A Reddit user by the name 'Pedxs' has invited other users to join him in a class action lawsuit against cryptocurrency Exchange HitBTC.

He claims that the exchange has not been allowing him to withdraw his money, instead repeatedly requesting that he send personal information, purportedly to fulfil know-your-customer requirements. The sum involved is 6 BTC or $41,910 at today's price.

From Saudia Arabia to Chile

Pedxs, who claims to be a student at MIT, consulted with a lawyer who informed him that this sum is too small to make a lawsuit worthwhile. At least 1,000 BTC ($6,985,000) in frozen assets would be necessary to make a profit after legal fees.

This is because the suit must be filed in the US, Europe and Asia; the location of the exchange is unknown. Information which it has posted online places it in locations as diverse as Saudi Arabia, Hong Kong, Chile, and Denmark. Its IP address originates from Arizona.

Finance Magnates reached out to Pedxs, who asked to remain anonymous. He said that after 35 email exchanges, HitBTC continues to repeatedly ask for a screenshot of a particular transaction hash before it will approve a transfer of funds. The user says that over 100 pictures have been sent

He told me that he trades at nine other exchanges, and they all confirmed his identity upon registration. In contrast, HitBTC told him that KYC is not necessary if a user does not transact with fiat.

He added that he is the technology officer of a cryptocurrency fund that manages around 1,000 BTC. The fund trades at most of the top 30 exchanges and some commercial banks, and in his experience KYC issues never last "more than a day or two."

Delaying tactic

His complaint is one commonly heard from traders of foreign exchange and binary options - KYC being used as a delaying tactic. If the exchange really cared about the identity of its customers, the process would have been completed when the user signed up/deposited money/at any point before he asked for a withdrawal.

Pedxs told me: "The common conjecture is that they made some bad bets with users' money. So if you make a large withdrawal (5 BTC in my case), they block it. They delay until users give up or until the market turns around on their bad bets."

Judging by the responses that he has received, he is not without support.

One user claims that he has been waiting for 70 days for his withdrawal to be approved despite providing his passport, proof of residence and bank details. Another mentions a recent case made public by a popular Twitter user called Sicarious.

Sicarious had claimed that his mother was locked out of her account for three months, again despite providing ample proof of identity. To him the exchange replied, perhaps because he has tens of thousands of fans on Twitter. This didn't go unnoticed by users of social media.

Source: Twitter

As an illustration, compare the exchange's response to the less-popular pedxs:

Source: Reddit

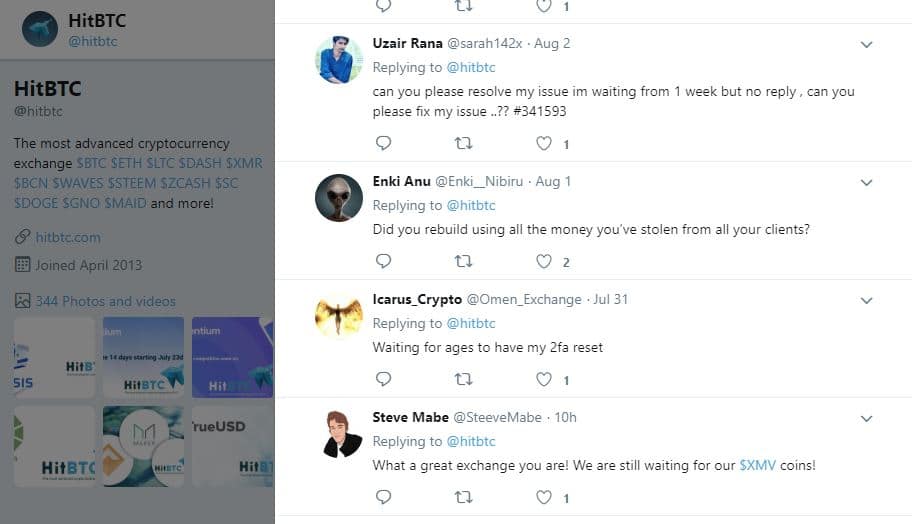

And as that unhappy customer points out, this is typical of the exchange's responses, as can be viewed at reddit.com/user/hitbtc and on the exchange's Twitter profile. The latter seems to be a magnet for angry comments; the snapshot below is typical:

Source: Twitter

The overwhelmingly negative sentiment could perhaps explain why HitBTC's daily trading volume has fallen from $316 million to $269 million in one week.

Not the first offence

In December 2017 a group of angry customers complained to UK and US police about their money being held by the exchange, and more recently, Korean customers have been amassing for action. According to South Korean news outlet Sisajournal-e, customers are waiting between three weeks and six months for their money, and they are being asked to provide personal information in English despite the exchange supporting the Korean language.