Ever since the ICO craze of 2017, the cryptosphere hasn’t been able to shake its association with the word “bubble”. At different points in time, nearly every aspect of the industry has been called the ‘b’ word--now, though, analysts have set their sudsy sites on a new corner of crypto: DeFi.

Indeed, DeFi as a whole has been a hot topic over the course of the last year: exchanges, loan platforms, and other projects that act as autonomous hubs that users can use to access a variety of financial services without having to rely on a third party.

Despite the fact that there has been quite a lot of insular industry hype around the DeFi space--along with whisperings that some DeFi projects may be overvalued--it’s only recently that the ‘bubble’ accusation has been applied so liberally.

Weiss Crypto Ratings didn’t go to far to describe the DeFi hype as a “bubble”, but did say in a tweet that “eventually, the mania will end, and DeFi will trade in line with the rest of the market.”

What has changed? And is DeFi really a bubble?

Surges in DeFIi 2017 token prices could be reminiscent of 2017

The thing that seems to have called the most attention to the DeFi sphere in recent times is the surge in value of governance tokens of certain DeFi platforms--in particular, COMP, the governance token of decentralized loan platform Compound, which jumped nearly 300% in value within a week of its launch.

However, shortly after COMP rose, it fell: after peaking at roughly $372 last month, COMP gradually slipped as low as $165 over the course of several weeks--a decrease of roughly 55 percent; at press time, the price had recovered to $185.

Still, the quick succession of boom and bust had a number of analysts in a tizzy: Twitter commentator @ThetaSeek wrote that the project was overvalued, saying that “[…] The value of the Protocol is an AUM business and AUM businesses are normally valued at less than 1/3 or 1/4 of the companies’ AUM.

ThetaSeek said, pointing to BlockFi as an example: “@realblockfi is valued at around 200M when their AUM was 650M. (This is generous as Goldman Sachs is valued at less than 1/50 of their AUM),” he said.

Run-off effects

John Wagster, the co-founder of law firm Frost Brown Todd’s Blockchain and digital currency industry team, also told Finance Magnates that Compound’s rise has caused a bit of destabilization in other corners of the DeFi and cryptos spheres. In other words, ThetaSeek explained, the value of COMP should be about $50;

“Since the Compound protocol currently rewards markets that lend dollars more than other tokens, the demand on dollar-denominated stablecoins, such as DAI, is making it difficult for those coins to hold their dollar peg,” he said.

Therefore, “DAI holders who are counting on the peg to provide stability to their other trades could be adversely affected,” he continued, adding that “other Yield Farming tokens like $SNX and $LEND, which have dramatically increased in value since Yield Farming took hold several weeks ago, have probably not yet found their true price point.”

And it seems that DeFi’s alleged overvaluation problem doesn’t stop there.

Frost Brown Todd’s John Wagster.

Price-to-earnings ratios for some DeFi projects are off the charts--and not in a good way

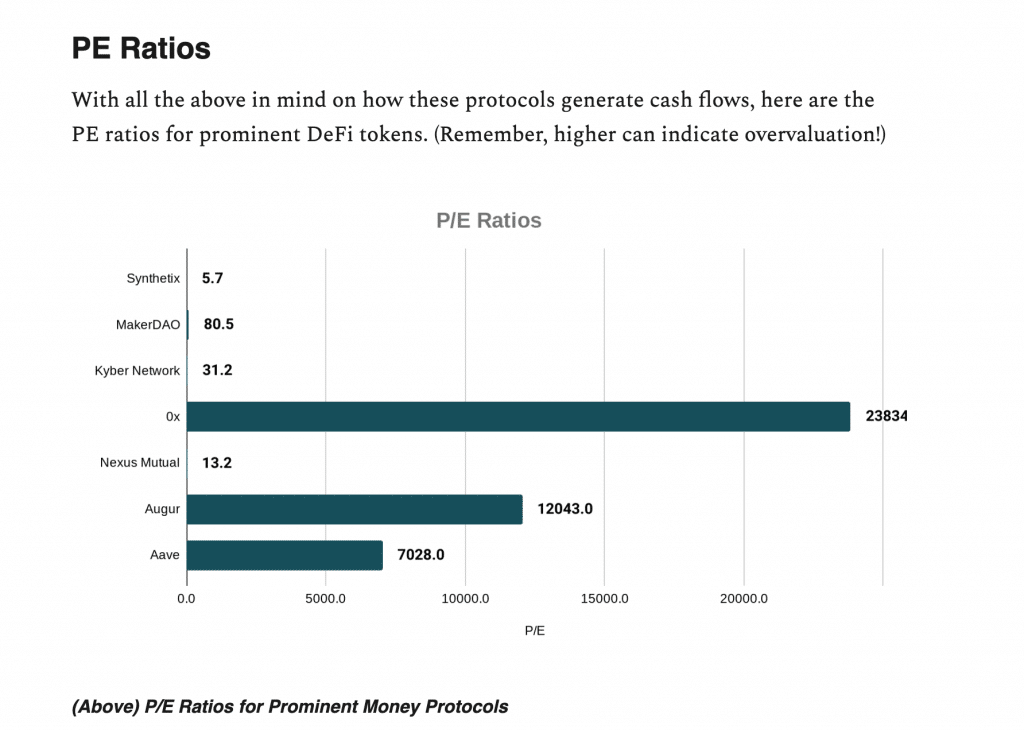

Indeed, Alex Salnikov, co-founder of Rarible, a DeFi marketplace for digital collectibles, pointed out that the price-to-earnings (PE) ratio of a number of well-known platforms in the DeFi space has been calculated to be surprisingly high.

Investopedia describes a PE ratio as essentially, “the dollar amount an investor can expect to invest in a company in order to receive one dollar of that company's earnings.” PE ratio is calculated in units of years, which can be interpreted as the number of years of earnings it would take to pay back an asset’s purchase price.

(In other words, a platform’s PE ratio can be used to determine whether or not it is overvalued.)

Lucas Campbell, an Analyst at Fitzner Blockchain Consulting & DeFi Rate, wrote in a February blog post for Bankless that if some DeFi projects don’t increase their profitability, millennia could pass before investors earn the same amount of funds they used to purchase DeFi assets.

According to Campbells’ calculations, some DeFi projects are fairly well-positioned to earn cash for their investors: specifically, Synthetic, Nexus Mutual, and Kyber, which had PE ratios of 5.7, 13.2, and 31.2, respectively.

Even MakerDAO--which had a PE ratio calculated at 80.5--was described as “in-line with many high-growth stocks today”; Alex Salnikov, co-founder of DeFi collectibles marketplace Rarible, pointed out to Finance Magnates that for example, “Amazon's PE ratio fluctuates between 80 and 140.”

However, there are some projects in the space that--according to Campbell’s calculations--are grossly overvalued.

“The rest of the tokenized money protocols, 0x, Aave, and Augur, all have off-the-chart PE ratios that are pretty much unfathomable in traditional capital markets,” Campbell wrote: Aave’s PE ratio was calculated at 7028, while Augur’s was 12,043 and 0X was 23,834.

Source: Lucas Campbell, via Bankless.substack.com.

“With that, we can assume that these protocols likely either need to garner a significant more amount of usage to accrue cash flows or a token economic rework to capture the value from the usage and protocol fees,” he said.

”the DeFi market in general is not overvalued--despite the fact that certain projects clearly are.”

However, Rarible’s Alex Salnikov wrote that while there may be examples of overvaluation in the DeFi space, the space as a whole should not be described the same way.

“In June 2020, total DEX (decentralized exchange) turnover reached $1.5 billion, with the amount of funds locked in DeFi protocols passing a $2 Billion mark,” he said. This is “double the growth compared to two months ago.”

“These numbers show organic growth and clearly state that the DeFi market in general is not overvalued--despite the fact that certain projects clearly are.”

Frost Brown Todd’s John Wagster also told Finance Magnates that he also believes that “the DeFi space as a whole is not currently overvalued.”

However, he does see change on the horizon for the ways that some projects earn cash: for example,” the dramatic rise in some token prices due to the new practice of Yield Farming is likely to be short-lived.”

Instead, more and more platforms could switch to other revenue models--including Compounds, despite the volatility in the COMP token price throughout the month of June.

“The amount of money currently locked in DeFi, which rose to over $2 billion on July 6, is likely to continue to increase as more protocols mimic Compound’s method of using its governance token to attract new users to the platform,” Wagster said.

However, “it’s also likely that some protocols will not be as successful as Compound so buyers should do their homework before investing.”

If DeFI “falls victim to the hype like the ICO craze,” blame users who didn’t do due dilligence

If they don’t, it’s possible that these investors--and thereby, the DeFi space as a whole--really could fall victim to the same kinds of patterns that drove the ICO boom and bust in 2017.

“The ICO bubble didn’t come to fruition because all the ideas behind the creation of hundreds of new tokens were bad,” John Wagster explained; “the bubble arose because token purchasers quit doing their homework to determine which token ideas were good.”

Indeed, at the time, investors were seemingly willing to throw money into anything that had “blockchain” in the name.

As such, “any time an investor assumes his or her investment will grow just because other investments are growing, there is likely to be disappointment,” Wagster explained.

“We don’t yet know whether DeFi will fall victim to the hype like the ICO craze, but if it does, blame the DeFi users who favor trends over financial due diligence,” he said. “I can guarantee you there will be more failures within DeFi, but I also feel strongly that DeFi is incubating the financial marketplace of the future.”

The DeFi ecosystem is “entirely orthogonal and different” to the existing financial world’s infrastructure

Wagster isn’t alone in this belief--indeed, Lex Sokolin, head of global fintech and chief marketing officer at ConsenSys, told Finance Magnates in an online panel discussion earlier this week that the DeFi movement is “literally a platform shift in how financial products are manufactured. Full stop. End of story.”

It’s “entirely orthogonal and different to the core banking systems, portfolio management systems, and underwriting systems that we’ve had for the last forty years,” he continued.

Lex Sokolin, CMO and Global Fintech Co-Head at ConsenSys.

“It’s on entirely different logic and infrastructure,” he said. “And we’ve had this magical moment over the last six months where you have, essentially, these programmable vending machines of loans, of margin trading, of book building and market making; of insurance: all of these things being turned on and integrated, and starting to create some really bizarre and interesting outcomes.”

”Fits and starts” in the short-term; but “the rewards are real and predictable” in the long term

John Wagster also believes that “of all the hype and hoopla around blockchain and Cryptocurrencies over the last several years, DeFi is the one market that has delivered the goods,” and that there isn’t “a market comparable to DeFi.”

Indeed, the DeFi movement has brought “sophisticated financial products available to any person in the world with an internet connection,” Wagster said.

Therefore, questions around whether or not DeFi is a bubble may indeed be missing the point: certain projects may be overvalued at the moment, and the DeFi sphere as a whole could eventually reach a level of chronic overvaluation; for now, though, it seems that DeFi could be revving up into a truly revolutionary force.

“Yes, there have been fits and starts and successes and failures, but DeFi is proving to be a valuable FinTech sandbox that allows borrowers, lenders, investors and speculators to engage in bank-like transactions without a bank,” Wagster said.

“Like any new market, there will be highs and lows as new products, tokens and protocols are brought to life, and caution is warranted,” he continued. “But for those who invest the time and money to understand the marketplace, the rewards are real and predictable.”

“As long as centralized interest rates remain at historically low levels, I expect the potential for double-digit returns in DeFi to continue, particularly as institutional investors start to get in the game.”