If you have any doubts lingering about what is going on with the cryptocurrency market, this morning Google's AI was providing the newest answer it thinks is relevant. If you entered the search term “Bitcoin ”, the card below displaying essential information popped up next to your results.

This is the card the Google shows you when you google "Bitcoin"

Fast-forward a couple of hours and the designation has been amended to: "Bitcoin is a cryptocurrency, a form of electronic cash. It is a decentralized digital currency without a central bank or single administrator that can be sent from user-to-user on the peer-to-peer bitcoin network without the need for intermediaries."

Aggregating information is at the core of Google’s machine learning algorithm which is displaying search results and the useful cards on the side. As you can see above, the company’s AI system was clearly stating: “The bitcoin market is widely viewed as a collapsed economic bubble.”

The card is yet another public display of what seems to be becoming a prevalent issue for the search giant. The way its machine learning algorithm is designed is affecting our lives in such a massive way, that having no independent oversight over it is becoming politically and socially difficult.

Sundar Pichai on Capitol Hill

The CEO of Google Sundar Pichai was testifying in the US House of Representatives this Tuesday. Among many other things, during his testimony he was asked by a Republican representative why does Google's AI list negative articles on the party’s “repeal and replace Obamacare” bill.

He explained that he could only find positive opinions of the bill when getting to the 3rd or 4th page of results. But this is not what is at the core of this article. I am not here to question the political bias of Google. The Monopoly Man already did a great job at expressing some of the public’s worries about the company:

Congress is a v serious place pic.twitter.com/Ro9ddGsU4Z

— Ian Madrigal - The Monopoly Man (@wamandajd) December 12, 2018

Pichai explained that Google’s AI algorithm looks at every keyword based on “things like relevance, freshness, popularity and how other people are using it”.

This is the basis used by the company to determine the best results for every query. This might be the reason why Bitcoin’s card was displayed the way it was this morning. People experienced pain and downgraded Bitcoin into a “collapsed economic bubble”.

Brief Anatomy of Bitcoin Bubbles

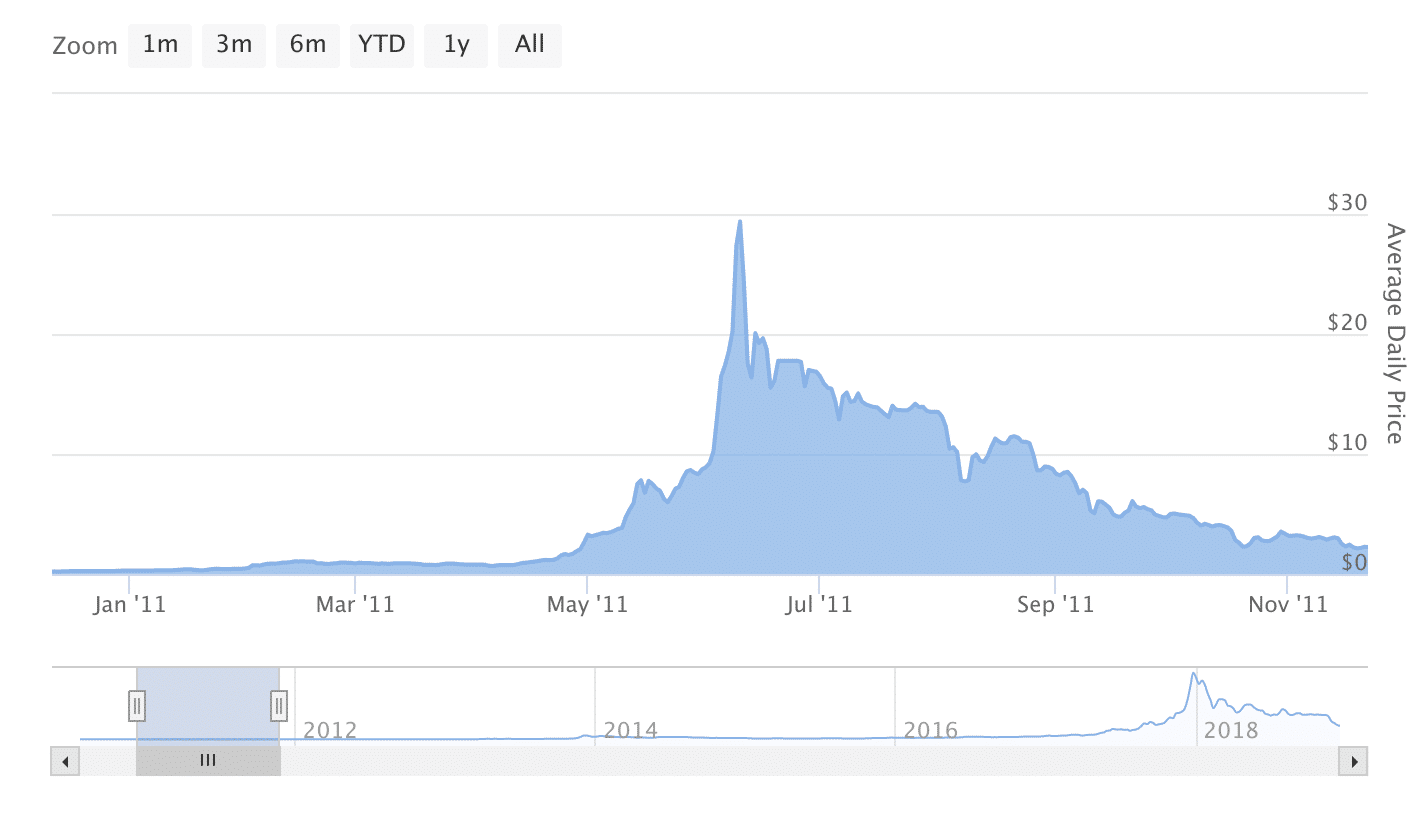

The first sharp rise in the price of Bitcoin was related to its first foray into mainstream media. At least that is what happened just before the price topped out at above $20 in June 2011. After an article in Gawker detailed the emergence of the go-to underground website for drug purchasing called Silk Road, BTC doubled in value in 10 days.

Price action around the first Mt. Gox hack in 2011

What happened 18 days after the publication of the article however caused prices to drop from $22 to near $2 in November. That event was the first hack of Mt Gox.

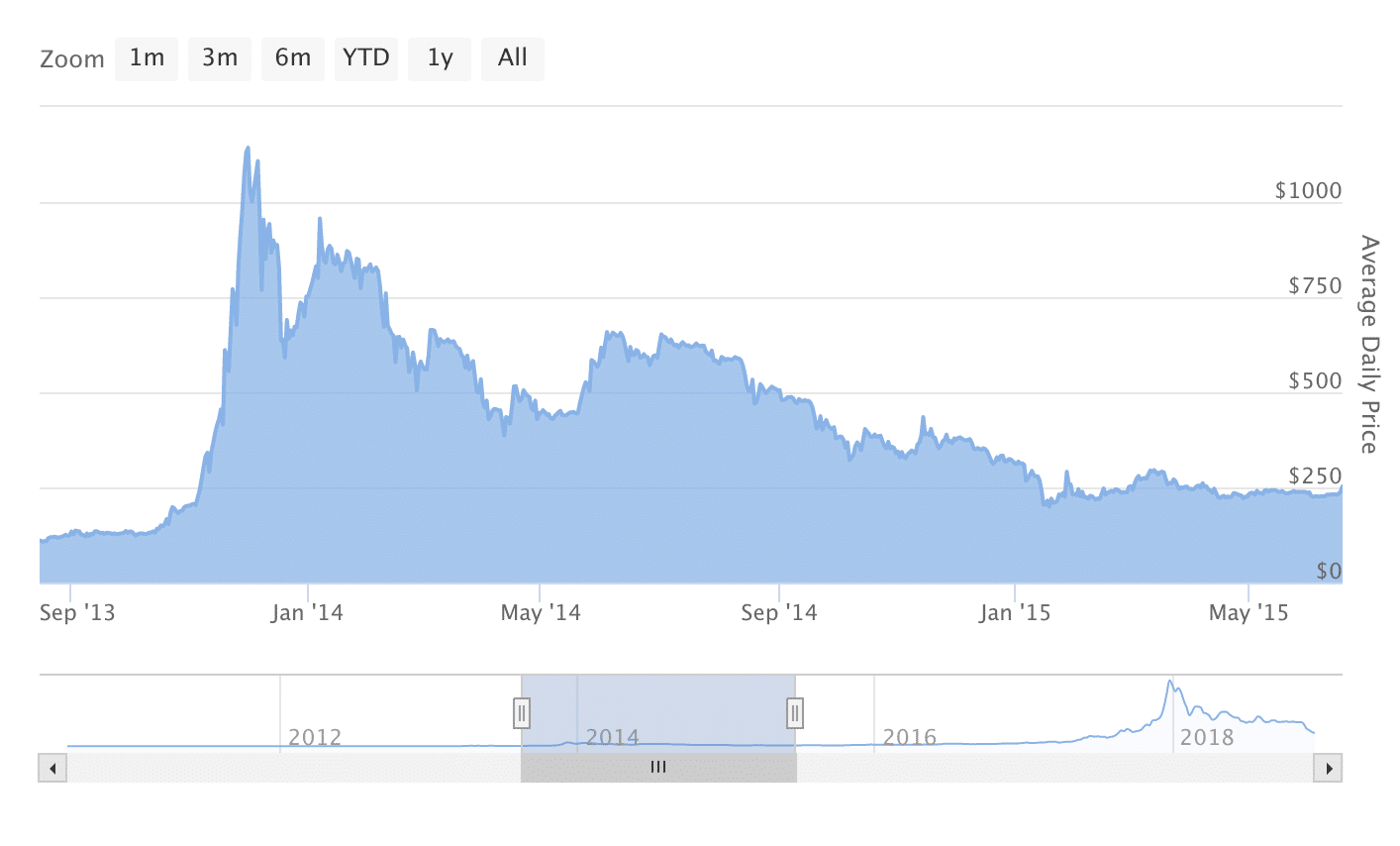

Fast forward two years and the Cyprus banking crisis has made the cryptocurrency popular once again. It broke above $200 before breaking the Mt Gox exchange due to the increasing trading volumes. A subsequent drop to $50 was helped by mainstream media coverage.

While the Cyprus banking crisis was raging, Bitcoin gained additional traction

That same year was the first time when Bitcoin made it into financial media on a sustained basis. Bloomberg and CNBC both paid attention briefly just before the Mt Gox crash. Towards the end of the year, attention from the Senate and the People’s Bank of China (PBOC) caused prices to spiral out of control to above $1000.

Bitcoin's first glimpse above $1,000

Another hack at Mt Gox caused another drop in prices. It was exacerbated by the crackdown on Silk Road and the $200 mark was breached before Coinbase was granted a license to operate in 25 US states as a Bitcoin exchange.

The subsequent rise in the number of exchanges, media coverage and last but not least, Donald Trump caused a return of attention to the decentralized nature of Bitcoin. We all know what happened since then. Prices topped out just below $20,000 just around the time of the launch of Bitcoin futures.

The incident still proves that Google is swift to address any factual inconveniences. Th the company's search engine is undoubtedly great, but still not perfect. Human's might still be needed after all.

Also, for all I know, Google's AI is protected by the first amendment, so the cryptocurrency community's temporary outrage at the company this morning can remain contained.