A wise old saying explains that the best way to make a profit during the gold rush wasn’t to dig for the metal itself but to sell the shovels. However, when the gold ran dry, there were a lot of clever merchants left with a lot of useless shovels.

Now, Bitcoin’s sputtering valuation has been all over the news throughout the past year. While the falling price of BTC has taken center stage, Bitcoin’s mining industry has slowly begun to collapse around it. Because these two industries are so inextricably connected, the demise of one automatically means the demise of another.

How close are we to that point?

Trouble in Paradise

Hard evidence that the cryptocurrency mining industry was declining started to appear several months ago with a rather grim prediction from GPU manufacturer Nvidia. GPUs (graphics processing units) are chips that are used in various kinds of computing, and play a particularly important role in cryptocurrency mining.

In a conference call with investors this past August, Nvidia Chief Financial Officer Colette Kress shared horrifically low forecasts for revenue for cryptocurrency-related products: “our revenue outlook had anticipated cryptocurrency-specific products declining to approximately $100 million, while actual crypto-specific product revenue was $18 million,” she said. “Whereas we had previously anticipated cryptocurrency to be meaningful for the year, we are now projecting no contributions going forward.”

Kress did add some context for the projected decline that struck a slightly more optimistic tone: she explained that while GPU business revenue was “down 4 percent sequentially”, “GPU business revenue was $2.66 billion, up 40 percent from a year earlier.”

Then, in late November, things really started to hit the fan. An egoic “hash war” that resulted in an ideological rift about the future of the Bitcoin Cash network caused serious damage to the price of Bitcoin and most other Cryptocurrencies . Reports emerged that cryptocurrency mining firms in China were starting to sell their equipment “by the kilo”--declining cryptocurrency prices had caused the business of mining to cease its profitability.

Craig Wright, the self-proclaimed creator of Bitcoin, led one half of the ideological battle over the future of the Bitcoin Cash network.

A Slow Death?

Since these reports made their way onto the airwaves, the trend of crypto mining shutdowns has only continued, reportedly reaching all the way to the top: last week, Chinese mining giant Bitmain rang in the winter holidays with a round of layoffs. The company is rumored to have plans to cut 50 percent of its staffers in the future.

⚠️⚠️⚠️

there’s post on Chinese Linkedin (usually very high accuracy, posted by employees themselves) saying Bitmain will start a layoff the coming week ... ??? A separate rumor said the plan is for more than 50% of its headcount ???! pic.twitter.com/b0ZSBuPX4d — Dovey Wan ? (@DoveyWan) December 23, 2018

Bitmain has more than 2000 employees. If the rumors are true, the crypto industry could take a serious hit.

Major Japanese IT firm GMO Internet pulled the plug on its own mining-related affairs with an announcement that came early last week.

“After taking into consideration changes in the current business environment, the Company expects that it is difficult to recover the carrying amounts of the in-house-mining-related business assets, and therefore, it has been decided to record an extraordinary loss,” the statement said.

Finally, DMM.com revealed today that it has plans to shut down its mining business.

The shutdown of these companies and independent miners has stirred up fears that the BTC network has hit the point of no return--the dreaded Bitcoin Death Spiral™.

What is the ‘Bitcoin Death Spiral’?

The theory describes a vicious cycle in which falling prices cause a decrease in mining profitability. As mining becomes less and less profitable, more and more miners shut down their operations.

As a result, fewer and fewer transactions get processed on the Bitcoin network; as fewer transactions are processed, users grow increasingly frustrated with the network’s limited ability to process transactions and begin to sell off their assets. Miners and users alike keep exiting the network until bang--everyone is gone and Bitcoin is dead, rest in peace.

Had a short debate on crypto twitter about realities of a Bitcoin hashpower "death spiral" and what assumptions go into dismissing it as a risk. The TDLR: holders of BTC or equity in key service providers probably have incentive to mine uneconomically to prevent it.

— Ari Paul (@AriDavidPaul) December 3, 2018

But exactly how real is the threat of the death spiral? The truth of the matter is that a death spiral situation is certainly a possibility--however, according to Arjun Balaji, an analyst for The Block, there are a few things that would have to happen before a death spiral could be considered as a serious threat.

#1: The Price of BTC Would Have to Get Low--Really Low

First of all, Bitcoin’s price would need to take a serious hit. Of course, it has already lost around 90 percent of its value since the beginning of 2018--but for a death spiral to really hit, Bitcoin would need to sink back under $1000, a low that hasn’t been touched since February of 2017.

Before we move onto the other factors that could contribute to the dawn of a death spiral, how likely is it that Bitcoin could reach back under $1000? Of course, it depends on who you ask--some analysts predict that Bitcoin is on the verge of a massive U-turn, and will shortly be headed back toward anywhere from $10,000 to $100,000 throughout the next two years.

But the bulls are no the only ones with strong opinions about where Bitcoin is headed--there have been plenty of voices within and without the cryptocurrency space that have expressed serious concerns that Bitcoin will never recover. In an article for Seeking Alpha, analyst Geoffrey Caveney wrote that there was a “50-50 chance” that Bitcoin could sink back below $1000 sometime during 2019.

Caveney also references the fact that many Bitcoin bulls will reference Bitcoin’s massive price crashes of the past in order to assuage their own worries, but with the caveat that the stakes are higher than ever before.

“It's one thing to have huge bull and bear markets in relative obscurity with most of the world not paying attention,” he wrote. “It's a completely different thing to have the biggest bull and bear markets ever, playing out on the global stage with everybody watching - and with a lot more people's money involved.”

#2: Bitcoin’s Hash Rate Would Have to Drop Dramatically Before a ‘Difficulty Adjustment’

Despite long-standing issues about the Bitcoin community’s ability to make productive changes to the network’s software, the algorithm that runs the Bitcoin network is designed to automatically make some adjustments to itself based on the way that it's being used.

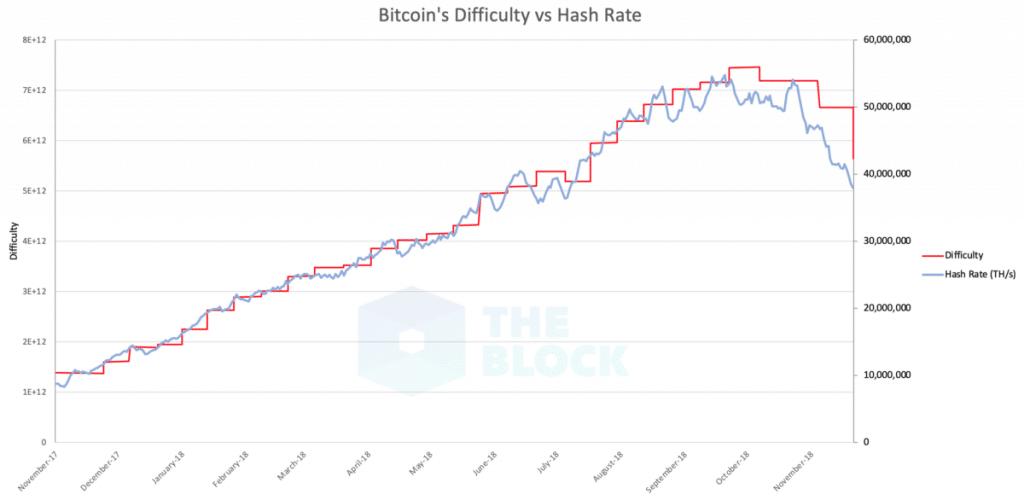

For example, the Bitcoin network automatically readjusts its mining difficulty (the amount of computing power required to mine a Bitcoin) every 2016 blocks, which roughly translates into once every two to three weeks. You can see how the hash rate (the rate of computing power) changes along with the adjusted mining difficulty in this chart by The Block.

Essentially, for a death spiral to happen, the hash rate would have to significantly drop before the mining difficulty had the opportunity to adjust accordingly.

Even now, the mining difficulty is adjusted and readjusting to fit the network's needs.

Remember the Bitcoin mining death spiral FUD? Mining difficulty just adjusted +10% pic.twitter.com/aAhENjWGFS

— Alistair Milne (@alistairmilne) December 31, 2018

So picture this: a number of major mining firms decide that they are going to leave the Bitcoin network suddenly, and all at once. The hash rate on the network suddenly falls significantly; the miners who are left on the network are suddenly faced with way more transactions than they can handle. The network slows down significantly, and frustrated users exit the network en masse. Death spiral.

But how realistic is this scenario? It’s true that some miners have already exited the market, but what are the circumstances that could cause a real mass exodus?

At What Point Would A Massive Exit of Miners Happen?

In a blog post, Christopher Bendiksen, Head of Research at CoinShares, wrote that there are two price points that Bitcoin miners need to pay attention to when considering whether to stay or to leave the industry.

The first of these price points is the “all-in ROI breakeven level, above which they make a profit on their investment, and below which they make a loss on their investment,” he wrote.

“The second is their cash-cost breakeven level, above which they are cash-flow positive but still potentially loss-making (ROI can still be negative if they never make enough cash to cover what they paid for their mining gear); and below which they are cash-flow negative and thus — depending on their industry view, risk appetite and capital levels — are likely to shut off mining gear entirely.”

Would Miners Stay in the Game Even If It Isn't Profitable?

Bendiksen wrote that this is an important distinction because miners who have not broken even with the cost of their equipment will keep their machines turned on as long as they are returning any positive cash flow, even if they are still netting an overall negative ROI.

However, if operational expenses exceed the income that the mining gear is generating, miners are extremely likely to remove their machinery from the network. And if cash flow has no foreseeable chance of exceeding operational expenses, there is no financial incentive for miners to return to the business.

However, Arun Balaji wrote that the point of breaking even may come sooner for most miners (and that mining may still be more profitable) than is often portrayed in the news: “the ‘break-even cost of mining’ is much lower for many miners than is often quoted by analysts (who focus on the average miner),” he wrote.

Balaji said that this is due to heavily subsidized electricity and the deals that high-volume miners receive from manufacturers. However, reports from various countries all over the world have shown that many governments, including the Chinese government, are cutting electricity subsidies to Bitcoin miners.

Is There Hope Yet?

Still, there are some reasons that miners may stay in the network at a loss, writes Balaji. “Long-term power purchase agreements, hardware purchase agreements, facility leases, and other financial arrangements,” could all be reasons to stay active within the Bitcoin network. “With these constraints and strategically-planned cash reserves, miners can mine at a loss for an extended period.”

Additionally, “rational miners want to mine Bitcoin to accelerate the time to the next difficulty adjustment,” Balaji wrote, explaining that this could result in greater profitability--”the miners that endure a crypto ‘bear market’ are at a massive competitive advantage, as we saw with miner consolidation in the last market cycle.”

Still, the best course of Bitcoin hodlers may be not to hold their breath. While there certainly is a chance of recovery, the Bitcoin network--and the mining industry surrounding it--are likely to get worse before they get better.