In a May post entitled “Chasing fake volume: a crypto-plague,” self-described trader and investor Sylvain Ribes picked a bone with many major crypto exchanges.

“In this piece I will expose why I believe more than $3 billion of all cryptoassets’ volume to be fabricated, and how OKex, #1 exchange rated by volume, is the main offender with up to 93% of its volume being nonexistent,” he wrote. “I’ll endeavour to prove it by analyzing publicly available data.”

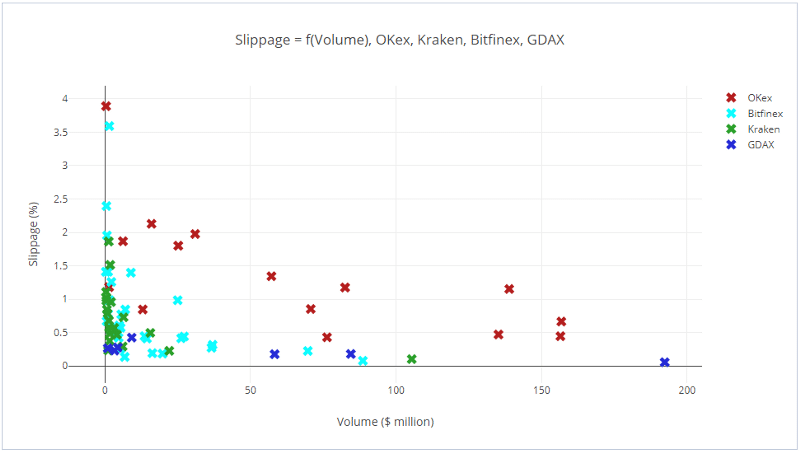

In the piece, Ribes describes a study he conducted in which he collected order books from “major” cryptocurrency exchanges and then measured the price-crashing effect of selling $50,000 worth of each cryptocurrency on each exchange. He referred to this effect as “Slippage .”

Massive Discrepancies in Trading Volume

“I expected that slippage should generally be a decreasing function of volume, but that some differences might show from one currency to another,” he wrote. However, Ribes soon found that while there were minor discrepancies in slippage between currencies, there were massive discrepancies between exchanges.

Sylvain Ribes' representation of the average slippage and volume of all pairs among a selection of a score of Cryptocurrencies with a daily volume over $100k over four major exchanges: OKex, Kraken, Bitfinex and GDAX, over the course of 24 hours.

Ribes explained that the chart shows that “OKex pairs, in red, all have a massively higher slippage with regards to their volume. Like I explained before, this can only mean that most of the volume OKex claims is completely fabricated”--a hefty accusation.

However, Ribes is not the first to claim that a large number of cryptocurrency exchanges (including OKex) are guilty of inflating their volumes, and he has not been the last.

In May, a man named Andrew Rennhack published a google doc that he dubbed “Honest Coinmarketcap,” a spreadsheet that displays the results of a script written to more accurately record cryptocurrency exchange volume and compare it with the data presented on CoinMarketCap.

1/ I spent the afternoon writing a script I call Honest Coinmarketcap. It displays trading volume by coin by USD pairs only(bitfinex excluded as its USDT). Attached are coins ranked by marketcap, listed volume, true volume pic.twitter.com/x7MEy1dD2i

— Andrew Rennhack (@andr3w321) May 12, 2018

At the time, Bitcoin.com reported that CoinMarketCap had been criticized for overstating cryptocurrency exchange volumes “due to the way it pulls its data from exchanges, exacerbated by the way these platforms record trading activity.”

Indeed, Rennhack’s data showed far lower trading volumes on most exchanges than CoinMarketCap. “The second tab of the ‘Honest Coinmarketcap’ spreadsheet, which compares fiat volume with Coinmarketcap’s listed volume, claims that Bitcoin’s actual 24-hour trading volume is $1,508,351,500.00, while Coinmarketcap lists it as $8,281,980,000.00, a discrepancy of roughly 80 percent,” Finance Magnates reported.

Detecting False or Inflated Trading Volumes

Even if figures describing trading volumes don’t differ so much, there can be other indications that an exchange might have falsely inflated trading.

In an exclusive email to Finance Magnates, CEO of RunCPA Evan Maslennikov wrote that discrepancies between website traffic and trading volumes should raise eyebrows. While this data “does not include API traders who usually have the biggest impact on the volume figures,” Maslennikov alleges that “if you compare two exchange services that show more or less equal volumes, with one of them having 10 to 20 times more traffic than the other one, this raises a certain suspicion.”

The same can be said about an exchange’s online community. If a cryptocurrency exchange only has a couple of thousand followers spread across its social media platforms, and yet it’s producing millions upon millions in volume, there may be something fishy happening.

Additionally, Maslennikov said that it’s often easy to identify market manipulation on smaller exchanges. “For instance, there can be just 20 Ether in the market, but the daily trades figure will be over 3000,” he said. However, “it's a real pain to figure out who started it in the first place.”

“The short story is – most cryptocurrency exchanges do inflate their trading volumes,” wrote Maslennikov. “But it's hard to pin all the blame on the exchange, let alone prove it.”

If the inflated trading volume problem is as widespread as it is believed to be, then what are the reasons behind it?

Why Would an Exchange Falsify or Inflate Volume?

Timofei Fortunatov, PR-director of TugushBlockchain Capital, told Finance Magnates that “inflation of the trading volume is a [marketing] strategy that is way cheaper than the cost of creating and implementing both marketing and communication strategies as well as building a real and supportive community.”

In other words, higher volumes mean greater visibility and more credibility. Higher-volume exchanges will be listed higher on sites like CoinMarketCap, and cryptocurrency investors tend to have greater trust in exchanges with higher trading volumes.

“Users and experts rarely question numbers and graphics on such well-known platforms,” wrote Fortunatov. Most members of the crypto community don’t have the technical know-how to examine the data even if they do question its validity. “Therefore, the quick rise of several new exchanges to the top 10 might be unintentionally left unnoticed by many people.”

Maslennikov said that there could be several reasons for crypto trading volume inflation, and not all of them nefarious. An exchange can “[launch] a bot that trades at a 0% commission rate”; an “honest market-maker” could be hired by an exchange or token owner to “hold the spread.” If publicly disclosed, this practice isn’t necessarily a bad thing.

However, he also acknowledged that market-makers “can be hired by a token owner acting on insider information and boosting the token.” Exchanges could also create trading bots to covertly trade a certain cryptocurrency. In either case, this practice is known as “wash trading.”

OKex [left] fakes its volume in a “laughingly obvious and artificial way,” wrote Ribes. “Compare this perfectly neat and absurdly consistent sinusoidal volume with what happens on an actual exchange [on the right.]”

Crypto Exchanges Could Also Be Guilty of Pump-and-Dump Schemes

“It gets worse,” he continued. “As in, crypto exchanges charge money for listing tokens. But they do not necessarily set a fixed price in a cryptocurrency, but sometimes accept some part of the payment in tokens of that very project.” In other words, a cryptocurrency exchange could accept the listing fee in a certain crypto token, and then falsely pump up the volume of that token to make a profit.

“This makes the exchange a party in interest,” Maslennikov continued. “Now, in the ordinary world that would be classified as a conspiracy and persecuted by law, but in the world of crypto – it's still considered to be 'okay.'”

Similarly, Covesting CEO Dmitrij Pruglo told Finance Magnates that the lack of clear regulations for cryptocurrency exchanges around the world has left room for some less-than-savory practices.

For example, “OKex is registered in [an] offshore jurisdiction without any regulatory supervision, which means that the company can execute any type of possible fraudulent activity and there will be nobody to chase them,” Said Pruglo. “In fact, investors don’t have any protection even in case such exchange decides to manipulate the price of a particular digital asset or shut operations at some point.”

Inflated Volumes are Keeping Big Money Out of the Crypto Space

Pruglo argued that inflated trading isn’t just a bad thing for the average crypto trader--it’s hurting the industry on a deeper level. “Only after establishing proper controls we may see inflow of institutional money into the market.”

“I really hope that we will see more regulations coming in to the industry and with proper market surveillance and monitoring to weed out exchanges which do not operate in a compliant manner,” he added.

Indeed, several weeks ago, Mike Novogratz (head of crypto merchant bank Galaxy Digital) said that a “herd of institutional investors” was headed straight for the cryptocurrency space. While there are a growing number of trustworthy options, many of which that have been designed specifically for institutional investors, the industry still has a long way to go.