The amount of Bitcoin being held on cryptocurrency exchanges has decreased roughly 20 percent over the last 12 months, according to data from cryptocurrency analysts firm, Glassnode.

The decrease in the amount of Bitcoin held on exchanges could be an indication that more investors are buying BTC and storing it offline, which CoinTelegraph says could be contributing to a BTC 'supply crunch'.

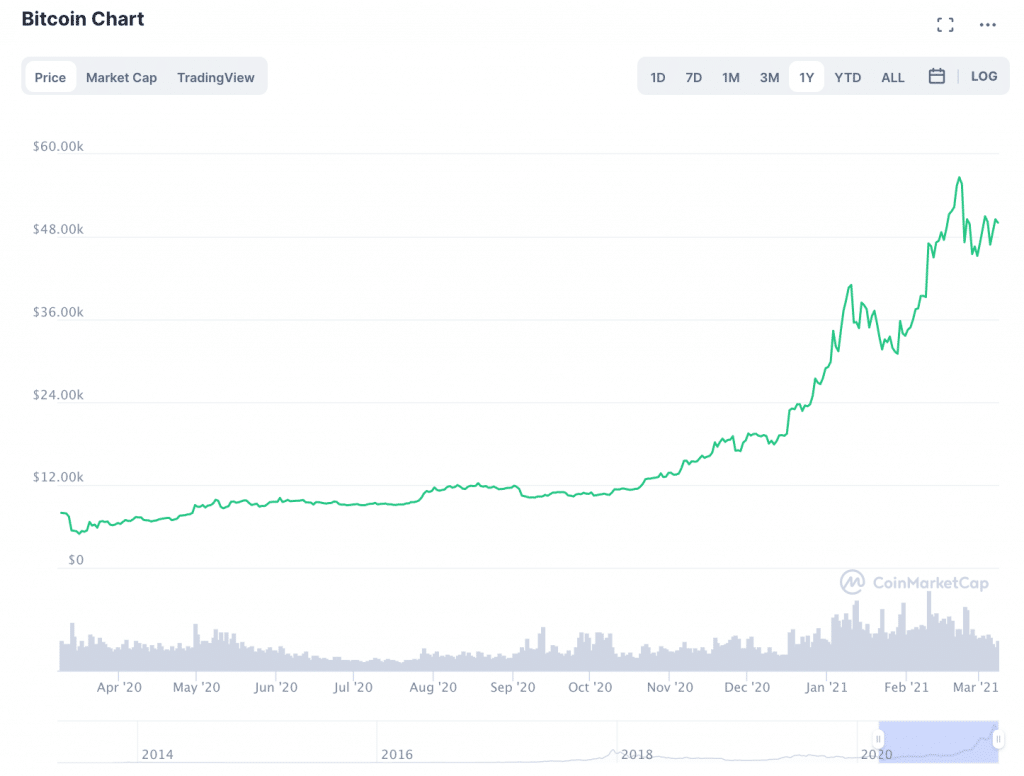

This 'supply crunch' may have contributed to Bitcoin's scarcity, and, in turn, its price increase. Over the past 12 months, BTC's price has risen from $7,950 to roughly $50,000.

More Than 57% of BTC's Circulating Supply Has Not Moved in over a Year

Glassnode’s finding contributes to the narrative that an increasing number of investors are buying Bitcoin as a 'store-of-value' asset that can be used as a hedge against fiat inflation; a sort of 'digital gold'.

Glassnode also shared findings on March 6th that show most of the Bitcoin that was purchased earlier in 2021 was not sold during the massive market corrections that took place toward the end of February. (From February 21st to 23rd, Bitcoin dropped from $58K to $45K; from February 25th to 28th, BTC dropped from $50,800 to $43,600.)

These findings, and the idea that more Bitcoin investors are 'hodling' for the long term, was further supported by Glassnode’s 'Hodlwaves' metric. Hodlwave shows the amount of time that has passed since a Bitcoin was last moved on-chain.

According to Hodlwaves data published on February 22nd, 57 percent of Bitcoin’s circulating supply has not been moved in more than one year. This means that 57 percent of Bitcoins were purchased more than one year ago and have not moved since then.

Additionally, one-third of the Bitcoins that have not been moved in over a year have also not been moved in over five years. According to CoinTelegraph, this suggests that 'a significant portion' of circulating Bitcoins may have been permanently lost.

The Bitcoin Fear and Greed meter, which measures how likely Bitcoin hodlers are to sell (fear) or hold (greed) their Bitcoins also currently reads at 'extreme greed'.

Is BTC's Usage in DeFi Contributing to the Bitcoin "Supply Crunch"?

Part of Bitcoin’s migration off exchanges may be due to the increased popularity of decentralized cryptocurrency exchanges and DeFi protocols that allow their users to generate income from lending out their BTC.

For example, CoinTelegraph reported that: “evidencing strong demand for Bitcoin in the DeFi ecosystem, the total value locked, or TVL, of BTC Tokenization protocol, Wrapped Bitcoin has increased by more than $1 billion since the start of March.”

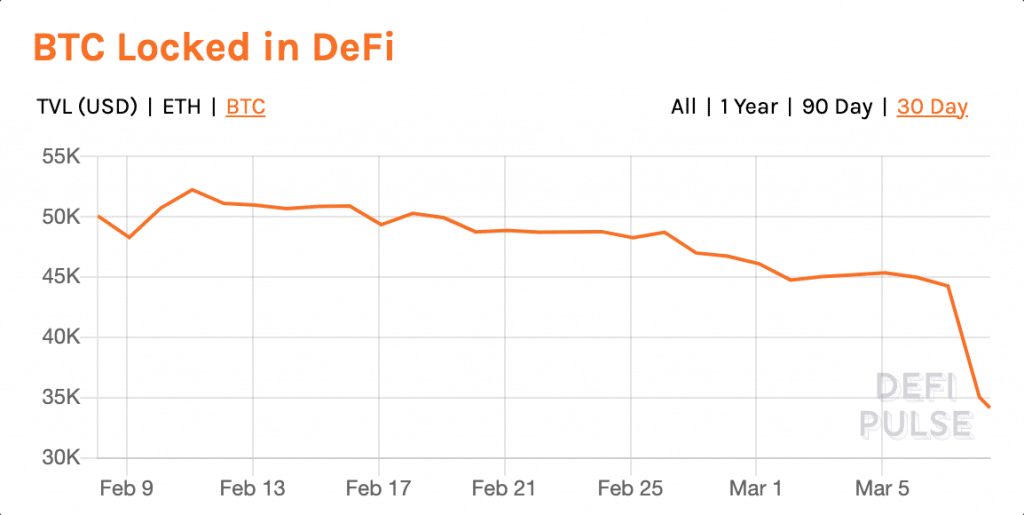

However, the amount of actual BTC being used in DeFi protocols appears to have recently dropped quite sharply. Data from DeFi Pulse shows that just one month ago, there were more than 50,000 BTC 'locked' inside of the DeFi world; today, there are just 34,140 BTC.