Indonesia’s fintech ecosystem is booming, according to a new report by Singapore Fintech News. The country is now home to at least 322 fintech companies, including 125 registered but unlicensed online lenders, according to a new report produced by Fintech News Singapore.

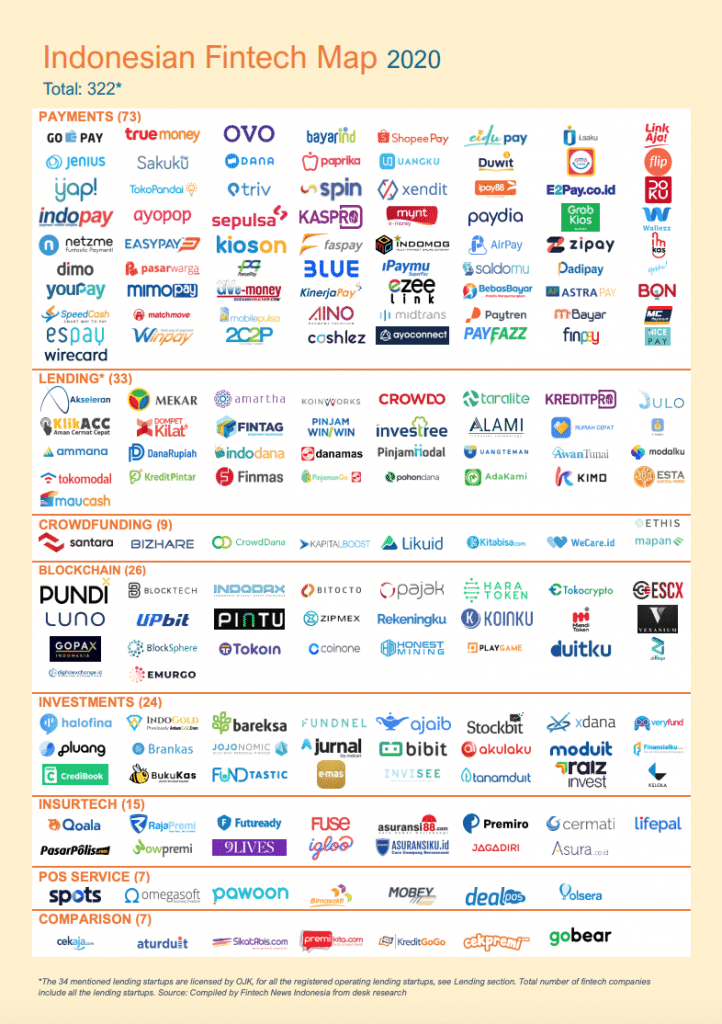

Of the remaining 197 fintech startup companies, 73 exist in the Payments arena; 33 offer lending services, 9 offer crowdfunding services, 24 have to do with the investments world, 15 are insurtech firms, 26 work with Blockchain , 7 are point-of-sale services and 7 are price comparison firms.

According to Fintech News Singapore, the booming fintech industry was reportedly set for success by the country’s “proactive government,” which “introduced rules in areas including peer-to-peer (P2P) lending, digital payments, and most recently open banking, in hopes to encourage innovation and improve financial inclusion.”

Investors Are Lining the Indonesian Fintech Industry’s Pockets; A Growing Population Could Contribute to Further Growth

This proactive approach seems to have attracted a number of impressive investors to the country’s fintech industry: a number of global investment giants, including China’s Ant Group, have reportedly entered into joint ventures in Indonesia.

For example, Fintech News Singapore reported WeChat’s owner Tencent has invested in GoJek, an app that operates GoPay, Indonesia’s largest e-wallet. Warburg Pincus, an American private equity firm, reportedly led a US$25 million Series B round for tax compliance solutions provider, OnlinePajak in 2018.

The country’s fintech industry is set for even more growth: Indonesia has the 16th-largest economy in the world; with a population of 274 million people, it is the fourth-most populous country on Earth. Additionally, 84 percent of the population is under the age of 54, which could signal that the population is set to grow even further.

Later-Stage Startups Are Also Making up an Increasingly Large Market Share

While many of the fintech startups in Indonesia may be in their earlier stages, later-stage startups are also making up an increasingly large share of the market. According to the report, this is evidenced by early signs of consolidation and several merger and acquisition (M&A) deals over the last two years.

These include “GoJek’s US$130 million acquisition of POS services provider Moka, and Ovo’s purchase of local startup Taralite to enter the online lending space.”

Furthermore, the report singles out 15 of Indonesia’s fastest-growing fintech startups to watch out for in 2021, including 10 companies in the lending space, 3 in investment, and 2 in payments.