officer at Tether, said in a statement that “while no one could of course have anticipated the severe challenges that we’ve all had to adapt to in 2020, it is clear that in times of uncertainty people like having accessibility to gold," and that this may be driving the appeal of Tether Gold, as well as other gold-backed stablecoins.

Increased interest in gold stablecoins first appeared to be developing in March, shortly after the global pandemic began wreaking havoc on society and the economy.

At the time, Roy Sebag, founder of metals custodian Goldmoney, told CoinDesk that the United States Federal Reserve “completely changed the rules – the real rate of interest swung even more and so we are seeing all that money flow into gold immediately.”

The trend appears to be continuing.